Intel is having a torrid time in 5G, and it may get worse

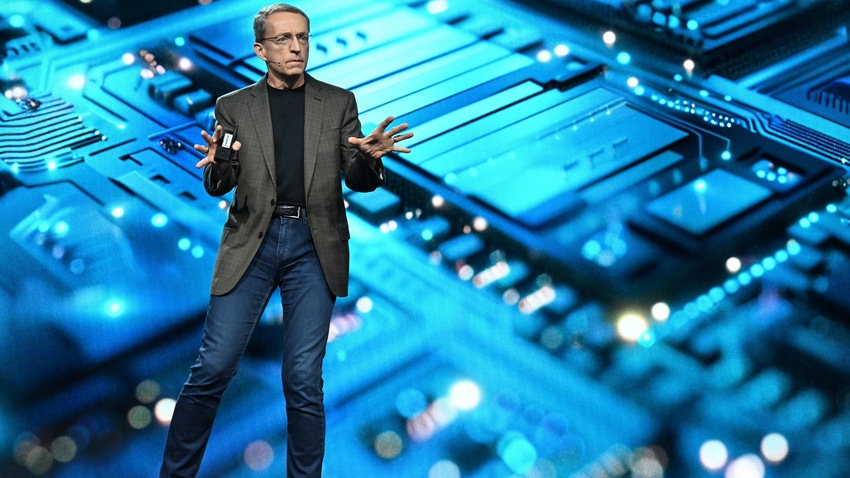

The network and edge group is now the worst performing of Intel's main product groups, with CEO Pat Gelsinger laying the blame on 5G headwinds.

Pat Gelsinger has much bigger worries than the state of 5G. The CEO of Intel has been struggling to revive the US chipmaker ever since he took charge of it in February 2021. Since then, its share price has lost more than 40% of its value. Manufacturing woes, a loss of market share in core business areas and the dramatic rise of Nvidia are Gelsinger's main problems. But 5G stands out as one of Intel's ugliest features so far this year, and it is subject to many of the same forces affecting the bigger business.

The one unique to 5G is a market slowdown as telcos pause network rollouts or deplete existing stock. That trend partly explains the 19% year-over-year drop in sales at Ericsson's networks business for the recent first quarter, and a 37% tumble at Nokia's equivalent unit. Gelsinger blamed 5G "inventory headwinds" for the pain experienced by his own network and edge division.

"As discussed last quarter, we saw significant declines in the 5G market," he told analysts on Intel's call about first-quarter figures. While sales of other network and edge products grew a tenth year-over-year, overall revenues at this part of Intel fell 8%, to $1.4 billion. That disappointing performance singled it out as the only main product business to shrink.

Intel's total sales were up 9%, to around $12.7 billion. Yet investors weren't happy about the gloomy outlook, with Intel guiding for second-quarter revenues of $13 billion (at the midpoint), just $100 million more than it made a year before. Intel's closely watched gross margin improved for the first quarter, growing 6.7 percentage points year-over-year, to 45.1%. But that was well below the 60% it previously managed. At $800 million, net profit was $4.9 billion less than Intel reported for the same period of 2021, Gelsinger's first quarter in charge.

The chipmaker cannot, of course, be held responsible for the slowdown in 5G spending that has crippled the whole market. Intel sells basestation chips to both Ericsson and Nokia, which account for a huge chunk of the 5G market outside China. The rest is mainly served by Huawei, which is not a customer of Intel's network products. When the Nordic vendors suffer, Intel is hurt as well.

The market has also been shrinking. Last year, sales of radio access network (RAN) equipment fell 11%, to just north of $40 billion, according to data from Omdia, a market research company (and sister company to Light Reading). Omdia is guiding for another decline of between 4% and 6% this year, while Dell'Oro, another analyst firm, expects a 4% contraction. During his first-quarter earnings update with analysts, Ericsson CEO Börje Ekholm described that 4% figure as "optimistic."

Cloud cuckoo RAN

A telco industry transition from purpose-built to "virtual" or "cloud" RAN technologies should have buoyed Intel. It is supposed to mean switching from custom silicon and software, designed exclusively for the RAN, to the general-purpose chips and platforms used across the data-center world. With its x86 architecture, Intel remains the leader in the market for central processing units (CPUs) installed in data-center servers, even if it has ceded ground to rival AMD in recent years.

This transition, though, has not been happening as quickly as Intel would like. Very few operators globally have deployed these virtual and cloud RAN technologies at scale, and their benefits are still unclear. They would supposedly allow an operator to centralize its RAN compute resources (so-called C-RAN) and then share these with other telco and IT workloads. But no telco appears to have done that meaningfully, according to Gabriel Brown, a principal analyst with Heavy Reading (another Light Reading sister company).

"Where C-RAN is deployed today, RAN functions are deployed on dedicated servers/racks optimized for RAN," he wrote in a recent blog. "Heavy Reading is not aware of wide-area vRAN being deployed as a workload on a multi-tenant cloud infrastructure."

Meanwhile, Intel has been criticized by Nokia for marketing as "general purpose" products that seem to be highly customized to handle the unique requirements of 5G RAN technology. Granite Rapids-D, a forthcoming processor design, offloads more RAN functions from the CPU to accelerated computing platforms than Intel's previous offers did, according to the Finnish equipment maker. That would make servers based on Granite Rapids-D an inefficient choice for other workloads outside the RAN.

This has led to a bust-up between Intel and Nokia, which is instead relying on Marvell Technology, another chipmaker, for silicon to host the most resource-hungry "Layer 1" part of the RAN. Because this silicon comes on separate cards (smart network interface cards, or SmartNICs), it can be slotted into a true general-purpose server, says Nokia.

Arm wrestle

Here, the risk for Intel is that other chipmakers power the servers used in future. Worried about Intel's dominant position in the market for general-purpose silicon, operators such as Vodafone are keen to nurture alternatives. Architecturally, the main option is Arm, a designer of chip blueprints headquartered in the UK and better known for its role in smartphones. Several deep-pocketed companies have either built or are building Arm-based chips that could be used in a 5G RAN. They include Amazon, Nvidia and Oracle-backed Ampere Computing.

This all reflects much bigger analyst concerns about the threat to Intel posed by Arm and the rapid advance of accelerated computing, chiefly through Nvidia and its graphics processing units (GPUs). Vivek Arya, an analyst with Bank of America Merill Lynch, suggested to Gelsinger that the choice of CPU might not even matter if most of the workload is handled by an accelerator, while noting that "a number of your cloud customers have announced Arm-based server alternatives."

Even Ericsson, which has forged a close partnership with Intel for cloud RAN, is working to develop software that could be deployed on Arm CPUs. A modification called SVE2 would help address some of the concerns about Arm's suitability, said Matteo Fiorani, the head of Ericsson's distributed unit, cloud infrastructure and security business, during a previous interview with Light Reading. "That is basically vector processing and is very suitable for Layer 1 processing and, when they get that in, we think we can squeeze some good capacity out of an Arm system."

At the very least, Intel seems destined to lose cloud RAN market share within Ericsson's footprint. That might not be such a bad thing if the market takes off, but the latest Intel update combined with Omdia's forecast suggests it won't be happening soon.

About the Author(s)

You May Also Like