Fiber focus helps Frontier return to 'sustainable growth'

Frontier Communications added a record 318,000 fiber subs in 2023 and achieved full year EBITDA growth for the first time in a decade. 'I'm confident that we will accelerate our growth in 2024 and beyond,' says CEO Nick Jeffery.

Frontier Communications' turnaround story continued in the fourth quarter of 2023 as the service provider built fiber to another 333,000 fiber locations, extending its fiber footprint to 6.5 million locations.

That build pace, which basically matched the company's pace in the prior quarter, means Frontier is 65% of the way toward making good on its commitment to build fiber to 10 million locations.

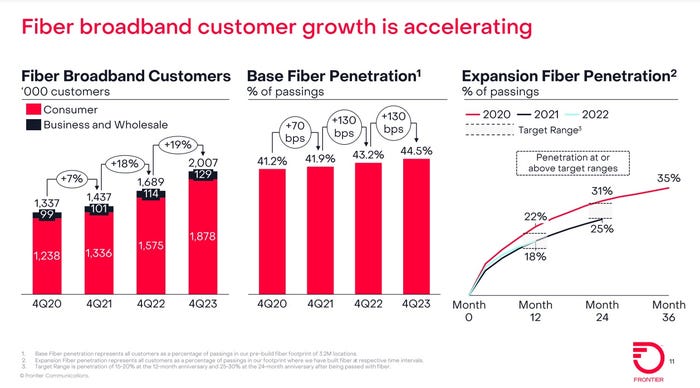

The company tacked on 84,000 fiber customers (81,000 residential and 3,000 business) in Q4, up from a gain of 75,000 in the prior quarter. Frontier ended 2023 with about 2 million fiber subs (1.87 million residential and 129,000 business).

(Source: Frontier Q4 2023 earnings presentation)

Consumer fiber broadband average revenue per unit (ARPU) hit $64.15, up from $61.20 in the year-ago quarter. Nearly 60% of new Frontier fiber customers are taking speeds of 1 Gbit/s or higher, and 45% of customers are now purchasing at least one value added service (such as whole home Wi-Fi).

Consumer fiber gains of 81,000 in the quarter offset about 48,000 copper losses, giving Frontier a net gain of 33,000 residential broadband subs in the quarter. Frontier ended Q4 with 2.7 million residential broadband subs (1.87 million fiber and 822,000 copper).

Frontier shed 14,000 residential video subs, lowering it total to 222,000. Following a partnership announced last year, YouTube TV is now Frontier's primary video service for new customers.

EBITDA milestone

Frontier, which sparked its fiber focused strategy after emerging from bankruptcy in the spring of 2021, also achieved full-year EBITDA growth (+1%) for the first time in a decade. Fiber related EBITDA for 2023 climbed 14%.

When the results are rolled up, 2023 marked Frontier's return to "sustainable growth," Frontier President and CEO Nick Jeffery declared Friday on the company's earnings call. "With the strong results we delivered in 2023, I'm confident that we will accelerate our growth in 2024 and beyond."

Frontier is standing firm on its expectation that it will achieve penetration rates of at least 45% across its fiber footprint, but Jeffery hinted that it could go higher. "We have no ambitions to stop at 45% whatsoever," he said.

The company expects to build fiber to an additional 1.3 million locations in 2024 and to add more fiber subs in 2024 than the record 318,000 it added for full-year 2023. Frontier also expects ARPU to grow at or above a range of 3% to 4%.

Frontier is forecasting 2024 capital expenses in the range of $3 billion to $3.2 billion – a bit below 2023's capex of $3.22 billion. CFO Scott Beasley said fiber build costs are expected to stay in the neighborhood of $1,000 per location.

Frontier announced earlier this month that it is undergoing a formal evaluation of its business. That review will explore potential partnerships, joint ventures, divestitures and mergers. Jeffery said the process aims to unlock additional shareholder value and is ongoing.

"It's live, it's in the moment, and when we are ready to share something we'll come back and do that with the market," he said.

Financial snapshot

Frontier posted total revenues of $1.43 billion, down 0.8% year over year but in line with analysts' expectations.

Business and wholesale revenues were down 3.6% to $635 million as growth among small and midsized businesses and enterprise customers was offset by declines in wholesale. However, Frontier expects that segment, which tends to be lumpy quarter to quarter, to stabilize in 2024.

Frontier shares were up 37 cents (+1.69%) to $22 each in mid-morning trading Friday.

About the Author(s)

You May Also Like