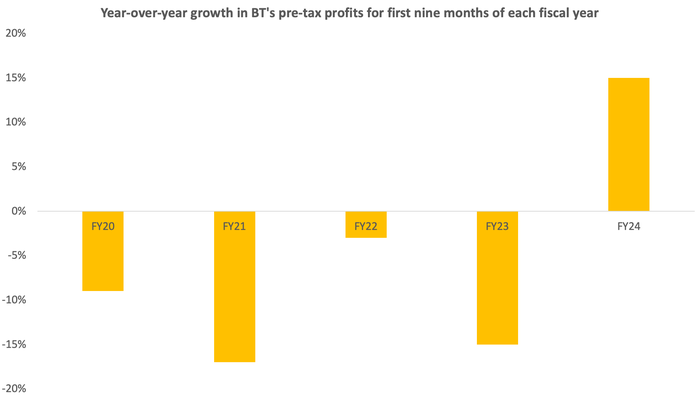

Allison Kirkby is off to a good start as BT's new boss, although it has nothing to do with her. Kirkby may still have been rearranging the office furniture and cleaning the desk drawers of predecessor Philip Jansen's uneaten snacks in her first official day in the job when the investor relations team dispatched a nine-month trading update (for April to December 2023) that showed adjusted sales grew 3%, to nearly £15.8 billion (US$20 billion), compared with the year-earlier period, and that profit before tax rose 15%, to about £1.5 billion ($1.9 billion).

(Source: BT)

BT hasn't seen this kind of bottom-line growth in years. For the corresponding part of 2022, its profit before tax sank 15% year-over-year. In 2021 fiscal year, there was a 3% dip over this nine-month period, while in 2020 BT reported a 17% drop. Accounting standards changed the year before that, but the reported number was down about 9% on the year-earlier figure. You get the picture.

The London Stock Exchange duly rewarded BT, whose share price opened 3.4% higher than its closing price the day before. It has, nonetheless, fallen 8% since the start of the year amid fresh challenges and lingering business concerns, evidence of which can be glimpsed in the trading update that went around today, and it is worth less than a quarter its level in early 2016, when BT acquired mobile operator EE. Jansen would hold Q&As with analysts for these trading updates, but Kirkby seems to have dispensed with the nicety on this occasion (if she hasn't, details of it are not publicized on BT's website). In the journalistic interests of transparency, one must hope it is not a permanent move.

Why the rise in headline figures, then? Unfortunately, it owes just about everything not to growth in customer numbers, or the take-up of new 5G applications from which BT generates revenues, but to controversial price rises that add 3.9% to the rate of inflation. Last year, this meant many BT customers were hit with a 14.4% increase. And because other UK operators adopted the same formula, there was no haven. Prices are reportedly due to go up 7.9% this year, although BT, under pressure from regulator Ofcom, has promised from the summer to abandon this percentage-based formula and say what any additional charges will be in pounds and pence.

Broadband setbacks

The gloomier news from BT today is that its broadband customer base is shrinking, albeit by relatively small amounts. After reporting the loss of 255,000 connections for the first six months of this fiscal year, BT saw another 114,000 go in the final quarter and it expects line losses to exceed 400,000 for the full year. This would equal almost 2% of the 21,457,000 broadband lines BT's Openreach networks division served at the end of March 2023.

The reason? BT blames "ongoing weak broadband market conditions" in today's trading update. But it's unlikely many customers are ditching what operators and governments routinely describe as a critical service – up there with water and gas – especially since it's become nearly impossible to get through a single day this century without logging on.

The reality is that BT's effective near-monopoly in the market for telecom infrastructure has weakened as smaller rivals with private-equity funding have nibbled into its share. This was acknowledged by Jansen during his final earnings-based Q&A with analysts in November. "I think it's worth noting that our broadband-based decline has occurred where we do not have FTTP [fiber-to-the-premises]," he said. The lines BT is losing are "primarily low-value copper lines," he added. But that's probably because people are switching from Openreach to FTTP rivals in areas where BT has not yet rolled out fiber.

Hence the expensive push to reach as many homes as quickly as possible. The overall job is likely to cost as much as £15 billion ($19 billion), according to earlier guidance, and has driven BT's capital expenditure up to record levels as a fraction of sales, with this "capital intensity" figure hitting about a quarter in recent years. BT, nevertheless, now claims to "pass" about 13 million of a targeted 25 million homes and says it is currently building out fiber at the rate of 73,000 premises passed a week.

Under 5G pressure

It has performed well on 5G rollout, too, for all the difference that has made. BT today claimed to have about 10.3 million 5G customers, without saying how many mobile-phone subscribers it serves overall, and it recently put nationwide coverage at more than 70%. Detractors note that coverage remains rubbish indoors and that some Asian operators have built out far more 5G equipment compatible with midband spectrum, the range ideally needed for higher-speed wide-area services.

BT may find itself under serious commercial pressure to do more if a merger between Vodafone and Three goes ahead. After site decommissioning, it would be left with about 26,000 mobile sites across the UK, compared with BT's roughly 19,000, and hold vast reserves of midband spectrum. Authorities may intervene there. But if they do not force the merging operators to give up too much, both BT and Virgin Media O2, the other player, may be at some network disadvantage. Dealing with all this is certain to be high on Kirkby's list of priorities.

There was some excitement when she was unveiled as BT's incoming boss last year, as if the appointment of a woman with a reputation for no nonsense was a radical step. But along with most other European telco bosses, she has never shown signs of being a visionary, having previously led Tele2 and Telia, and will have limited freedom and capital to do much outside the box at BT. For those who didn't think a lot of Jansen, expect largely more of the same.

Update: BT contacted Light Reading after this story was published to point out that a decision was taken while Jansen was still CEO to retain briefing calls for only the half-year and full-year results.

Read more about:

EuropeAbout the Author(s)

You May Also Like