GSMA calls for EU 'fair share' and mergers support amid traffic growth

GSMA's annual European Mobile Economy Report highlights growing data traffic trend, while arguing in favor of fair share and telco mergers.

The GSMA has backed 'fair share' demands for Big Tech to contribute to network costs and called for more European Union leniency on telco mergers in the latest version of its annual European Mobile Economy Report, which forecasts continued growth in data traffic with 5G adoption.

The report from the non-profit group forecasts that mobile data traffic in Europe will almost triple over the next five years as 5G coverage and capacity improves across the continent.

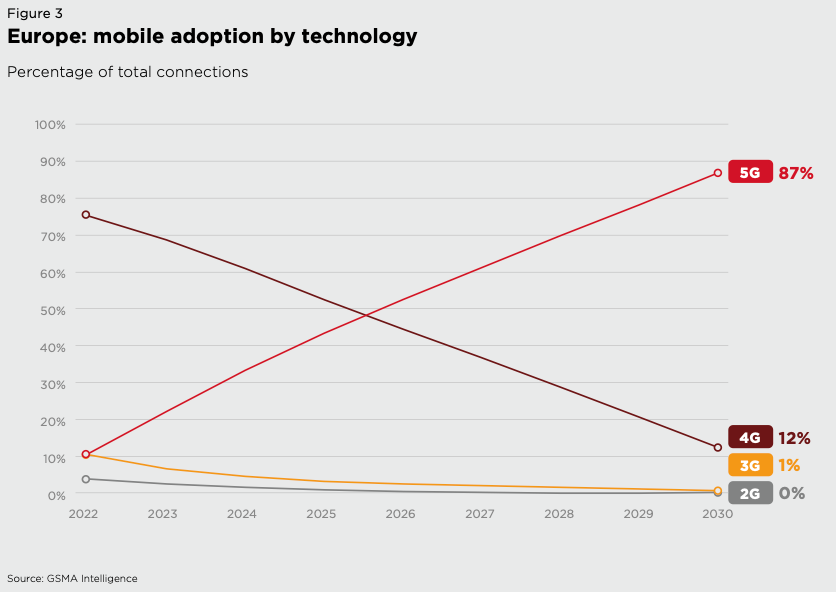

Within the next three years, GSMA expects the number of 5G connections to overtake 4G and represent more than half of the total, rising to 87% by 2030. By then, 4G will account for 12% of connections while use of 2G and 3G will be negligible, it says.

(Source: GSMA)

It also points to the importance of the mobile sector to the European economy, estimating its economic contribution to be €910 billion (US$992.5 billion) in 2022 and saying it accounted for 4.3% of European GDP last year. The report reckons its economic contribution will grow to €1 trillion ($1.1 trillion) by 2030.

Fair share is fair?

The GSMA has previously come out firmly on the side of "fair contribution," and it seems to restate this position in the report. It believes such a mechanism would bring benefits to European users and encourage so-called "large traffic generators" to effectively manage their traffic.

The report points to the EU Digital Declaration – a document signed last year by heads of the three main EU bodies – and says the status quo is falling short of fulfilling it. The report refers specifically to a section of the declaration that states all market actors benefiting from the digital transformation should make a fair and proportionate contribution to the cost of public goods, services and infrastructure.

This general statement from the declaration, however, does not appear to automatically endorse charging an extra fee to Big Tech companies classed as large traffic generators. Critics argue it is not "fair" to ask some companies to pay because their content represents a large share of traffic, noting that consumers have already paid for this. At the same time, increasing traffic does not always mean rising costs.

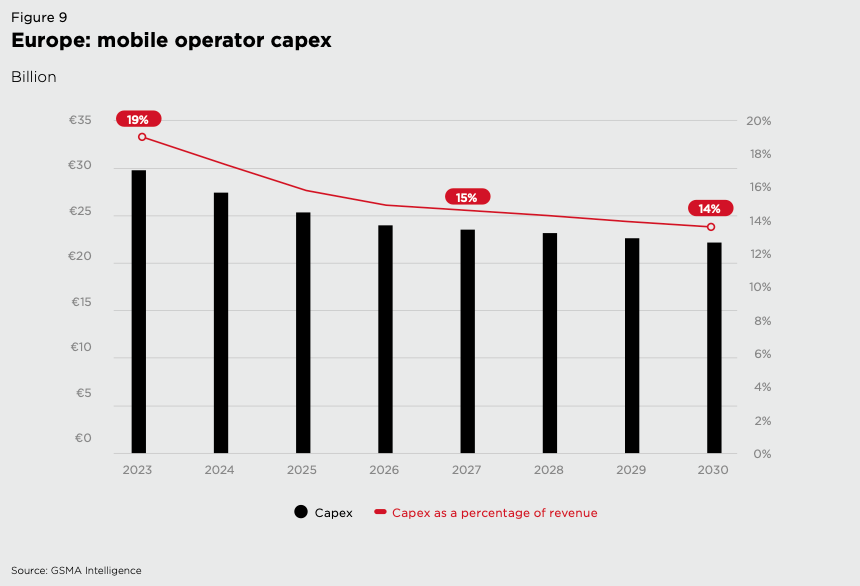

The GSMA report itself states that operator capex is expected to decrease as a percentage of revenues. As operators focus on generating a return on investment from their 5G rollouts, it forecasts capex will correspond to 14% of revenues in 2030, down from 19% in 2023.

(Source: GSMA)

While the fair share argument has gained telco support this year, it seems the Commission might be cooling on it. It has reportedly postponed the decision, passing it on to the next Commission, which will emerge after the EU parliamentary elections in June. Many European leaders are said to be against the idea (paywall applies), including the German state secretary for digital and transport, Stefan Schnorr. A preliminary assessment by the Body of European Regulators for Electronic Communications (BEREC), meanwhile, concluded that there was no justification for such direct compensation.

Call for merger rethink

The GSMA paints a rather grim picture of Europe's mobile industry. It says market fragmentation has left "operators below the minimum viable scale to meet network investment targets," especially when it comes to 5G deployment. It goes on to call for a re-evaluation of EU merger policy, which would take into account the role of minimum long-term viable scale in markets with high fixed costs.

The EU's reluctance to allowing telco consolidation is currently being tested by Orange and MasMovil, which have agreed to merge their Spanish operations if regulators approve the deal. The block's antitrust regulators have voiced concerns over reduced competition and prices in case it is allowed, which is a common argument against such mergers.

Reuters has, however, reported that some progress has been made in negotiations. It cites unnamed sources as saying a possible solution would see the parties sell off assets, possibly to Romanian telecom holding company Digi, owner of Spanish MVNO DigiMobil.

Thierry Breton, European Commissioner for the Internal Market, has, meanwhile, argued for cross-border consolidation as part of a solution to the sector's problems. Operators are not thrilled by the idea, wanting consolidation to take place in national markets first, as Telecoms.com (Light Reading's sister publication) has written.

Elsewhere in the report, the GSMA notes that 5G standalone (SA) represented only 5% of all live 5G networks, lagging Asia-Pacific, with 25%. While it attributes the lag to the challenging operating environment, the GSMA also says that adoption is likely to pick up because 5G SA represents an opportunity for monetization through upgrading customers and improved support for network slicing.

The report also says 5G private networks are on the rise and represent an opportunity for creating additional revenue streams. While deployments currently focus on LTE because of equipment availability, the growing share of 5G makes it possible to serve additional enterprise customers.

Read more about:

EuropeAbout the Author(s)

You May Also Like

.jpg?width=300&auto=webp&quality=80&disable=upscale)