Here comes the AI phone

Around 60M AI-enabled smartphones are expected to ship this year, opening fresh use cases and growing network traffic, but for telcos, the task once again will be to find a way to extract revenue.

Smart devices have been the biggest single driver of mobile revenue for the past 15 years, so it makes sense to try to understand the new generation of AI phones.

Analyst firm Canalys has forecast that AI-capable devices will account for up to around 5% of smartphones shipped in 2024 – that still means around 60 million units. Canalys believes the smartphone will play a central, if not the central, role in the era of on-device AI, thanks to its huge installed base, its versatility and its portability.

In a new post, analyst Lucas Zhong says AI has already been running on devices for nearly a decade.

“Chipset vendors such as Qualcomm, Mediatek, Samsung and Google have focused on improving NPU [neural processing unit]/TPU [tensor processing unit] performance for years. Smartphone vendors including Apple, Huawei, vivo, and Xiaomi are implementing AIML algorithms locally to improve imaging quality, battery life, and typing experience,” he writes.

Automated social media posts

But with the arrival of large language models (LLMs) and other GenAI models, on-device AI will require a different computing platform and new software capabilities.

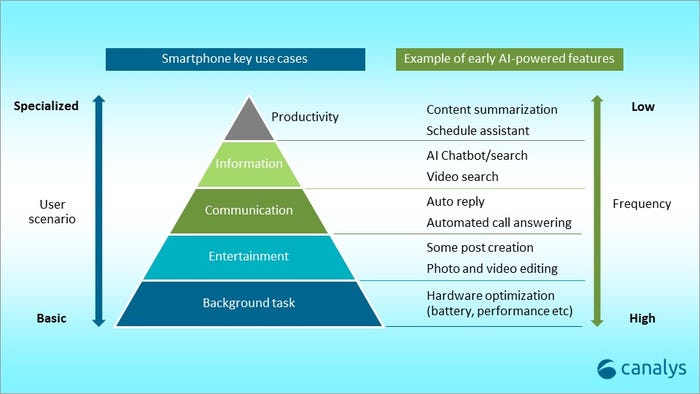

To get a sense of what the new phones will be able to do, Canalys has come up with a hierarchy of likely use cases, running from low-frequency professional apps like scheduling to high-frequency background tasks like battery optimization.

(Source: Canalys)

These might include cross-device automation, like harnessing sensors to automatically turn on the lights or TV when the user arrives home; automating social media posts and photo editing; or delivering automated call answering.

Zhong says the emergence of LLMs means the handset industry will have “to rethink and redefine the definition of 'AI-capable' smartphones powered by GenAI.”

Inevitably the broad definition means we are going to see a deluge of AI-branded devices, with a lot of discussion about just what makes it AI.

AI handsets and chips will be a big focus at CES next week. Among the heavyweight brands Samsung seems to be first out of the gate, foreshadowing a new flagship device with the tagline “Galaxy AI is coming.”

Besides the usual suspects, the AI device sector is also set to be enlivened by a collaboration between former Apple chief designer Jony Ive and Open AI CEO Sam Altman.

They're going to build AI-based hardware, with OpenAI supplying the software and Ive's company LoveFrom the hardware.

We don't know what exactly these products will be, although Altman says he has no intention of competing with the smartphone. Bloomberg reports that it may include home devices. LoveFrom's clients include Ferrari, Airbnb and Italian fashion house Moncler.

For operators this seems a now-familiar scenario of an exciting new technology driving extra traffic and enabling new use cases. The task once again will be to find a way to extract revenue.

Read more about:

AIAbout the Author(s)

You May Also Like