After T-Mobile layoffs, big US telco job cuts hit 28,100 in 2023

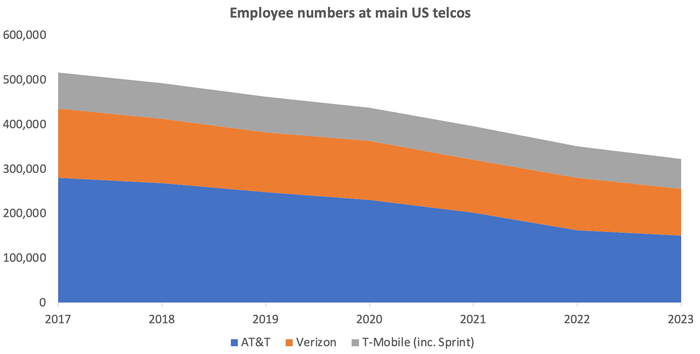

AT&T, T-Mobile and Verizon cut about 8% of their combined workforce last year, their latest accounts show.

Time travel and soothsaying would seem to fall outside the remit of telecom technology, and yet T-Mobile US famously pulled one of them off before merging with Sprint in 2020. Realizing concern about job losses could thwart the deal it announced in early 2018, when the two operators had around 81,000 employees combined, executives either procured Dr. Emmett Brown's DeLorean or gained Nostradamus-like powers to see that T-Mobile and Sprint had fewer than 71,000 employees by late 2022 in a future where they had been stopped from uniting.

Provided they had more on the payroll by that date after a merger, they could not be accused of lying. "The overall plan is for the larger company to employ more staff than the two previous companies put together," they told authorities, naturally meaning the two companies in the alternate, no-merger future of late 2022. True to their word, T-Mobile finished that year post-merger with 71,000 employees, according to its annual filing with the US Securities and Exchange Commission. A year later, the number had fallen to 67,000.

That detail is included in the SEC filing published on February 2 this year, and it comes after T-Mobile reluctantly warned in August 2023 of plans to cut about 5,000 mainly corporate jobs. While the drop, therefore, is no great surprise, it means T-Mobile and Sprint have effectively cut their workforce by about 14,000 roles since they first aired their merger plans. That's a head-spinning 17% of the pre-merger total.

For all the excitement about T-Mobile compared with older and more sluggish rivals, it has effectively entered the plateau phase of its existence, the telco equivalent of middle age in men. Sales haven't risen since the year of the Sprint merger. And like men of a certain disposition, T-Mobile is desperately trying to slim down in response and pump up its profits. Shedding a few thousand members of staff would have helped lift operating income from $6.5 billion for 2022 to $14.3 billion last year.

(Source: Companies)

Those older and more sluggish rivals are dab hands at cuts. Having already tossed aside enough people in recent years to repopulate small nations, AT&T and Verizon scrapped another 24,100 jobs between them in 2023, accounts show. Of course, the middle-age slowdown currently affecting T-Mobile has been a problem for these companies for much longer. But the collective 28,100 job cuts that happened last year at the three telcos represent 8% of their combined workforce.

AT&T and Verizon blame the cuts, in part, on the divestment of assets, including the Time Warner business that AT&T disastrously bought for $85 billion in 2018 before it was spun out and merged with Discovery just three years later. Verizon had its own catastrophic career moves with acquisitions of AOL and Yahoo, two darlings of the early dotcom era that looked badly wrinkled – to put it diplomatically – by the time of the Verizon takeovers in 2015 and 2017. T-Mobile and Sprint, naturally, would not have required hundreds or thousands of employees in overlapping roles post-merger, whatever their promises on jobs.

Welcome to the machine

Even so, there will be alarm at the scale of last year's cuts as the volume control is turned up on chatter about automation and artificial intelligence (AI). For several years, the message from senior technical executives has been that technology is increasingly reducing the manual effort needed for humdrum network maintenance and operations. A new lexicon has emerged to describe this phenomenon. Expressions like "zero touch," "closed loop" and "self-driving network" all denote the absence of humans in parts of the business.

Last year, of course, brought generative AI into mainstream public view for the first time, and there is an expectation it will be a standout theme of this year's upcoming Mobile World Congress in Barcelona. It would be a depressing development if so, given that most of the telco use cases discussed until now have been about cost savings and efficiency rather than sales growth. Cue chatbots to handle customer service queries and provide technical advice to engineers, or "co-pilots" to write code while software programmers take a mid-flight nap.

Despite all this, some executives and press-relations staff still deny their main goal is to cut jobs through automation and the use of artificial intelligence. Instead, they argue, these technologies will "free up" staff for more worthwhile tasks. But with the lack of sales growth, profits won't rise unless employees are "freed up" for layoffs. Philip Jansen, the former CEO of BT, has been more forthright than most of his peers, arguing last year that AI would claim 10,000 of 130,000 BT jobs by 2030, and that another 45,000 would disappear for other reasons.

What's evident from the US data is that staff numbers have declined at a much steeper rate than sales, proving telcos can manage the same operations with fewer people. Annual revenues generated by AT&T, T-Mobile and Verizon were $24.6 billion or 7% lower in 2023 than the figure earned by the same companies plus Sprint in 2017. But combined headcount plummeted by 193,500 or 37% over the same period. Sales per employee, a measure of productivity, has correspondingly soared, growing from less than $700,000 in 2017 to nearly $1.04 million last year.

Still unclear is whether T-Mobile bosses used their time machine or soothsaying skills to look much further ahead. Is the North American operator of 2035, when this correspondent will be in his seventh decade, a fully autonomous telcobot with a sole human employee, retained like the drivers on the London Underground for purely cosmetic reasons? The bottom line, at least, should have ample room to grow.

About the Author(s)

You May Also Like