DeWi player World Mobile leases spectrum, eyes blimps

World Mobile recently inked a four-year spectrum lease agreement with ATN International and said it hopes to begin 'rewarding individuals to roll out and maintain the network.'

World Mobile recently inked a four-year lease agreement with ATN International to obtain the rights to spectrum licenses covering parts of California, Nevada, Utah and New Mexico. And based on the company's website, it appears to be planning to cover rural areas in those states with cell sites deployed on blimps.

It's not a new idea. Other companies that have discussed similar plans include Airbus, Facebook, Intelsat, BT, SoftBank, Elefante, Google and Altaeros. AT&T first used a blimp for its FirstNet service in 2020.

However, World Mobile appears to be bringing one new element to the cell-tower-in-the-sky concept: a decentralized wireless (DeWi) business model.

"By rewarding individuals to roll out and maintain the network, both capital and operational expenditure is reduced," the company wrote on its US website.

World Mobile representatives declined to respond to questions from Light Reading. That isn't surprising. Last year a PR firm contacted Light Reading to offer an interview with a World Mobile executive, but after several exchanges, the firm said instead that the interview was "no longer relevant." After another round of emails, the firm suggested World Mobile had "paused all PR efforts."

US expansion

In a press release last month, World Mobile said it has "secured up to 20MHz of spectrum across the states of California, New Mexico, Nevada and Utah, providing a solid foundation for World Mobile's US expansion plans."

The company's CEO, Micky Watkins, added in the release: "By securing licensed spectrum, we are signaling our intent to revolutionize the connectivity landscape in the United States. Securing spectrum strengthens our position to deploy our network and support a profitable sharing economy. We believe in harnessing the collective power of individuals and communities to create a more inclusive and connected world." According to his LinkedIn profile, Watkins has founded several other startups.

World Mobile said in the news release that it plans to deploy its service in the US later this year.

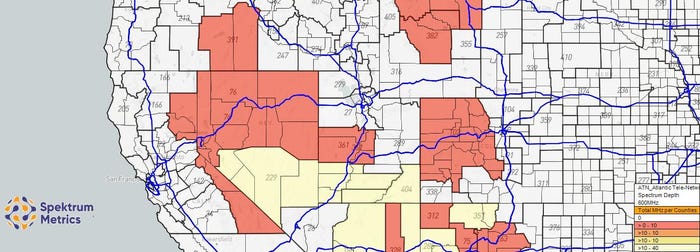

Although World Mobile officials wouldn't discuss the company's spectrum transactions, Brian Goemmer, of spectrum-tracking company Spektrum Metrics, found FCC documents showing World Mobile's leasing agreement with ATN including for 10MHz near Reno, Nevada; 20MHz near St. George, Utah; and another 20MHz near Espanola, New Mexico.

World Mobile inked leases for spectrum covering parts of California, Nevada, Utah and New Mexico.

(Source: Spektrum Metrics)

On its website, World Mobile boasts that its Super AirNode blimps provide the same coverage as 12 traditional, ground-based telecom towers. (The company calls the airships "aerostats," presumably because they are semi rigid.) The company said it has been testing its offering in New Hampshire.

World Mobile said last year that it was "evaluating and planning first USA deployments in Wyoming. Site visits and potential first rollout scheduled for early September." More recently, the company has touted efforts in countries such as Kenya, Mozambique, Pakistan and Zanzibar.

Taking DeWi to the skies

DeWi companies like World Mobile have been promising to use cryptocurrency as a reward for the construction and operation of cell sites, although some are working to shift from crypto to regular dollars. In either case, the business model promises to shift the costs of building wireless networks from an operator to, well, just about anyone willing to make an investment.

Players in the space include Helium Mobile, Pollen Mobile, Xnet and Karrier One. Some, like Xnet, have been loudly touting progress. Others, like Pollen, have grown quiet in recent months.

Helium remains the pioneer – and best-known name – in the sector. It recently launched mobile services in the US through a mobile virtual network operator (MVNO) deal with T-Mobile.

Helium is also working to entice investors to build their own 3.5GHz CBRS transmission sites in support of a Helium Mobile DeWi network. The company's latest: a mapping feature on Helium Mobile phones that can help the company identify locations where it should encourage the construction of new CBRS sites.

But Helium continues to face difficulties. For example, its CBRS network in the US earlier this year spanned more than 8,000 sites but today sits at around 5,000.

Related posts:

— Mike Dano, Editorial Director, 5G & Mobile Strategies, Light Reading | @mikeddano

About the Author(s)

You May Also Like