Altice USA prioritizes fiber subscriber 'migrations'

The pace of Altice USA's fiber network upgrade has slowed, but an emphasis on migrating cable broadband subscribers to its new fiber platform helped the company add a record high 46,000 fiber subs in Q4 2023.

Altice USA will continue to upgrade its hybrid fiber/coax (HFC) networks to fiber, particularly in its footprint in New York, New Jersey and Connecticut. But the operator is putting a greater emphasis on migrating existing cable broadband customers to its new PON platform, which is now being used to deliver symmetrical speeds up to 8 Gbit/s.

"We remain committed to fiber," Altice USA Chairman and CEO Dennis Mathew said Wednesday on the company's Q4 2023 earnings call. "We want to lean in and drive more customers to that network. We are prioritizing migrations in particular."

He noted that Altice USA has also improved some processes to help accelerate the company's ability to migrate cable subs to fiber.

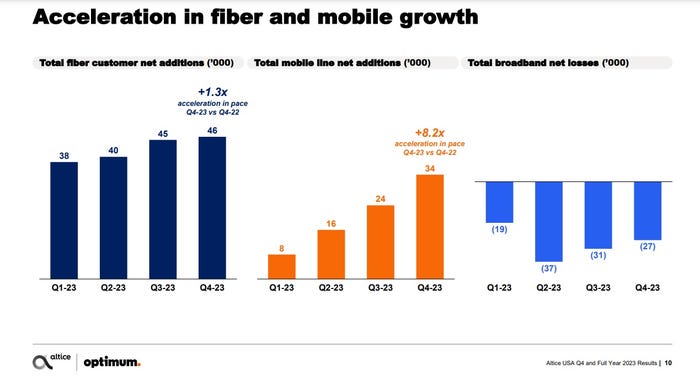

That focus is starting to show in Altice USA's fiber subscriber results. The company added a record high 46,000 fiber subscribers in Q4 and 170,000 for the full year, extending its grand total to 341,400.

(Source: Altice USA Q4 2023 earnings presentation)

The company built fiber to another 14,900 locations in Q4 2023, slowed from a build to 250,500 new fiber locations in the year-ago quarter. Altice USA built fiber to 576,400 locations for full-year 2023, compared to 987,800 for full-year 2022.

Meanwhile, Altice USA's emphasis on fiber migrations caused penetration of Altice USA's fiber network to reach 12.5% at the end of 2023, up from 8% at the end of 2022.

Still, those fiber gains were not enough to offset total broadband losses. Altice USA shed 27,000 total residential broadband customers in the quarter, for a total of 4.17 million. Execs attributed the loss to intense competitive pressure during the holiday season along with ongoing low housing move activity. But the company believes it is positioned to improve broadband subscriber trends "over time," but isn't pinpointing when that might occur.

More mobile momentum

Altice USA's mobile business is gaining some steam. Altice USA added 34,000 mobile lines in Q4, up from additions of just 4,100 lines in the year-ago quarter, giving it a total of 322,000 mobile lines.

The company added 82,000 mobile lines for full-year 2023, versus a gain of 53,800 for full-year 2022. Mobile penetration of Altice USA's broadband base hit 7.1% at the end of 2023, up from 5.2% at the end of 2022.

Altice USA is seeing a 20% reduction in annualized churn in broadband/mobile bundles when compared to the part of the base that is getting broadband without mobile.

The fourth quarter of 2023 also marked the fourth consecutive quarter of accelerated mobile line growth for Optimum Mobile, a service that piggybacks on the T-Mobile network.

Those numbers are coming together as Altice USA is in the midst of a broader turnaround focused on returning the overall business to growth. Among recent moves, Altice USA launched new "rack rate" pricing for its fiber and cable broadband products while also looking to move some customers to faster tiers.

Pay-TV is thrown for another loss

Video's still a sore spot. Altice USA lost 62,200 video subs in Q4 2023 and shed 266,700 for the full year, ending the period with 2.17 million.

Optimum Stream, an Android TV-powered platform that runs Altice USA's pay-TV app alongside third-party streaming services, is now the company's primary video product. Mathew said Altice USA plans to introduce new, more flexible video packages later this year, but did not elaborate.

He was also asked to weigh in on a sports streaming bundle from ESPN, Fox and Warner Bros. Discovery that will launch sometime this fall.

Mathew said such direct-to-consumer offerings are good for the company's broadband business, but he's also hopeful that Altice USA will have an opportunity to sell similar packages to its video customers

"We're fighting for more flexibility as well," he said.

About the Author(s)

You May Also Like

.jpg?width=300&auto=webp&quality=80&disable=upscale)