Verizon adds 384K more FWA subs amid price boost

Verizon CEO Hans Vestberg also hints that the company will bring forth new speed and pricing options for fixed wireless access as the service approaches 2.3 million subscribers.

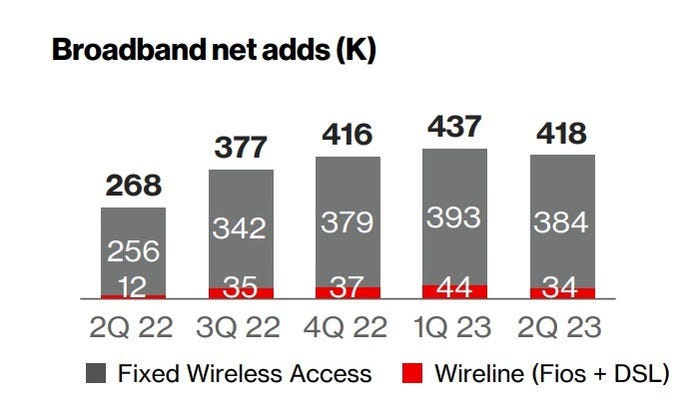

Verizon tacked on another 384,000 residential and business fixed wireless access (FWA) customers in the second quarter of 2023 as the company teed up plans to raise the price for new customers and explore a range of speed and pricing tiers for the service.

Verizon's adds of 384,000 FWA subs – comprised of 251,000 residential customers and 133,000 business customers – improved on a gain of 256,000 in the year-ago period but came in slightly below the 393,000 it added in the prior quarter. Company CFO Tony Skiadas said Verizon expects FWA subs to grow at a similar pace in Q3 2023.

Verizon ended the quarter with 2.26 million total FWA subscribers – 1.39 million consumer FWA subs and 870,000 business consumer customers.

Those results arrive a day after Bloomberg reported that Verizon is increasing the price on its 5G home broadband service to new customers by $10 per month. The decision to raise pricing could slow FWA sub growth while benefiting cable and fiber competitors, New Street Research analyst Jonathan Chaplin explained in a note issued in the wake of Monday's report. The move could also aid T-Mobile's own FWA service, as it's priced at a discount to Verizon's fixed wireless offerings.

"Based on past practice, we would bet T-Mobile holds price and goes for share," Chaplin noted.

Speaking on Tuesday's earnings call, Verizon Chairman and CEO Hans Vestberg noted that the company is on track to meet a target of 4 million to 5 million FWA subs by the end of 2025, and that he believes Verizon might do better than that. "Fixed wireless access is here to stay as a proven competitive broadband product," he proclaimed.

Vestberg also hinted that Verizon is exploring the introduction of different speed and pricing tiers for FWA.

"We also have an opportunity to segment the fixed wireless access market based on price and speed tiers so that our customers can choose the service that best suits them," he said. "We think this is natural when you pass more than 2 million subscribers on fixed wireless access."

Vestberg again shrugged off concerns that the company will run into a capacity crunch for FWA, noting that the company will be able to add coverage and capacity as it gains access to a new tranche of C-band spectrum.

"We don't have any capacity problems," he said.

New Street's Chaplin also noted that Verizon's FWA price cut has "caused us to question our thesis on capacity limits." His latest analysis indicates that Verizon is limited to 5 million to 6 million FWA subs with current spectrum holdings.

Fios broadband gains

Turning to Verizon's wireline broadband business, the company added a better-than-expected 51,000 residential Fios customers, improving from a gain of 30,000 in the year-ago period. Verizon ended the quarter with 6.85 million residential Fios broadband subs.

With the loss of 15,000 DSL factored in, Verizon added 36,000 total consumer wireline broadband subs in the quarter, ending Q2 with 7.09 million.

Q2 also marked the third-consecutive quarter in which Verizon added at least 400,000 net wireline and FWA broadband subs (residential and business).

Click here for a larger version of this image.

(Source: Verizon Q2 2023 earnings presentation)

Verizon shed 69,000 Fios video subs in Q2, improved from a year-ago loss of 86,000. Verizon ended the quarter with 3.09 million Fios video subs, down 9.3% year-over-year.

Cable MVNO partnerships a 'complex area'

Verizon also faced some questions about the future of its relationship with the cable industry, which includes MVNO pacts with Comcast, Charter Communications and Cox Communications.

Execs largely sidestepped questions as to whether its cable partners truly have a perpetual MVNO deal and if its cable partners are guaranteed to make money regardless of how much data is consumed on Verizon's mobile network.

"It's a complex area," Vestberg said of Verizon's relationship with US cable, noting that non-disclosure agreements prevent him from providing much detail about those contracts.

"The only thing that I'm secure in is that Verizon is making money on this. We think that this is an important business; these are important customers to us," he said. "You should feel confident that Verizon is doing that with the best interest of our stakeholders and our shareholders and we want to get the best return on invested capital in the network."

Related posts:

— Jeff Baumgartner, Senior Editor, Light Reading

About the Author(s)

You May Also Like