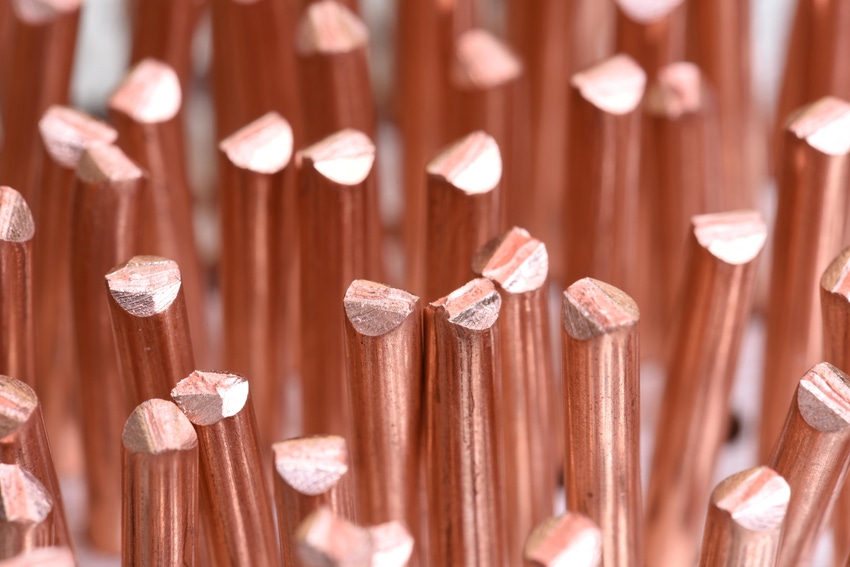

Copper decommissions spread across the US, albeit quietly

Frontier, TDS, AT&T and Verizon are among the fiber network operators working to shutter their aging copper networks. But few companies want to discuss the extent of their efforts, or the financial implications.

Some smaller US telecom providers are toying with the notion of shutting down their copper networks, following years of pioneering efforts by bigger network operators like AT&T and Verizon.

However, most players in the market don't have much to say about their own moves.

For example, officials from Frontier and TDS Telecom declined to provide Light Reading with details on their copper decommissioning activities or plans. But, according to the financial analysts at New Street Research, both companies are eyeing the savings they might be able to derive from shuttering legacy network technology.

"TDS has started decommissioning, and they think the savings could be material. Frontier is experimenting with decommissioning in a couple of markets," the analysts wrote in a recent report.

A Frontier representative said the company is not yet ready to discuss its copper decommissioning efforts. According to FierceTelecom, Frontier's CEO said last year the company expects to shutter its copper network in the next three to five years.

Similarly, an official from TDS Telecom told Light Reading the company is trialing a copper decommissioning project in an unnamed market, and the company hopes to have that location fully decommissioned by the end of the second quarter of this year. The official declined to name the market or say how many customers would be affected.

A common trend

To be clear, virtually all of the US market's telco operators are shifting from copper to fiber for their new network buildouts and upgrades. Indeed, the Fiber Broadband Association and RVA Market Research and Consulting estimate that fiber lines now pass nearly 78 million US homes, up 13% from a year ago. US government subsidies ought to accelerate those buildout efforts.

After all, copper network technology hails from the late 1800s and is far slower and more expensive to maintain than new fiber technology.

"Verizon told us they have decommissioned several million homes over the last seven years, and they are continuing at a pace of a few hundred thousand a year," according to the New Street analysts. Verizon officials didn't respond to questions from Light Reading on the topic.

Similarly, AT&T is planning to decommission about half of its legacy copper network by 2025.

But both companies are building fiber to replace many of those lost connections. AT&T is planning to reach 30 million locations with fiber by 2025. And Verizon continues to expand its Fios fiber network to roughly 400,000 new locations every year.

What's unclear though is whether every single decommissioned copper location will be serviced by fiber. For example, AT&T is replacing some copper connections with its new fixed wireless access (FWA) product.

According to Blair Levin, a policy adviser to New Street Research and a former high-level FCC official, officials in Utah recently turned down a CenturyLink request to decommission a copper network, "suggesting the difficulty telephone companies will have in the states with the transition away from traditional obligations."

The regulatory angle

As noted by Ars Technica, the FCC in 2015 outlined rules for carriers that intend to turn off copper networks and replace them with fiber. The agency noted that operators should feel free to make the switch as long as they keep providing services to customers.

On its website, the FCC has been tracking copper network shutdowns since 2017. For example, in 2023 Verizon filed shutdown plans in 38 different locations around the country. For AT&T, that figure was 134 in 2023.

Many such filings are decidedly local in nature. "AT&T plans to retire certain copper facilities in the affected distribution area (DA) in response to a city of Wilmington road construction project. The city has requested that AT&T remove or relocate facilities in the way of the project, so AT&T intends to migrate customers currently served on the affected copper facilities over to existing Gigabit Passive Optical Network/Fiber-tothe-Premises (GPON/FTTP) facilities," AT&T warned last year.

But other, smaller operators have filed similar announcements. For example, in 2022 operators including Pioneer Telephone, Frontier, Tennessee Telephone, Ziply Fiber, CenturyLink, Wilton Telephone, Hollis Telephone and Windstream were among the smaller companies that filed alerts with the FCC to warn of copper shutdowns.

Still, though, it was AT&T and Verizon that filed the most shutdown notices in 2022, as well as in other years. "Verizon plans to retire and remove the Reading MA DMS100 switch after it migrates all traffic served by the switch to the Newton MA C20 switch," the operator warned in one such filing in 2022.

About the Author(s)

You May Also Like