5G from space: A flight path to NTN

A recent Heavy Reading white paper argues that the new wave of space-to-X services offers strong customer value and helps create a long-term "flight path" for the satellite sector to adopt 3GPP standardized non-terrestrial network (NTN) technologies. #sponsored

Lower launch costs, advances in satellite technology and end-user demand for connectivity everywhere are driving a boom in activity in the satellite communications sector.

For mobile and fixed terrestrial operators, satellite is an opportunity to radically expand coverage to remote locations and connect devices and customers worldwide. For satellite operators, collaboration with telcos can bring millions (and maybe one day, billions!) of new customers and devices to their systems.

In play is a range of solutions to connect directly to smartphones and Internet of Things (IoT) devices and to provide high bandwidth satellite service using specialist terminals:

1) Connect smartphones and IoT modules to satellite systems. The pace in satellite-to-device connectivity today is being set by players integrating existing proprietary connectivity modules into smartphones and IoT devices — examples include Globalstar/Apple, Inmarsat/Bullitt and Iridium/Qualcomm. Coming up behind is a new wave of solutions to connect unmodified smartphones directly from space — examples include AST Space Mobile, Lynk Global and Starlink.

2) Provide high speed service to purpose-built terminals. New systems are adding capacity rapidly to radically change the economics of satellite access. For low earth orbit (LEO), think OneWeb, Starlink, Kuiper, et al., and for middle earth orbit (MEO), think O3B. Use cases are diverse — cell backhaul, enterprise access, redundancy, remote industry, residential broadband, ships, planes, trucks, emergencies, etc. — and revenue per connection is much higher than for occasional use, low data rate smartphone or IoT services.

A new Heavy Reading white paper, 5G from Space: A Flight Path to Non-Terrestrial Networks, argues that these space-to-X services, based on proprietary satellite technology, offer strong customer value. They will radically expand the market (OneWeb and Starlink already show this) and create a long-term "flight path" for the satellite sector to adopt 3GPP standardized non-terrestrial network (NTN) technologies. Standardized interfaces, argues the paper, can create economies of scale in customer equipment and enable tighter integration with terrestrial services.

To download a free copy of the Heavy Reading white paper 5G from Space: A Flight Path to Non-Terrestrial Networks, click here.

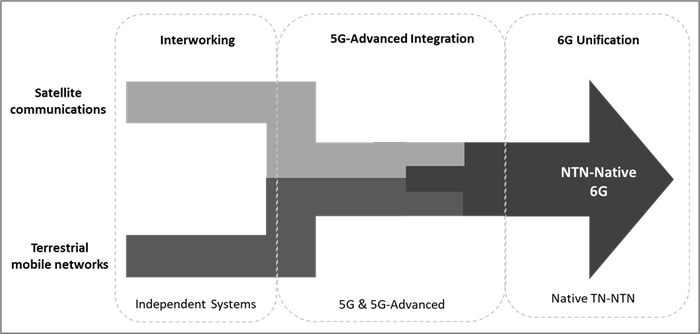

The NTN concept, which includes satellites, high altitude platforms (HAPS) and other air-to-ground communications, has been part of the 3GPP work plan for several years. The basic calculus is that the 5G system and New Radio (NR) interface were designed to be highly flexible and can be readily extended to NTN scenarios. Longer term, there is a sightline to NTN-native capabilities in 6G to help meet the vastly expanded coverage targets of IMT 2030.

The figure below shows a high level schema for how these three phases may play out, starting with interworking independent systems through deeper integration in 5G Advanced and onward to native NTN in 6G.

Toward an NTN-native 6G system

(Source: Heavy Reading)

For companies in the 3GPP ecosystem, this is a good story. NTN is a chance to drive scale and efficiency and to integrate satellite deeper into the global mobile telecommunication ecosystem with the aim of providing better services to customers. I am personally of the view that, over the longer term, NTN will deliver such benefits.

At the same time, it is important not to be seduced by the story. It is just as important to look objectively at what the market is doing, where investors are focusing and what services customers want to use and pay for. In this context, the running is being made by innovators focused on an earlier prize.

The LEO operators working to bring high bandwidth connections to remote communities, industrial sites, and cell sites, as well as across the telecom, utilities, maritime, ground transportation, aerospace and public safety sectors, already provide scalable services with price/performance far superior to legacy satellite providers. And they are not slowing down. Sure, they need investment (lots of it), and they need customers (lots of them) to make the business case, but they have made an incredible start.

The space-to-handset players are also making truly impressive progress. To "close a link" between an unmodified smartphone and LEO satellite and run a 4G or 5G data session is an astounding breakthrough. These players still have a lot to prove in scaling their systems and creating a sustainable business case, but for now, the (solar?) winds are with them.

So where, then, does NTN — an approach currently tied to ITU and 3GPP time cycles and frequency allocations — fit in this dynamic, heady environment? In the first instance, NTN will have to adapt to some of the technologies and companies currently making the market. Then, in the longer term, as gravity inevitably reasserts itself and the satellite sector needs long-term investment and access to customers and high volume advanced technology, a more mature NTN ecosystem will have a chance to prove its worth.

To download a free copy of the Heavy Reading white paper 5G from Space: A Flight Path to Non-Terrestrial Networks, click here.

This blog is sponsored by Qualcomm Technologies.

About the Author(s)

You May Also Like