A state of balance: How to think about open RAN in 2024

Heavy Reading's Gabriel Brown provides a framework to analyze the medium-term development of open RAN.

The O-RAN Alliance was formed in 2018 – just prior to the 5G cycle, but too close for open RAN technology to be ready in time for the buildout. Since then, while some success is visible, it is fair to say the industry has not yet seen a pivotal change in how mobile networks are built.

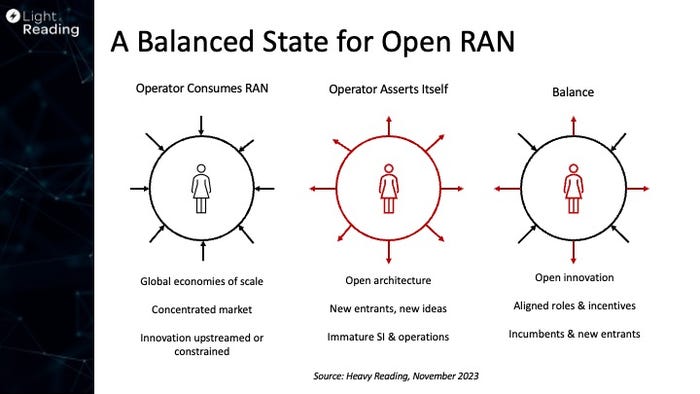

In my opening remarks at the recent Light Reading Open RAN Symposium, I set out a framework to think about the ongoing development of open RAN. The framework, shown in the figure below, breaks down into three phases:

The starting position is dominated by vendor-integrated RAN.

The development of an open architecture for RAN.

The pivotal change – to what I call a "balanced state" – where customer value comes to the fore.

Starting position: Vendor-integrated RAN

Vendor-integrated RAN works really well in the sense that it has enabled the rollout of 5G networks at a rapid rate and supports almost 2 billion customers. In this model, vendors amortize R&D across many customers and incorporate the best innovations they find around the world into the mainstream product. 5G RAN is now an industrialized technology; it is available in high volume and can be quick to deploy. This is the bar to which open RAN must measure up and, eventually, exceed.

At the same time, operators saw how open, disaggregated networking was being used elsewhere in their infrastructure and how cloud providers were using it to build hyperscale networks. They naturally wanted to bring some of this open networking goodness to RAN – which, alongside fiber build, is their biggest capital and operational expense. In countries where operators could not use Chinese suppliers or wanted to reduce reliance on them, vendor concentration in the RAN market also gave cause for concern.

Operators judged that their opportunity for innovation in RAN was constrained by having to work through a small number of big vendors, each with long development cycles. And unique innovations that operators identified would be upstreamed into the global vendor's portfolio, reducing their scope for differentiation. Whether these views were right or wrong is debatable, but clearly, large operators felt this way. In the language of psychology, they felt like RAN was being done to them and that they lacked agency.

An open architecture for RAN

The move toward an open architecture allowed operators to better assert themselves and take back some control. This is the stage of open RAN that we are in now.

Open RAN has attracted new ideas and, to some extent, new entrants (e.g., Mavenir, Rakuten Symphony). It has also enabled existing RAN companies that were struggling for market access to take a bigger role (e.g., Fujitsu, NEC). In this sense, open RAN is already something of a success.

But there are still few large-scale deployments because:

Technology and products are not/were not competitive.

The systems integration and operations models are immature.

Timing needs to fit with RAN investment cycles.

As we enter 2024, the open RAN ecosystem has not yet overcome these challenges. There have certainly been some successes – DoCoMo's multivendor 5G open RAN and Verizon's embrace of vRAN chief among them, followed by Rakuten Mobile and, arguably, DISH. But how close we are to an industry crossover is open to debate. In Europe, Vodafone Group thinks it is on the cusp of large-scale deployment with its nascent UK deployment.

My personal view, and where I depart from challenger vendors, is that I do not think positioning open RAN as a direct competitor to vendor-integrated RAN is the right way to think about the market. A market share of somewhere between 10% and 20% (optimistically) in a few years' time, split between n vendors, lacks scale and will not be sustainable in the long term.

But I have also argued, many times, that open RAN fundamentally changes the RAN and that the industry will see this impact play out over a decade or more.

A balanced ecosystem

The next phase is to move from a novel architecture to a balanced ecosystem that could bring open RAN into the mainstream.

In this phase, new entrants will be "all-in" on multivendor open RAN (the novel approach), and the industry will continue to have a global estate of vendor-integrated RAN (the conservative approach). We will also see – are already seeing – incumbent vendors (i.e., Ericsson, Nokia and Samsung) adopt open RAN into their portfolios and start to work with new entrants. Taken together, this makes for a balanced RAN ecosystem.

Challenger open RAN vendors, of course, cannot rely on incumbents to offer open interfaces. They need to act and compete independently. This should remain a key objective for these players, and operators should support them in this goal because, without it, open RAN momentum will fade. While the ecosystem may not need more open RAN vendors at this point, it does need at least a few strong new entrants.

At the same time, it is clear there will continue to be a large market for vendor-integrated systems. Nearly all incumbent vendors expect vendor-integrated systems to remain the largest part of their business over the medium term. Operators in China, for example, the world's largest RAN market, show little sign of adopting open RAN (aside from, perhaps, for indoor small cells). Until they do, their major vendors, Huawei and ZTE, will not either. Meanwhile, both of those vendors will continue to offer highly competitive vendor-integrated systems to their export markets. In every global region, there are operators that believe vendor-integrated systems are the best way for them to build RANs.

Elsewhere, other incumbent vendors (i.e., Ericsson, Nokia and Samsung) have introduced vRAN and cloud RAN offers and are committed to supporting operators that want to use open vRAN infrastructure. The move to open vRAN hardware – telco servers, containers, merchant silicon, etc. – has long-term implications and is the start of a bigger transition to cloud native (more of that in a later column). To varying degrees, incumbent vendors now also support open fronthaul interfaces and have adopted the O-RAN Alliance's Service Management and Orchestration (SMO) framework.

The adoption of open RAN interfaces by incumbent vendors is an important – perhaps vital – step to achieving industry crossover.

There are several ways incumbent vendors can support open RAN, not limited to the following:

Initially, large, established vendors are likely to connect their basebands to a mixture of their own radios and radios from independent vendors. The baseband is the control point in this scenario because it drives so much of the wider RAN system functionality and performance. It is probable that the established vendor is also the lead systems integrator in this scenario.

Over time, as challenger baseband software improves in capabilities and features, radios from incumbent vendors deployed on the tower may be transitioned to a new baseband supplier. Today, there are very few (if any) competitive new entrant baseband software suppliers, but when this changes, it will give operators another option.

Strategically, a major objective for operators is to use open RAN to strongly encourage large incumbent vendors to interoperate between themselves. This would give operators an extra lever to pull in pricing and vendor share negotiations. It would also go some way to providing resiliency if, for some reason, a critical supplier cannot fulfill its commitment.

Quite where the balance point between open and vendor-integrated RAN systems lies and how the RAN market will look in three to five years is hard to predict. Nevertheless, a balanced state with competitive new entrants and where large incumbent vendors are committed to working in an open architecture will give operators the best outcome. Such a model will increase operator control and innovation potential, enhance industry resiliency and allow operators to continue to benefit from global R&D and economies of scale.

To view the recording of the November 2023 Light Reading Open RAN Symposium, click and register HERE.

About the Author(s)

You May Also Like

.jpg?width=300&auto=webp&quality=80&disable=upscale)