Vantiva the right 'consolidator' in fragmented CPE market, CEO says

Vantiva CEO Luis Martinez-Amago says there are limited customer overlaps between Vantiva and CommScope. Vantiva intends to evaluate and streamline the companies' product portfolios and determine whether to retain or grow CommScope's retail CPE business.

Vantiva pointed to scale and synergy as key reasons it inked a deal to acquire CommScope's Home Networks division.

But the proposed deal also fits with Vantiva's plan to "reinforce" its core business, which is focused on video, broadband and IoT devices, and emerge as the company best suited to consolidate what's become a "fragmented" customer premises equipment (CPE) business, Luis Martinez-Amago, Vantiva's CEO, explained.

"I believe we are the ones to be the consolidator" of the broadband and video CPE sector, he said.

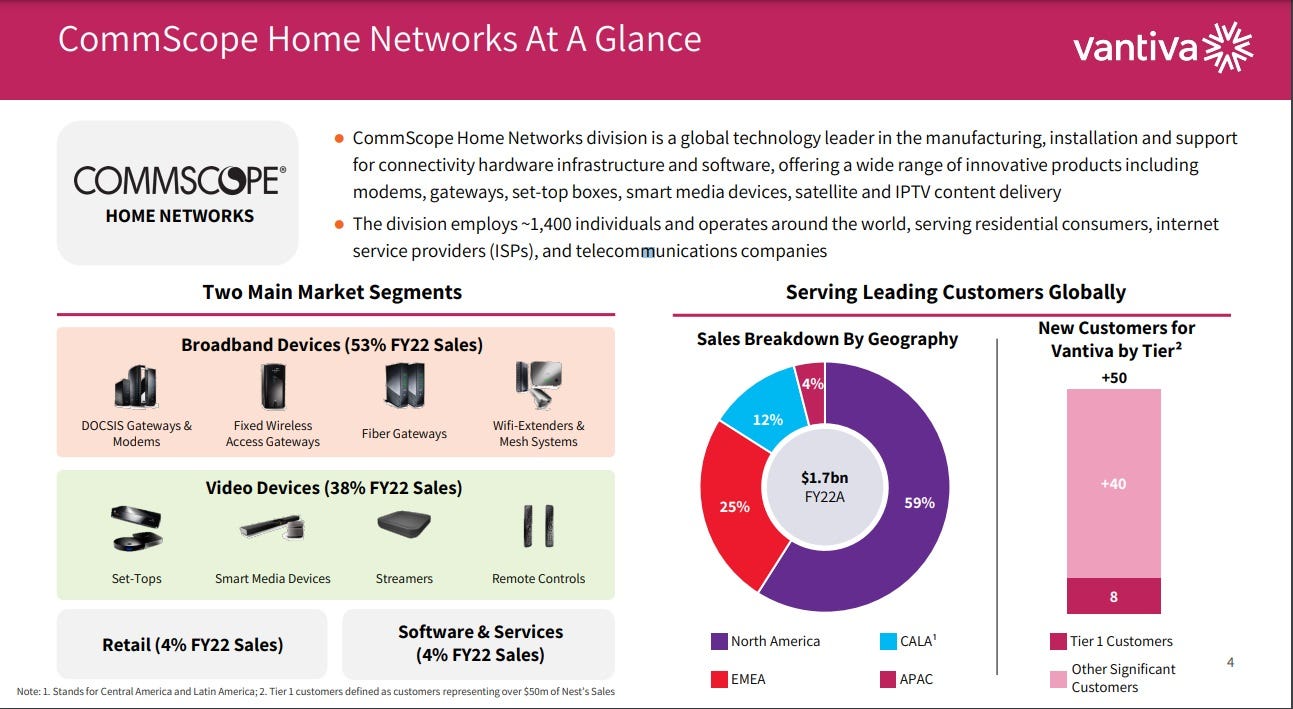

Both Vantiva and CommScope have a solid position in the North American cable market, including relationships with majors such as Comcast and Charter Communications. More than half (59%) of CommScope's Home Networks unit sales originated in North America for full-year 2022. But there is "little overlap" in those businesses with respect to both customers and geography, Martinez-Amago said.

Vantiva CEO Luis Martinez-Amago. (Source: Vantiva)

"We have presences in similar regions, but we felt that the overlap is limited," Martinez-Amago said.

The Vantiva CEO declined to name the new customers that Vantiva stands to gain from the acquisition while the agreement is still going through approval processes. But the company presented a slide showing that Vantiva would gain eight tier 1 customers and get access to more than 40 additional "significant customers."

The slide also illustrated that broadband devices represented 53% of CommScope's CPE sales. That compares to about 80% for Vantiva through the first half of 2023.

(Source: Vantiva, presentation dated October 3, 2023)

Given that Vantiva and CommScope have some product overlap in areas such as set-tops, streaming media players, broadband gateways and Wi-Fi extenders, it's no surprise that Vantiva intends to assess those products and develop a streamlined portfolio.

"We are in a similar market, but we don't need two portfolios," Martinez-Amago said.

He said it's also too early to say how many CommScope employees, including top execs at the company's Home Networks division, will join Vantiva after the deal closes. CommScope's Home Network unit employs about 1,400 people, similar to the number employed by Vantiva's Connected Home division. CommScope will get a 25% stake in Vantiva in exchange for the sale of its Home Networks unit.

Those key decisions will be made soon enough. Vantiva and CommScope have put the agreement on a fast-track, expecting to wrap the deal by sometime in late Q4 2023. Vantiva shareholders are set to vote on the proposed transaction the week of December 18.

'Neutral' on retail

Retail is currently a wild card. Vantiva does not sell CPE products at retail, but CommScope does under the "SURFboard" brand it inherited from its 2019 acquisition of Arris. Retail represented about 4% of revenues for CommScope's Home Networks division in 2022.

Martinez-Amago said he's "neutral" on the retail topic but is likewise "motivated" to take a closer look to see if retail is an area Vantiva would want to maintain or perhaps expand upon.

"My ears are open to understanding the value of [retail]," he said. "We need to see if there's a retail component that we can still pull forward."

Martinez-Amago added that Vantiva will also take a closer look at the software and services segment of CommScope Home Networks, which generated about 4% of revenues last year. Several service providers are using those CommScope products today, so it will be worth seeing if they could be extended to Vantiva's existing product line, he said.

Sourcing silicon

A big question moving forward is whether Vantiva intends to source silicon from multiple chipmakers for DOCSIS modems and gateways. The company has primarily based its DOCSIS gear on Broadcom silicon. CommScope's Home Networks unit has also built DOCSIS products powered by Broadcom, but it also has been an important customer of MaxLinear, the chipmaker that acquired Intel's home gateway business in 2020.

Vantiva has been asked whether it will employ a dual-silicon strategy with respect to DOCSIS. But it's possible that the decision will largely be out of its hands as cable operators start to upgrade to DOCSIS 4.0. According to multiple industry sources, top cable operators, not their suppliers, are driving DOCSIS 4.0 deals with chipmakers such as Broadcom.

About the Author(s)

You May Also Like