Comcast cuts price on some mobile plans

Comcast's decision to reduce the price on some Xfinity Mobile plans puts the operator closer to Charter's 'hyper-aggressive Spectrum One pricing model,' MoffettNathanson analyst Craig Moffett says.

Comcast has lowered the price on certain Xfinity Mobile plans, a move that puts the operator closer to Charter Communications' "hyper-aggressive Spectrum One pricing model," MoffettNathanson analyst Craig Moffett noted in a new report (registration required) sizing up the broader US wireless sector. SpectrumOne is Charter's mobile/home broadband bundle that also includes a free mobile line for 12 months.

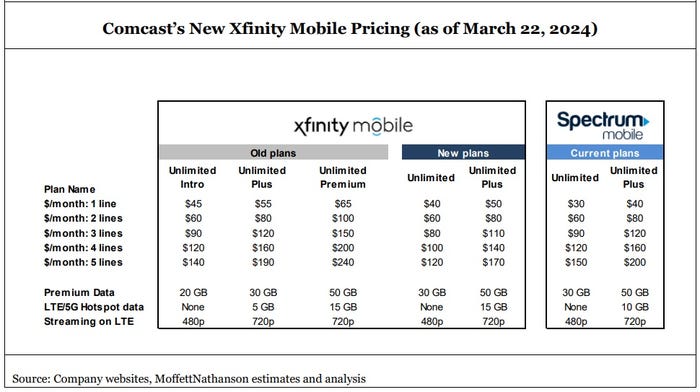

Launched last week, Comcast's mobile pricing updates pare down its unlimited mobile plans from three to two. Pricing on Xfinity Mobile plans for single lines and for family plans with three or more lines have been reduced while two-line plans remain the same. Here's how Comcast's new plans stack up and how they compare to Charter's current plans for Spectrum Mobile.

Comcast's by-the-gig option still sells for $20 per month for 1 gigabyte of data.

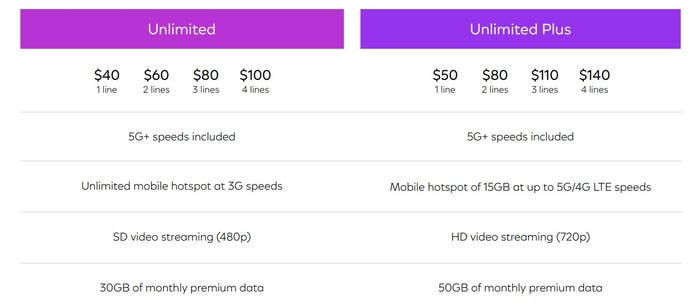

Update: Here's a closer look at Comcast's new unlimited tiers for Xfinity Mobile:

(Source: Comcast)

Comcast's revised mobile pricing arrives as the operator continues to add mobile lines every quarter, but the rate of growth has started to slow. Comcast added 310,000 wireless lines in Q4 2023, down from a gain of 365,000 mobile lines in the year-ago quarter. Comcast, which is scheduled to report Q1 2024 results on April 25, ended 2023 with 6.58 million mobile lines.

"I think we can improve on these [mobile] results," Comcast Cable CEO Dave Watson said in January on the company's Q3 2023 earnings call.

Cable's share of mobile net adds drops

Per Moffett's calculations, US cable's share of mobile net adds in Q4 2023 was 41%, down from 54% in the year-ago quarter. Cable's share of mobile net adds in Q4 also was down sequentially from the 49.2% tallied in Q3 2023.

"Perhaps that quieted some of the anxieties about the impact that Cable's ultra-low prices are having, or will have, on the Big Three [AT&T, T-Mobile and Verizon]," Moffett noted. "But the typical seasonal pattern is that Cable tends to take a much higher share of net industry growth in Q1, and then even more in Q2 (the law of small numbers). We expect anxiety about Cable's competitiveness to be more prominent over the next six months as a result."

Cable's share of total mobile lines is now hovering at about 4.5%, Moffett noted, holding that cable's "runway [in mobile] still looks quite long."

Reflecting back on Q4 2023, T-Mobile's share of industry postpaid mobile gross adds led with 31.2%, followed by Verizon (30.5%), AT&T (23.2%) and cable operators (14.3%).

Moffett expects US cable to add 3.56 million lines in 2024, with Charter expected to add 2.07 million mobile lines, followed by Comcast (+1.36 million lines) and Altice USA (+119,000 lines).

His mobile tally and forecasts do not yet include Cox Communications, which like Comcast and Charter is selling mobile through an MVNO deal with Verizon.

In January, Cox officials stressed that the operator will focus on ramping mobile volume in 2024.

About the Author(s)

You May Also Like

_International_Software_Products.jpeg?width=300&auto=webp&quality=80&disable=upscale)