New Heavy Reading survey investigates what CSPs are looking for in MEC performance monitoring/assurance in a hybrid cloud environment

Heavy Reading's Telcos and Hyperscalers report indicates carriers have committed to edge computing and are progressing rapidly with implementations.

Heavy Reading collaborated with Ericsson, Google Cloud, Intel and Viavi to conduct a survey of 101 global CSPs that have launched edge computing solutions or are planning to do so within 24 months. The aim was to understand how communications service providers (CSPs) and hyperscale cloud providers (HCPs) work together to enable edge computing. One of the themes we were interested in exploring was the challenge of managing an edge computing service in a hybrid cloud environment.

Edge computing infrastructure and service management can be difficult and complex. It is even more so in a hybrid cloud environment. The CSPs are starting out internally with multiple (in some cases, dozens of) operations support systems (OSS), inventory systems and data repositories, which may or may not impact the edge computing service. End-to-end service management across the public or private cloud then requires insights into device and application performance that is outside the control of the CSP. Managing multi-access edge computing (MEC) services demands tight coordination between the enterprise and hyperscaler to establish not only the key performance indicators (KPIs), but also how these KPIs will be enforced, measured and reported.

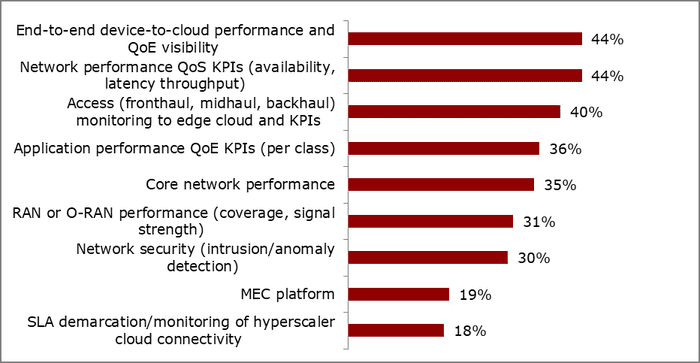

Heavy Reading asked survey respondents, "What performance monitoring/assurance capability will your organization need for edge computing infrastructure and services?" The top response for most demographic segments was "end-to-end device-to-cloud performance and QoE [quality of experience] visibility." It is this holistic, bird's-eye view of the end-to-end service that is most difficult to capture, and most of the other capabilities listed in the figure below are prerequisites for that.

All performance monitoring & assurance capabilities look attractive to the CSPs

(Source: Heavy Reading, 2023)

All the other capabilities vary in terms of survey responses according to revenue, region, type of CSP and edge deployment status. Each capability is important to specific subsets of the survey. In general, however, survey results show that, after end-to-end service management, the CSPs are concerned with the overall network, then the access network, then core, then the radio access network (RAN). Applications performance and QoE rank near the top for most demographic segments. MEC platform and service-level agreement (SLA) rank near the bottom. Not all CSPs are managing their own MEC platforms, and even fewer offer SLAs for MEC services — nor are their HCP partners offering them SLAs partners.

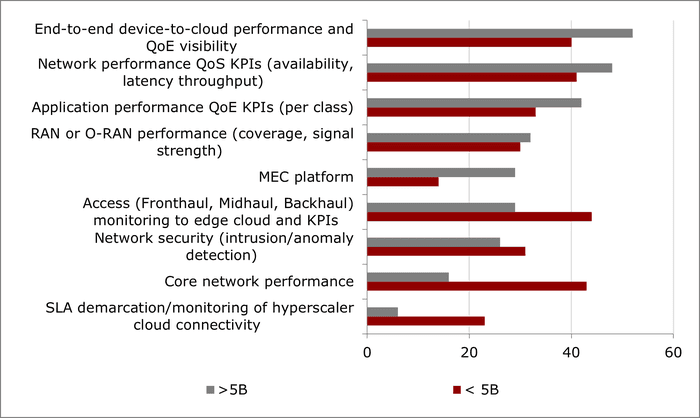

The most significant differences occur when we compare CSPs with more than $5bn in revenue to those with less than $5bn in revenue. The top two capabilities — end-to-end performance and network performance quality-of-service KPIs — remain the same but are significantly more important to the largest carriers. Application performance, RAN or O-RAN performance and MEC platform move up the list in importance for large carriers, while access and core network performance sink in the order. A higher percentage of the largest carriers are looking to manage their own MEC platforms, raising the importance of that capability. Core performance, on the other hand, shows the greatest divide between the two revenue sets, with 17% of the more than $5bn crowd choosing it as a priority compared to 43% of CSPs with less than $5bn in revenue. These results highlight the focus of the largest carriers on big picture edge issues versus those capabilities that, while important, currently fall outside of that focus — security, the core network and SLAs.

Priorities change when looking at the largest CSPs

(Source: Heavy Reading, 2023)

Read the full report for more edge computing insights

Heavy Reading's survey results show that carriers have committed to edge computing and are progressing rapidly with implementations. At the same time, they are expanding their partnerships with the hyperscalers, particularly in the areas of automation and AI. To gain more in-depth details of service providers' perspectives on edge computing deployment and their hyperscaler brethren, download and read the full report now.

This blog is sponsored by Viavi.

About the Author(s)

You May Also Like

_International_Software_Products.jpeg?width=300&auto=webp&quality=80&disable=upscale)