Network operator views on the evolving cloud metro

Key findings from Heavy Reading's Year 2 Cloud Metro Survey show that 5G and edge continue to drive metro network modernization, but requirements for suppliers are changing. #sponsored

To meet networking demands — largely driven by the migration to the cloud by customers as well as by the communications service providers (CSPs) themselves ― network operators must apply cloud principles to architecting, building and operating their metro networks. Cloud principles include open interfaces, cloud native software design, artificial intelligence/ machine learning (AI/ML) and software as a service (SaaS), among others.

Aimed at understanding the metro network evolution of CSPs, Heavy Reading launched its first Cloud Metro Survey in 2022. In spring 2023, we conducted a Year 2 version of the survey with the goal of understanding how operator priorities are evolving over time. The 2023 survey fielded responses from 84 network operators globally. A Heavy Reading white paper analyzing the survey results can be found here.

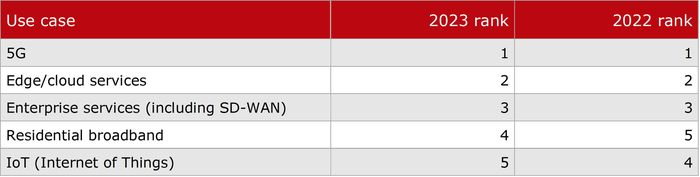

5G and edge/ cloud services are the number 1 and 2 application/ use case drivers, respectively, for metro network modernization, according to the 2023 survey. 5G and edge/ cloud are also tightly linked initiatives because network operators view edge cloud as essential for many of the emerging enterprise 5G use cases that require ultra-low latency and hosting workloads close to customers. 5G and edge/ cloud were also the top two application drivers in the 2022 Cloud Metro Survey.

What are the main application/use case drivers for modernizing your metro network?

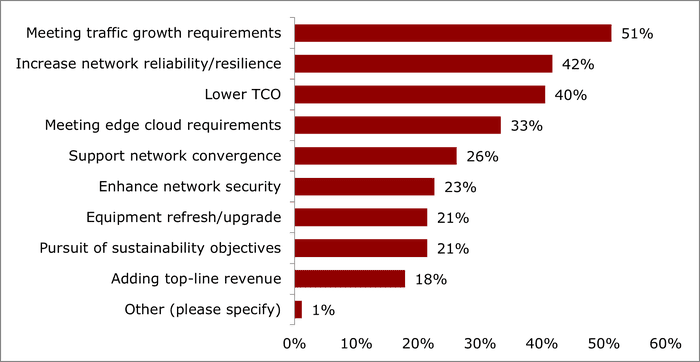

The top three business drivers for metro network modernization initiatives, according to this year's survey, are meeting traffic growth requirements, improving network reliability and resilience and lowering total cost of ownership (TCO). Each of these network modernization drivers was selected by at least 40% of respondents, well ahead of any other drivers.

Meeting traffic growth requirements while lowering the costs of doing so is a familiar story in telecom; therefore, it is no surprise that these drivers continue to top the list. The rise of resilience/ reliability to be essentially on a par with lower TCO is a newer trend, but one that has been coming through in other recent Heavy Reading surveys. Resiliency has become particularly important in 5G network plans as operators seek to differentiate 5G from 4G best effort mobility and target new enterprise use cases that place a premium on network reliability. (As noted, 5G is the top use case/ application driver for metro network modernization.)

What are the primary business drivers to modernize your metro network?

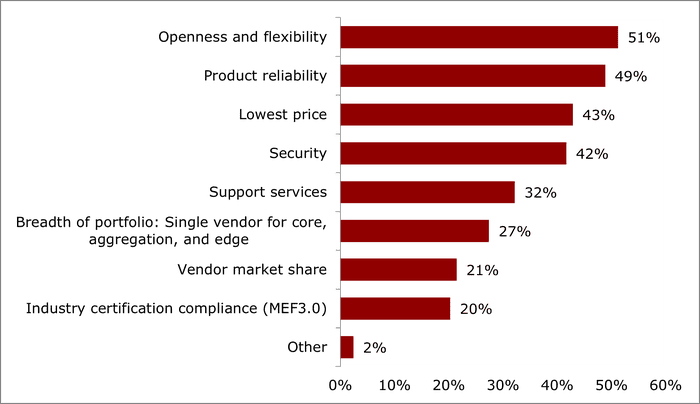

Network operator requirements for their suppliers evolve over time. Topping the list of critical attributes for metro vendors in 2023 are openness and flexibility, product reliability, lowest price and security. Openness and flexibility moved up from the third most important attribute in 2022 to the top spot in this year's survey. The results suggest that multiple trends under the umbrella of "openness" that have been percolating and progressing for several years have now reached critical momentum in the market. Prime examples include software-defined networking (SDN), disaggregation, open APIs, open RAN, virtualization and standardized pluggable optics.

What are the most critical attributes when evaluating metro network solution vendors?

CSPs are increasingly applying cloud principles to all aspects of their metro networks and relying on leading vendors to help them navigate big network changes. Heavy Reading survey data shows that operators will place the strongest emphasis on supplier openness, reliability, security and the lowest TCO.

Looking for more information? Register for the upcoming Light Reading webinar:

This blog is sponsored by Juniper Networks.

About the Author(s)

You May Also Like