Cable business services enter a new era

Cable's commercial services continue to gain ground on telcos, but have reached a level of consistency and maturity, causing operators to expand and evolve their business-focused offerings beyond core areas such as connectivity.

The US cable industry is still a disruptor of sorts in the business services sector, running units still considered growth engines that are stealing share from incumbent telcos.

But the rate of growth has tapered off as cable's focus on business services has expanded and matured over the last couple of decades. In addition to moving up market to serve mid-sized and enterprise-class businesses, cable operators are also evolving and expanding well beyond core categories such as voice services and raw connectivity. Cable operators also are playing a bigger role in areas such as edge computing as well as providing some of the key components underpinning smart cities and "smart spaces."

That was one theme touched on this week at Cable Next-Gen Business Services. Now in its 17th year, Cable Next-Gen Business Services is the longest-running event in Light Reading's history. (Editor's note: the event was called The Future of Cable Business Services when it debuted in 2007.)

Cable's growth in business services is now mature, marked by steady and consistent revenues, Heavy Reading's Alan Breznick explained in his opening remarks.

Steady and consistent growth

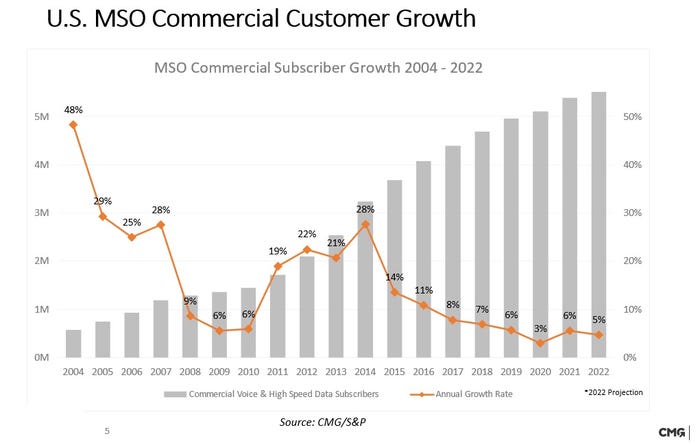

Customer growth in the category is still rising, but has started to plateau as this part of the business became larger and as cable amplified its focus on a smaller pool of midsized and large business customers.

According to CMG/S&P, the number of businesses served by US cable operators rose 5% in 2022, down from the 6% growth that was seen in 2021 and 2019, but ahead of the 3% rise seen in the pandemic-marked year of 2020.

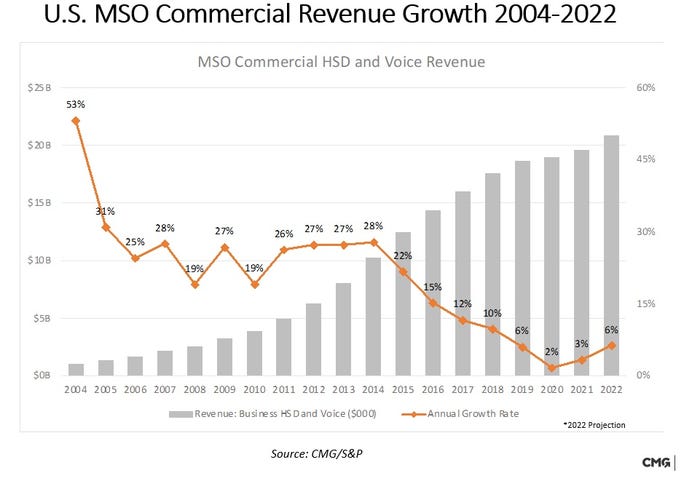

Meanwhile, US cable business services revenues rose 6% in 2022, recovering a bit from the lull seen in 2020 and 2021.

Cable is growing revenues across small (up to 19 employees), midsized (20-99 employees) and large businesses (100-plus employees). However, revenues are still highly concentrated in the small business segment. According to CMG/S&P, US cable is poised to draw $17.3 billion from the small business segment and a compound annual growth rate (CAGR) of 14% versus $3 billion and a 19% CAGR in the midsized category, and $4 billion and a 10% CAGR in the large/enterprise category.

More focus on digitization, cloud, AI and the edge

To keep pace with the changing market, Cox Communications is evolving its focus on business services to support "Web 3.0," a platform that will feature immersive/digitized experiences and a greater focus on cloud and artificial intelligence and machine language technologies, Joshua Sommer, Cox's VP of new growth development, explained in his event keynote.

"Whatever you call it, we know it's different," he said of this Web 3.0 inflection point.

For example, cities and municipalities are starting to digitize their footprints to aid areas such as construction, traffic pattern management and even prepare for floods. Cox, Sommer said, is positioned to help fill that role with connectivity, private networking, edge computing, managed cloud infrastructure and IoT capabilities.

"It's causing us to think different about the future ... it's forced us to disrupt ourselves," he said.

Getting smarter about smart cities

A follow-up panel shed more light on how cable operators have evolved their business services capabilities and their specific focus on smart cities opportunities.

Initiatives focused on transportation and safety are still in demand, but cities are becoming even more purposeful on the projects they're focusing on following the pandemic, Patti Zullo, senior director, smart solutions for Charter Communications' Spectrum Enterprise unit, said.

She said demand in cities jumped for connected kiosks and "curb management" for delivery drivers. "Cities are trying to manage what they found during the pandemic, which probably was a problem before the pandemic, but really got elevated during the pandemic," Zullo explained.

Caroline Goodbody, senior director, product strategy for Comcast Smart Solutions, noted that the demands to protect the privacy of citizens using smart, connected infrastructure also has risen.

Municipal leaders are also being extra vigilant on how they are spending on smart city applications and services. That trend has drawn increased interest in new LED lighting projects that can tap into existing budget line items, Christine Primmer, AVP of strategic business development at Cox, said.

Zullo agreed, noting that even small budgets can be transferred and translated to smart city projects. "Having a small budget doesn't mean you can't be a smart city," she said.

Panelists also noted that cities and municipalities can tap into grants and other resources to help fund their projects.

US Ignite is an organization that tracks those opportunities and can help city and municipal leaders quickly discover what's available to them, rather than making funding for smart city projects solely a bond or tax issue, said Lee Davenport, the organization's director of community development.

"As Patti said, you don't have to be small or big to be a smart city. You just need to know where the money is," Davenport said. "And there's a lot of money out there now, but it won't be there forever."

Meanwhile, activity is ramping up to include "smart spaces" – schools, parks and retail locations among them. "Anything can be smart, regardless of where it is," Zullo said.

Primmer said Cox has deployments underway in a handful of public parks, including public safety-focused cameras that connect to a Cox-supplied private network.

Goodbody noted that Comcast has increased its focus on solutions for multi-family environments and in retail stores that use capabilities already being used in smart city deployments. For instance, the technology to track foot traffic in a city or a retail store is similar, but the end goals and underlying drivers are different, she said.

About the Author(s)

You May Also Like

_International_Software_Products.jpeg?width=300&auto=webp&quality=80&disable=upscale)