Orange Business Services looks in much better shape than its European telco rivals, but can it now become an 'Internet of enterprises' market leader?

Helmut Reisinger, the newish boss of Orange Business Services, can afford to be chirpier than his main European rivals. Deutsche Telekom's T-Systems unit is slashing thousands of jobs as it tries to inflate profits. BT's Global Services division has been hobbled ever since an accounting scandal in Italy wiped billions off its parent company's market valuation. The IT services part of France's Orange is not quite performing the can-can, but it has a joie de vivre that its German and UK equivalents have long missed. (See DT's T-Systems Agrees Plan to Cut 5,600 Jobs ⎼ Report and BT: It's Good to Talk About Profits, but Not Customers.)

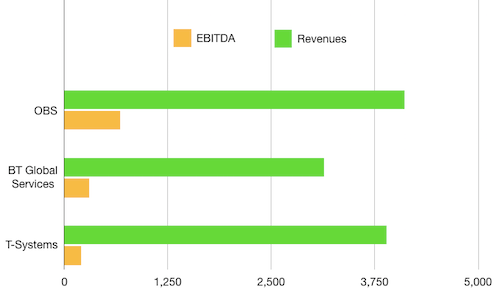

Nevertheless, Orange Business Services (OBS) is under much the same pressure as T-Systems International GmbH and BT Group plc (NYSE: BT; London: BTA). In the first half of this year, Orange's "enterprise" revenues held steady, at about €3.5 billion ($4.1 billion), but earnings (before interest, tax, depreciation and amortization) were down 5%, year-on-year, to just €579 million ($676 million). With sales of old-fashioned telco services in unstoppable decline, OBS is having to settle for lower margins as it charges into the faster-growing parts of the IT business.

Figure 1: Yes, We Can-Can  Orange Business Services is dancing ahead of its European telco rivals.

Orange Business Services is dancing ahead of its European telco rivals.

Reisinger, who took the CEO hotseat in May after the retirement of Thierry Bonhomme, reckons about one half of company revenues still come from "telco-centric" business. "In the market, that typically has an EBITDA margin of 25-30%, while for pure IT it is around 10%," he tells Light Reading. "Legacy telco will continue to go down, but our EBITDA margin remains one of the highest in the industry." (See Dr. Helmut Reisinger Named CEO of Orange Business Services.)

A comparison with T-Systems and the Global Services part of BT certainly flatters OBS. For the recent April-to-June quarter, T-Systems reported an EBITDA margin of 7% after adjusting the figure for one-offs, while BT managed about 8% over the same period. The equivalent margin for OBS was nudging 17% for the first six months of 2018. And unlike its German and UK rivals, OBS appeared to enjoy year-on-year sales growth for the April-to-June quarter, with Orange's "enterprise" revenues up 1.3%. T-Systems witnessed a 0.8% decline, and BT's sales tumbled 8% as it cut back on "low-margin" business.

Figure 2: Headline Figures, January-June 2018 ($M)  Source: Operators. Note: All currency conversions are at rates on September 18, 2018.

Source: Operators. Note: All currency conversions are at rates on September 18, 2018.

So what has OBS got right that its European competitors are doing wrong? Beyond noting that BT and Deutsche Telekom AG (NYSE: DT) currently face some "big questions," Reisinger is reluctant to comment specifically on the fortunes of other companies. What he will say is that OBS has been careful to avoid signing any "crazy deals," instead positioning itself as a premium player that can offer a high-quality service "from Alaska down to Argentina."

Network and business reach certainly helps. OBS today boasts a network capability in more than 200 countries and says only about one half of its 22,500 employees are based in France. At the same time, its forays outside the traditional telco business have generally met with early successes. Reisinger reels off a list of IT business areas where OBS is currently seeing a double-digit percentage rate of sales growth: Cloud, cyber security, analytics and (albeit from a small base) the much-hyped "Internet of Things." As reported in the last set of results, revenues from cloud services rose 18% for the first six months, while security sales were up 14%. The overall IT and systems integration business, which includes the cloud and security portfolios, seems to have gained momentum: Revenue growth soared to 9.7% for the second quarter, from just 0.4% for the first.

Takeover activity may have buoyed these figures, although it is unclear to what extent. In June, OBS acquired (for an undisclosed fee) a majority stake in Business & Decision, a big data specialist that brought skills it had previously lacked. "Apart from collecting and transporting data, we need to analyze it, and in this area we were quite weak until that acquisition," says Reisinger. Before the takeover, OBS had about 200 data experts, he reckons, and had made investments in a data management platform called Datavenue. Business & Decision gives it another 2,400 such experts across 11 countries and means it can derive greater insight from the data that OBS gathers. (See Orange to Buy Systems Integrator in $69.7M Deal.)

Even more recently, it bought a Norwegian data and cloud business called Basefarm, which made roughly €100 million ($117 million) in revenues last year and had about 550 employees, including 80 who are data scientists. "They have a great orchestration platform for managing multi-cloud services," says Reisinger. The takeover, as with Business & Decision, also brings new data skills into the OBS portfolio. Unbelievable Machine, a Basefarm subsidiary in Berlin, manages "data lakes" for major German companies, for instance, and has the capability to do that globally, according to Reisinger. (See Eurobites: OBS Buys Basefarm to Reap Multicloud Benefits.)

Next page: The Internet of enterprises

The Internet of enterprises

These moves now form part of Reisinger's grand plan to make OBS a recognized leader in what he calls the "Internet of enterprises," coining a new expression for the industry. "The Internet of consumers is basically a mobile play and unfortunately it has become dominated by the Googles of this world and the upcoming Chinese," he says. "The Internet of enterprises is about connecting people plus sites plus objects, and about sharing knowledge. It is an ecosystem play and we have a good claim that we can become a leader here."

Others may be skeptical. Many analysts would agree that Silicon Valley's Internet giants have trampled over the telcos' turf, in the consumer world, and left them as "dumb pipes." What is to prevent a similar erosion of value on the business side, they may wonder, with operators squeezed into the same dumb-pipe role?

When it comes to the cloud, Reisinger says OBS has no desire to offer a "me too" service that goes head-to-head with the public cloud offerings from the likes of Microsoft Azure and Amazon Web Services Inc. (AWS). One opportunity, he explains, is to support companies that want more than just the plain vanilla service the tech giants provide. "Of course, you can do everything from the cloud with an OTT [over-the-top] player, but European multinationals are very sensitive about data privacy and end-to-end service quality, and we have that carrier-grade integration capability," he says.

Figure 3: Bold Vision  Helmut Reisinger, CEO of Orange Business Services, is just four months into the leadership role.

Helmut Reisinger, CEO of Orange Business Services, is just four months into the leadership role.

In some areas, then, Microsoft and AWS are likelier to be OBS partners than rivals. The French operator already assists companies that want to integrate Microsoft's Skype for Business service with their customer experience systems, for instance. This week, it announced it would similarly help clients to manage critical applications on the AWS cloud. About 100 OBS employees have been trained up on the requisite technologies, it said. (See Eurobites: Nationwide 5G Too Costly, Says German Regulator .)

The overarching goal, it seems, is to be a sort of fulcrum that can support any of the various cloud needs a company might have, including demand for private and hybrid clouds. That makes the takeover of Basefarm, with its platform for managing "multi-cloud" services, a key element of the OBS strategy. It also means OBS will continue to invest in its own cloud facilities. A new data center in Amsterdam, due to open in October, could satisfy those European multinationals worried about the storage of data outside Europe, where rules may be less robust -- although an OBS partnership in this area with Huawei Technologies Co. Ltd. might trigger other security-related concerns, given the current backlash against the Chinese equipment giant in some jurisdictions. (See No 5G Deal: Huawei Misses Out at SKT and Australia Excludes Huawei, ZTE From 5G Rollouts.)

OBS also aims to recruit additional staff to support the expansion of the cloud business. Following its takeover of Basefarm, it currently has about 2,200 employees in this area. That number will grow by 300 this year, if a recruitment push works out as planned. By 2022, moreover, OBS hopes to generate more than one half of its cloud revenues outside France. The opening last May of a data center in Atlanta should go some way toward helping it realize that ambition.

Next page: From EasyGo to Flexible SD-WAN

From EasyGo to Flexible SD-WAN

The OBS desire to be seen as a partner and integrator is fundamental to its strategy for software-defined networks (SDN) and on-demand telco services, too. "Customers discovered these might bring down the cost from the carrier, but they had to buy so many boxes and licenses from an equipment maker that the total cost of ownership was not that interesting," says Reisinger. "What you need is to find someone who can integrate all the software and IT blocks that are relevant in SDN." Germany's Siemens AG (NYSE: SI; Frankfurt: SIE), the biggest OBS customer using on-demand products, chose OBS to support services across 1,500 international sites after recognizing the French telco's ability to play this integrator role, Reisinger insists.

Previously trialed during its EasyGo pilot, such network-as-a-service offerings are now a key part of the OBS portfolio. Indeed, Reisinger estimates that SD-WAN -- or the application of SDN to wide area network connectivity -- is a component in more than one half of all market demands. "It has now reached critical size," he says. Under the Flexible SD-WAN brand, the operator has been supporting SD-WAN products from Cisco Systems Inc. (Nasdaq: CSCO)'s Viptela business as well as Riverbed Technology Inc. (Nasdaq: RVBD), another vendor based in California. (See Orange Plots Mass Network-as-a-Service Rollout.)

This reliance on just two or three partners is a deliberate strategy, and one OBS has pursued across the entire service portfolio. "We cannot give a customer ten options because we need all skill pools and competence centers to be able to offer global support," says Reisinger. With Microsoft and AWS now identified as the main cloud partners, OBS has teamed up with Genesys and Avaya Inc. on customer experience, as well as Cisco and Microsoft Corp. (Nasdaq: MSFT) when it comes to cloud-based collaboration tools.

While the appetite for SD-WAN offerings sounds healthy, take-up is unlikely to buoy financials if it comes at the expense of the legacy business. Asked what impact these services might ultimately have on OBS margins, Reisinger says it is "difficult" to comment but notes that data volumes continue to rise inexorably. "We are serving one of the global mining companies based in Australia and one self-driving truck produces around three terabytes every day," he says. "To do this remotely you need the right transport capacity."

Want to know more about the impact of automation? Check out our dedicated automation content channel here on Light Reading.

How should one assess the broader OBS strategy? Its "multi-cloud" integrator move is certainly not unique. On the European telco stage, it seems to closely resemble BT's "cloud of clouds" approach. T-Systems, meanwhile, has also been collaborating with Huawei in the cloud, and insisting it is more concerned than certain US tech giants about customers' data privacy. Yet neither BT nor T-Systems rates very highly on execution. While they remain preoccupied with a turnaround, OBS has the luxury of being able to focus on new business opportunities. It helps, too, that parent company Orange (NYSE: FTE) is in a decent shape compared with most other European telecom incumbents. "Telco stocks are not preferred but we are one of the strongholds," says Reisinger. (See BT to Unveil New Cloud Partners by Christmas and DT Ups Cloud Challenge to Google, Amazon.)

The real challenge for OBS may come in areas where it ends up taking on the Internet giants. In big data and analytics, for instance, it might look to its detractors like David squaring up to Goliath. Nevertheless, with data scientists in short supply in the telco industry, the recent takeovers of Business & Decision and Basefarm seem like smart moves, and they will seem even smarter if OBS can maintain or boost the rate of sales growth. As with the broader cloud business, there may be an opportunity to serve customers who are increasingly anxious about dominant Silicon Valley companies in the aftermath of well-publicized data scandals. And the same anxiety could even bolster the appeal of OBS as an employer to the young software boffins telcos are desperate to hire. "Taking care of people is important," says Reisinger. "Culturally, we'll have to see how this works out in the coming years, but not everything I am hearing about OTT is great." (See Facebook: The Sick Man of Silicon Valley.)

— Iain Morris, International Editor, Light Reading

About the Author(s)

You May Also Like