A guide to India's fixed and mobile carriers and their service area 'circles'

March 6, 2008

India's booming telecom market has entered an accelerated growth phase as operators embark on massive network expansion projects and new players prepare to enter the market.

According to the Telecom Regulatory Authority of India (TRAI) , the country, which boasts a population of more than 1.1 billion, had 272.88 million telephone connections at the end of 2007, of which 233.63 million were mobile and 39.25 million were fixed line.

Fixed-line coverage is largely provided by state-owned operatorsBharat Sanchar Nigam Ltd. (BSNL) and Mahanagar Telephone Nigam Ltd. (MTNL) , which account for 35.31 million of the total subscriptions.

But while those players are trying to stimulate the market with broadband and even IPTV service offers, the number of fixed-line connections fell by 2.29 million during 2007. (See MTNL Puts Faith in Triple Play, Microsoft Seals $500M IPTV Deal, BSNL Picks NSN DSLAMs, UTStarcom Rolls IPTV in India, and Indian Telcos Tackle Broadband Shortage.)

That's because the demand for basic voice services is being met by the mobile operators, which, between them, connected 84.01 million new subscribers in 2007. That total looks set to be beaten in 2008 as the mobile operators are now signing up more than 8 million new customers every month.

To keep up with this demand, India's 13 mobile operators are expecting to invest more than $12 billion in their networks by 2010, in some cases expanding into new regions of the country.

And there are more players entering the market. Five new companies – Datacom, Loop Telecom, S Tel, Swan Communications, and Unitech – were awarded so-called "letters of intent" for licenses in January, signaling the potential injection into the market of several billion dollars of capital expenditure. (See Indian Gov't Grants Mobile Licenses.)

With the Indian market now such a hotbed of telecom growth, and becoming increasingly important to the business strategies of global players such as Vodafone Group plc (NYSE: VOD), it's never been more vital to have an information resource that identifies India's major service providers and outlines the market in which they operate.

This report provides a guide to the leading fixed and mobile operators, the licensing landscape, and the complex system of "circles," or service areas, in which the carriers operate.

Feedback and comments concerning the report, as well as any updates or additions, are most welcome, and can be added to the message boards at the foot of this page (preferable) or sent to[email protected].

Fixed-Line Operators

Wireless Operators

Circles

Licenses

Operator Coverage

— Nicole Willing, Reporter, Light Reading

Next Page: Fixed-Line Operators

Seven operators run significant retail fixed-line networks in India. They are listed in the table below, with subscriber numbers and areas of coverage:

Table 1: Fixed-Line Operators*

Operator | Subscribers in millions | Service coverage by circles** |

BSNL | 31.61 | All circles except Mumbai and New Delhi |

MTNL | 3.59 | Mumbai and New Delhi |

Bharti Airtel | 2.21 | All metro, A, and B circles except West Bengal |

Reliance Communications | 0.81 | All circles except Assam and North East |

Tata Teleservices | 0.69 | All circles except Assam, Jammu & Kashmir, and Northeast |

Shyam Telelink | 0.16 | Rajasthan |

HFCL Infotel | 0.15 | Punjab |

* As of Jan. 31, 2008** See page 4 of this report for a guide to India's circles |

The companies recently awarded new licenses will be able to offer fixed-line services in the future if they choose to do so, because they applied for Unified Access Service licenses, which cover fixed and mobile networks. (See Indian Gov't Grants Mobile Licenses.)

In addition, the following companies are licensed to provide national long distance calling services:

Aircel

AT&T

Bharti Airtel

BSNL

BT Group

Cable & Wireless

HCL Infinet

Rail Tel Corporation of India

Sify Technologies

Tata Communications (formerly VSNL)

Tulip IT Services

Verizon Business

Vodafone Essar

(See Verizon Receives India Licenses, BT Receives India Licenses, and AT&T Goes Long Distance in India.)

Also worth mentioning here are three network operators – Aksh Optifibre Ltd. , IOL Netcom (formerly IOL Broadband Ltd. ), and Time Broadband Services Group – that have invested in content delivery networks to provide managed video and IPTV services to India's operators. (See DIG Buys Into Indian IPTV, IOL, BSNL Team for IPTV, Optibase, Time Team, MTNL's IPTV Sparks Regulatory Debate, AKSH Signs UTStarcom, and Aksh Deploys Optibase.)

Next Page: Wireless Operators

India's mobile services sector is one of the hottest telecom markets in the world due to its existing and potential size, and its rapid rate of growth. At the end of 2007, there were nearly 234 million mobile subscribers, an increase of more than 50 percent from the end of 2006. At the end of 2005, India had about 76 million mobile users. (See Top 10 Emerging Mobile Markets .)

And the potential in India is such that the likes of Vodafone are willing to spend billions to buy a slice of the action. (See Vodafone Wins Battle to Buy Essar and Vodafone Completes Buy.)

It also means there are rich pickings for telecom vendors (especially as 3G networks are yet to be built), though while the size of some contracts are eye-watering, profit margins can be wafer-thin. (See BSNL Awards $1.3B GSM Contract, Nokia-Siemens Balks at BSNL Contract, Reliance Plans $7B GSM Build-Out, and India on Edge Over 3G.)

The cost of trying to compete across a country of nearly 3.3 million square kilometers (about one third the land mass of the U.S.) has led to infrastructure-sharing arrangements between the carriers. (See Indian Operators in Sharing Mood, Reliance Infratel Files for IPO, and Bharti Infratel Gets $250M.) So which operators dominate the market? The table below lists India's wireless operators, subscriber numbers, and areas of coverage:

Table 2: Wireless Operators*

Operator | Dominant Network Technology | Subscribers (in millions) | Service coverage by circles** |

Bharti Airtel | GSM | 57.42 | All circles |

Vodafone Essar | GSM | 41.15 | All metro, A, and B circles except Madhya Pradesh |

BSNL | GSM | 37.99 | All circles except Mumbai and New Delhi |

Reliance Communications | CDMA | 37.04 | All circles except Assam and Northeast |

Tata Teleservices | CDMA | 22.54 | All circles except Assam, Jammu & Kashmir, and North East |

IDEA Cellular | GSM | 21.95 | New Delhi, Andhra Pradesh, Gujarat, Maharashtra, and all B circles except Punjab and West Bengal |

Aircel | GSM | 9.93 | Chennai, Tamil Nadu, West Bengal, and all C circles |

Reliance Telecom | GSM | 6.00 | Kolkata, Madhya Pradesh, West Bengal, and all C circles except Jammu & Kashmir |

Spice Telecom | GSM | 3.94 | Karnataka and Punjab |

MTNL | GSM | 3.28 | Mumbai and New Delhi |

BPL Mobile | GSM | 1.26 | Mumbai |

HFCL Infotel | CDMA | 0.27 | Punjab |

Shyam Telelink | CDMA | 0.10 | Rajasthan |

* As of Jan. 31, 2008** See page 4 of this report for a guide to India's circles |

Since 2006, the government's telecom policy has lumped wireless local loop (WLL) subscribers in with mobile subscribers.

Next Page: Circles

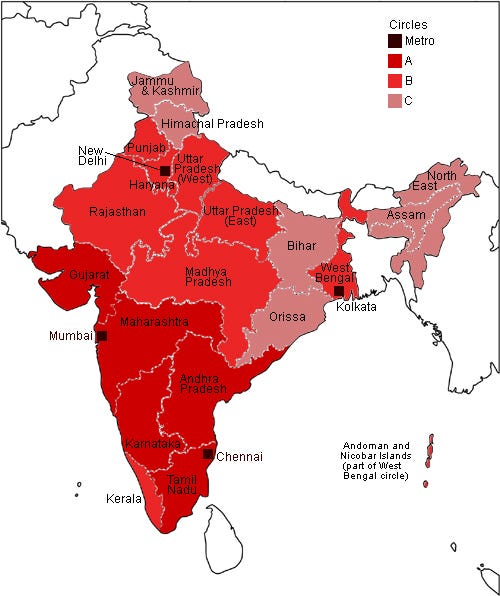

The Telecom Regulatory Authority of India has carved up the market into 23 different service areas referred to as "circles," which are further divided into categories: "metro" circles covering four major cities, "A" circles for regions with other large cities, "B" circles covering regions with smaller towns, and "C" circles for rural areas. Operators must have a separate license for each circle, and license fees vary depending on the category.

The circles are largely in line with India's 28 states, but several states, for example in the Northeast, have been combined, so that the list looks like this:

Metro circles

Mumbai

New Delhi

Kolkata

Chennai

A circles

Andhra Pradesh

Gujarat

Karnataka

Maharashtra

Tamil Nadu

B circles

Haryana

Kerala

Madhya Pradesh

Punjab

Rajasthan

Uttar Pradesh (East)

Uttar Pradesh (West)

West Bengal

C circles

Assam

Bihar

Himachal Pradesh

Jammu & Kashmir

Northeast

Orissa

The government is phasing out the Chennai metro and has merged it with the Tamil Nadu circle for the purpose of service provider licenses, so from March 31 operators will pay a combined license fee for the two areas. But most operators still consider it a separate circle for the purpose of service provisioning, subscriber counts, and financials.

While metro circles account for just 5 percent of India's estimated 1.1 billion population, they make up close to 18 percent of its mobile subscribers. Metro and A circles have so far provided the majority of subscriber growth but B and C circles are fast catching up, and operators are turning their attention to rural India to tap into the vast potential these more populous regions provide.

Next Page: Licenses

There are three types of operator licenses awarded for individual circles: 'Basic' for fixed-line services; 'Cellular Mobile Telephone Service' (CMTS) for mobile; and 'Unified Access Service' (UAS) covering both. In addition, the National Long Distance (NLD) license covers all circles.

The government's Department of Telecom (DOT) ruled in October 2007 that operators with Unified Access Service licenses are free to offer both GSM and CDMA-based services, paving the way for operators to roll out second networks. (See Reliance Gets GSM Nod.)

The DOT sends companies a letter of intent (LOI) for each circle as a precursor to awarding licenses. The LOI requires the company to pay an upfront entry fee and meet certain other requirements, including the submission of bank guarantees and proof that it does not hold more than 10 percent ownership in any other operator in that circle.

If those conditions are met, the operator is awarded a license and, if it wishes to offer wireless services, it must wait in line for spectrum allocation.

Entry fees vary by each circle, ranging from INR11 million (US$275,993) for Himachal Pradesh to INR2.04 billion ($51.18 million) for Mumbai, adding up to a total of INR16.6 billion ($416.5 million) for nationwide coverage. Service providers also pay a portion of their adjusted gross revenues in license fees – 10 percent for metros and category A circles, 8 percent for B circles, and 6 percent for C circles.

Companies that were previously paying an 8 percent fee for the Tamil Nadu circle have been paying 9 percent during the transition to include the Chennai metro; that fee will rise to 10 percent from March 31.

Wireless spectrum is allocated initially in a block of 4.4 MHz for GSM-based operators and 2.5 MHz for CDMA operators. Additional spectrum is granted on the basis of subscriber growth and efficiency benchmarks. A shortage of available frequency has slowed the allocation of spectrum, and new license holders are expecting a long wait before they can set up operations. (See Spectrum Fight Escalates in India.)

Spectrum usage fees depend on the amount an operator has been allocated: 4.4 MHz of spectrum carries a charge of 2 percent of adjusted gross revenues, for 6.2 MHz operators pay 3 percent, 4 percent for 8 MHz and 10 MHz, 5 percent for 12.5 MHz, and 6 percent for 15 MHz.

The DOT has proposed switching to the license fee model for spectrum charges, so that operators would pay a percentage of their revenues depending on the circle covered by the spectrum. That would apparently bring in an additional INR11 billion ($273 million) in fees during the 2008/2009 financial year.

Last year the TRAI – the regulatory body that makes recommendations to the DOT – had suggested keeping the same frequency-based system, but increasing fees to 5 percent of adjusted gross revenues for up to 10 MHz of spectrum, 6 percent for 12.5 MHz, 7 percent for 15 MHz, and 8 percent for more than 15 MHz.

Next Page: Operator Coverage

India's carriers vary in their coverage from a single circle, such as HFCL Infotel Ltd. in Punjab, to all 23, such as Bharti Airtel Ltd. (Mumbai: BHARTIARTL). Four of the five new players – Datacom, Loop Telecom, S Tel, and Unitech – will be licensed to provide national coverage, while Swan Communications received letters of intent for 13 circles.

Table 1 lists operators by circle and shows where companies have received approval for new licenses.

Table 3: Network Coverage

Circles | Operators | Licenses pending spectrum* | Licenses approved Jan 2008 |

Metro circles | |||

Mumbai | Bharti, BPL Mobile, MTNL, Reliance Communications, Tata Teleservices, Vodafone Essar | Aircel, IDEA Cellular | Datacom Solutions, Shyam Telelink, Swan Telecom, Unitech |

New Delhi | Bharti, IDEA Cellular, MTNL, Reliance Communications, Tata Teleservices, Vodafone Essar | Aircel | Datacom Solutions, Loop Telecom, Shyam Telelink, Spice Communications, Swan Telecom, Unitech |

Kolkata | Bharti, BSNL, Reliance Communications, Reliance Telecom, Tata Teleservices, Vodafone Essar | Aircel | Datacom Solutions, IDEA Cellular, Loop Telecom, Shyam Telelink, Unitech |

Chennai | Aircel, Bharti, BSNL, Reliance Communications, Tata Teleservices, Vodafone Essar | Aircel | (included in Tamil Nadu circle for licenses) |

A circles | |||

Andhra Pradesh | Bharti, BSNL, IDEA Cellular, Reliance Communications, Tata Teleservices, Vodafone Essar | Aircel | Datacom Solutions, Loop Telecom, Shyam Telelink, Spice Communications, Swan Telecom, Unitech |

Gujarat | Bharti, BSNL, IDEA Cellular, Reliance Communications, Tata Teleservices, Vodafone Essar | Aircel | Datacom Solutions, Loop Telecom, Shyam Telelink, Swan Telecom, Unitech |

Karnataka | Bharti, BSNL, Reliance Communications, Spice Communications, Tata Teleservices, Vodafone Essar | Aircel | Datacom Solutions, IDEA Cellular, Loop Telecom, Shyam Telelink, Swan Telecom, Unitech |

Maharashtra | Bharti, BSNL, IDEA Cellular, Reliance Communications, Tata Teleservices, Vodafone Essar | Aircel | Datacom Solutions, Loop Telecom, Shyam Telelink, Spice Communications, Swan Telecom, Unitech |

Tamil Nadu | Aircel, Bharti, BSNL, Reliance Communications, Tata Teleservices, Vodafone Essar | Datacom Solutions, IDEA Cellular, Loop Telecom, Shyam Telelink, Swan Telecom, Unitech | |

B circles | |||

Haryana | Bharti, BSNL, IDEA Cellular, Reliance Communications, Tata Teleservices, Vodafone Essar | Aircel | Datacom Solutions, Loop Telecom, Shyam Telelink, Spice Communications, Swan Telecom, Unitech |

Kerala | Bharti, BSNL, IDEA Cellular, Reliance Communications, Tata Teleservices, Vodafone Essar | Aircel | Datacom Solutions, Loop Telecom, Shyam Telelink, Swan Telecom, Unitech |

Madhya Pradesh | Bharti, BSNL, IDEA Cellular, Reliance Communications, Reliance Telecom, Tata Teleservices | Aircel | Datacom Solutions, Loop Telecom, Shyam Telelink, Unitech |

Punjab | Bharti, BSNL, HFCL Infotel, Reliance Communications, Spice Communications, Tata Teleservices, Vodafone Essar | Aircel | Datacom Solutions, IDEA Cellular, Loop Telecom, Shyam Telelink, Swan Telecom, Unitech |

Rajasthan | Bharti, BSNL, IDEA Cellular, Reliance Communications, Shyam Telelink, Tata Teleservices, Vodafone Essar | Aircel | Datacom Solutions, Loop Telecom, Swan Telecom, Unitech |

Uttar Pradesh (East) | Bharti, BSNL, IDEA Cellular, Reliance Communications, Tata Teleservices, Vodafone Essar | Aircel | Datacom Solutions, Loop Telecom, Shyam Telelink, Swan Telecom, Unitech |

Uttar Pradesh (West) | Bharti, BSNL, IDEA Cellular, Reliance Communications, Tata Teleservices, Vodafone Essar | Aircel | Datacom Solutions, Loop Telecom, Shyam Telelink, Swan Telecom, Unitech |

West Bengal | Aircel, Bharti, BSNL, Reliance Communications, Reliance Telecom, Tata Teleservices, Vodafone Essar | Datacom Solutions, IDEA Cellular, Loop Telecom, Shyam Telelink, Unitech | |

C circles | |||

Assam | Aircel, Bharti, BSNL, Reliance Telecom | Vodafone Essar | Datacom Solutions, IDEA Cellular, Loop Telecom, Shyam Telelink, S Tel, Tata Teleservices, Unitech |

Bihar | Aircel, Bharti, BSNL, Reliance Communications, Reliance Telecom, Tata Teleservices | IDEA Cellular, Vodafone Essar | Datacom Solutions, Loop Telecom, Shyam Telelink, S Tel, Unitech |

Himachal Pradesh | Aircel, Bharti, BSNL, IDEA Cellular, Reliance Communications, Reliance Telecom, Tata Teleservices | Vodafone Essar | Datacom Solutions, Loop Telecom, Shyam Telelink, S Tel, Unitech |

Jammu & Kashmir | Aircel, Bharti, BSNL, Reliance Communications | Vodafone Essar | Datacom Solutions, IDEA Cellular, Loop Telecom, Shyam Telelink, S Tel, Tata Teleservices, Unitech |

North East | Aircel, Bharti, BSNL, Reliance Telecom | Vodafone Essar | Datacom Solutions, IDEA Cellular, Loop Telecom, Shyam Telelink, S Tel, Tata Teleservices, Unitech |

Orissa | Aircel, Bharti, BSNL, Reliance Communications, Reliance Telecom, Tata Teleservices | Vodafone Essar | Datacom Solutions, IDEA Cellular, Loop Telecom, Shyam Telelink, S Tel, Unitech |

* Spectrum awarded Jan 2008; operators yet to start service in these areas |

Table 2 provides a quick reference for the number of circles where each company has licenses.

Table 4: Licenses by Operator

Operator | Licenses held | Licenses approved Jan 2008 |

Aircel | 23 (operates in 9) | -- |

Bharti Airtel | 23 | -- |

BPL Mobile | 1 | -- |

BSNL | 21 | -- |

Datacom Solutions | -- | 22 |

HFCL Infotel | 1 | -- |

IDEA Cellular | 13 (operates in 11) | 9 |

MTNL | 2 | -- |

Loop Telecom (BPL) | -- | 21 |

Reliance Communications | 21 | -- |

Reliance Telecom | 8* | -- |

Shyam Telelink-JFSC Sistema | 1 | 21 |

Spice Telecom | 2 | 4 |

S Tel | -- | 6 |

Swan Telecom | -- | 13 |

Tata Teleservices | 20 | 3 |

Unitech | -- | 22 |

Vodafone Essar | 22 (operates in 16) | -- |

* CDMA-based Reliance Communications has been permitted to offer GSM services; its GSM-based subsidiary Reliance Telecom will expand into the remaining circles |

You May Also Like