Big Telco in Europe thinks Big Tech from the US should pay for network usage, but it shows a cluelessness on the practicalities.

A favorite activity of Europe's telcos is to grumble that freeloading Big Tech players should be forced to pay for network usage. This is not quite how they describe it, because doing so would evoke the words used by Ed Whiteacre, a former AT&T CEO, when he reportedly said that "for a Google or Yahoo or Vonage or anybody to expect to use these pipes for free is nuts." That was 2005, and Whiteacre's comments were seen widely back then as an attack on net neutrality, a vague principle about fair treatment of Internet traffic.

Net neutrality has subsequently become a sacred cow on both sides of the Atlantic, and so Europe's telcos in 2023 instead argue that Big Tech players should make a "fair contribution" to network costs. After all, it's their traffic clogging up these pipes. But the argument amounts to the same as Whiteacre's, even if it's couched in the language of compromise: Telcos do all the spending and see hardly any of the returns, while Big Tech pays nothing and grows even more obscenely rich. Something must change, or those pipes will eventually burst.

What none of the whingers in telcoland appears to have thought about is how this charging mechanism should work. Last month, ETNO and the GSMA, the preeminent lobbying groups for the telco sector, dedicated a good chunk of a new report on the future of electronic infrastructure to fair contribution. It is intended to be read by European Union (EU) officials, the people who will steer any decision on the matter, but its executive summary includes next to nothing about the practicalities.

All telcos have said is that any "large traffic generator" – meaning Big Tech players as opposed to their own Internet-addicted customers – should be legally obliged to hold commercial negotiations about fees. Large traffic generator (or LTG), in this instance, would be any company whose services account for more than 5% of an operator's "yearly average busy hour traffic." If parties cannot reach an agreement, a "neutral" third party should adjudicate based on "EU guiding principles." American LTGs preparing for this adjudication would probably feel like a Putin critic facing a Moscow judge.

Data deluge

The biggest uncertainty is about the structure and level of fees. Telcos love to frame data traffic growth as an outright negative, an apocalyptic flood that will eventually submerge them, rather than something that buoys demand for their services. The suggestion is that for every additional gigabyte coursing down the network there is an extra cost to bear. This would make it easier to justify charges based on traffic levels. But it's bogus. The reality is that a gigabyte surge has had no discernible impact on either sales or costs – and it has clearly not driven up those costs as much as telcos would have regulators think.

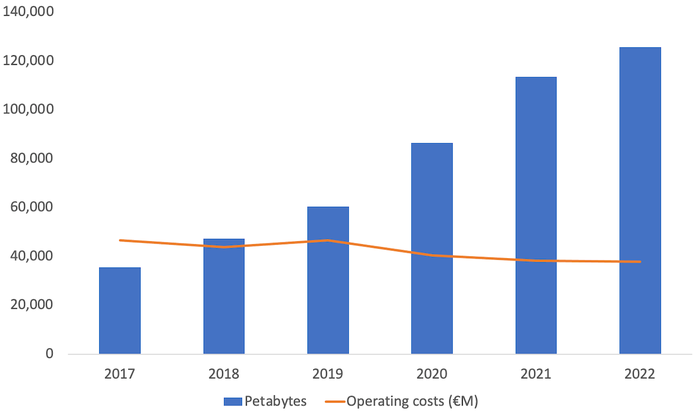

There is certainly no correlation whatsoever between traffic growth and headline expenses. This is best shown by reference to Spain's Telefónica, one of Europe's biggest operators of fixed and mobile networks and one of the few that includes details of traffic in its annual reports. Fewer than 36,000 petabytes flowed over its various networks in 2017. Five years later, the torrent was nearly 126,000. Yet Telefónica's annual operating costs – the sum of what it spends on supplies, personnel, miscellaneous items, depreciation and amortization – dropped from almost €47 billion (US$50 billion) in 2017 to €38 billion ($40.7 billion) last year.

Traffic growth versus operating costs at Telefónica

(Source: Telefónica)

(Source: Telefónica)

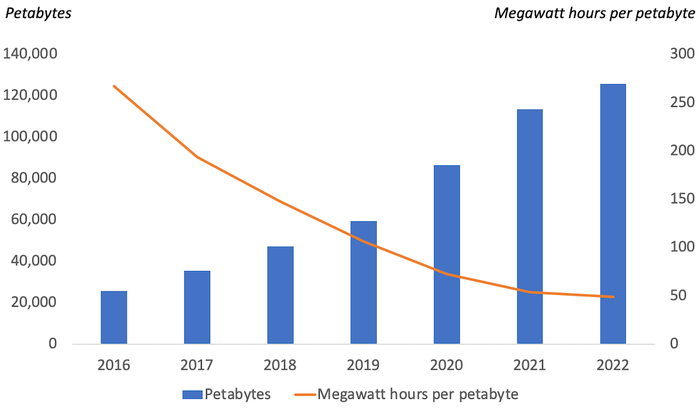

Yes, Telefónica has been offloading assets, quitting markets and shedding staff. Its costs would undoubtedly have risen were it not for these cuts, and its margins would have been thinner. But if there are cost problems, traffic is obviously not the main culprit – merely a convenient scapegoat. On other cost-related measures, too, there is no correlation. Telefónica's gigawatt hours, a measure of its electricity use, fell from about 6,900 in 2017 to roughly 6,100 last year. Its capital intensity (expenditure as a percentage of revenues) shrank slightly from 15% to 14.8% over this same period.

Were Telefónica to charge by the gigabyte, an LTG might last year have had to shoulder a 30% price rise when there was no sign of any corresponding increase in the operator's costs. A fairer scheme would be to charge a percentage of relevant costs, and yet total costs – as shown – have been dropping. To enjoy regular sales growth from these fees, Telefónica would have to prove to an LTG that LTG-related expenses are going up when every published metric bar traffic growth is either flattish or in decline.

Effectively subsidized by the Internet giants, operators in Europe's uber-competitive markets would move quickly to slash end-user prices and grab market share. This would swiftly erode the extra margin they saw in year one of fair contribution while leaving them financially dependent on Big Tech.

In the worst case…

All that is probably the best-case scenario. Charging a 5% traffic generator but not a 4.99% one sounds arbitrary. To critics, it may look just as bad as zero-rating, the system that allows unlimited usage of one app while its rivals are eventually throttled. That practice has landed operators in court before now on charges of discrimination, forbidden by net neutrality laws. What if an LTG refuses to pay, even after a "neutral" arbitrator gets involved? In most sectors, a non-paying entity or person would be immediately denied services or products. But this would contravene net neutrality rules that prohibit the blocking of Internet traffic.

The other problem is that a backlash from LTGs would be especially fierce if charges were substantial, and they would otherwise have little impact. Deutsche Telekom, Orange, Telecom Italia, Telefónica and Vodafone, all of which back the fair contribution idea, collectively generated more than $280 billion in sales last year. Payments totaling as much as $20 billion would equal just 7% of that figure and an even smaller percentage of total market revenues, including the numerous smaller telcos that might also demand fees.

Petabytes versus megawatt hours per petabyte at Telefónica

(Source: Telefónica)

(Source: Telefónica)

Aware of all this, Internet companies may be sniggering. Unless telcos negotiate as a collective, which could bring complaints about cartel-like behavior, an Amazon or Netflix would presumably be able to play them off and threaten to withdraw services from pricier networks. Sector history suggests some challenger brand will see the opportunity in not charging for usage. Once that happens, fair contribution will have nothing left to give.

Europe's national governments, if not its unelected supranational wonks, seem to have realized fair contribution is a nonsense. Citing sources familiar with the matter, a Reuters report from the weekend said the telecom ministers of 18 EU countries have rejected the whole idea, apparently insisting there is no evidence of an investment shortfall. Big Tech, charged for usage, would probably just pass the costs onto consumers, ministers reportedly believe.

Their other concern is that fair contribution does not look very compatible with net neutrality. EU mandarins seem to think the two concepts can live in harmony. Yet Roberto Viola, the director-general of an EU division called CNECT and a proud architect of net neutrality, was momentarily flummoxed during a recent Politico debate when asked if blocking a non-paying LTG would violate the rules he helped to write. "Who on earth would not distribute content that is popular?" he finally managed. Fair contribution's most strident critics could not have put it better.

Related posts:

— Iain Morris, International Editor, Light Reading

Read more about:

EuropeAbout the Author(s)

You May Also Like