News

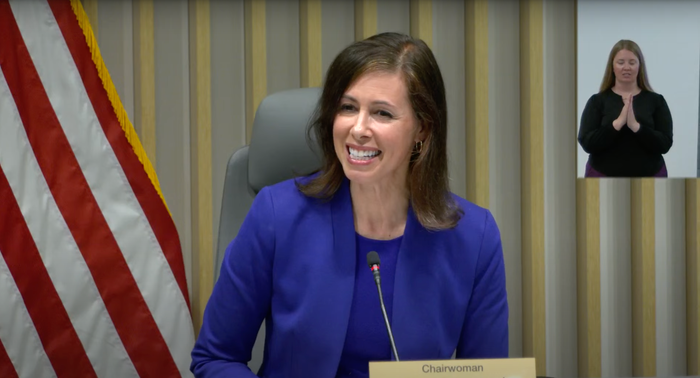

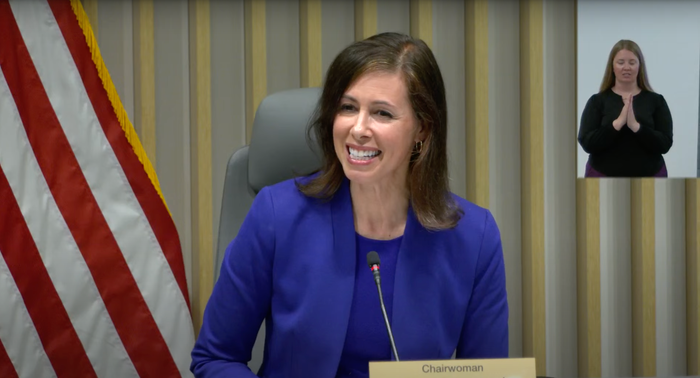

FCC Chairwoman Jessica Rosenworcel

Broadband

FCC passes net neutrality order ... again ... for nowFCC passes net neutrality order ... again ... for now

Democrats on the FCC voted to restore net neutrality and Title II rules. The issue will face inevitable court challenges and is likely to be undone again under the next Republican administration.

Subscribe and receive the latest news from the industry.

Join 62,000+ members. Yes it's completely free.

.jpeg?width=300&auto=webp&quality=80&disable=upscale)