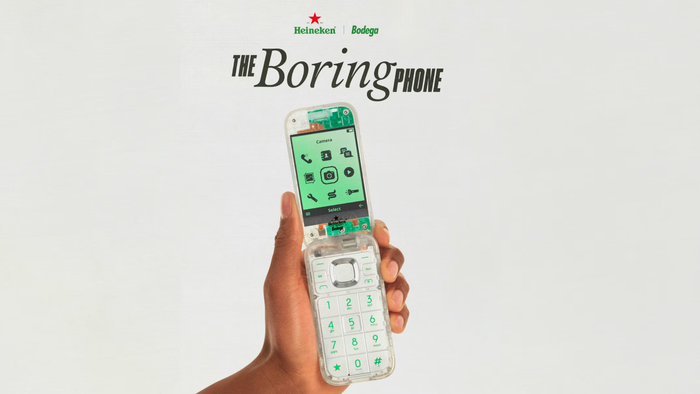

Heineken and Bodega teamed up to develop The Boring Phone.

Smartphones & Devices

Dumb phones start to get real dumbDumb phones start to get real dumb

Stop me if you've heard this one: A beer company and a clothing brand are teaming up with a smartphone company to make a dumb phone.

Subscribe and receive the latest news from the industry.

Join 62,000+ members. Yes it's completely free.

.jpg?width=300&auto=webp&quality=80&disable=upscale)