News

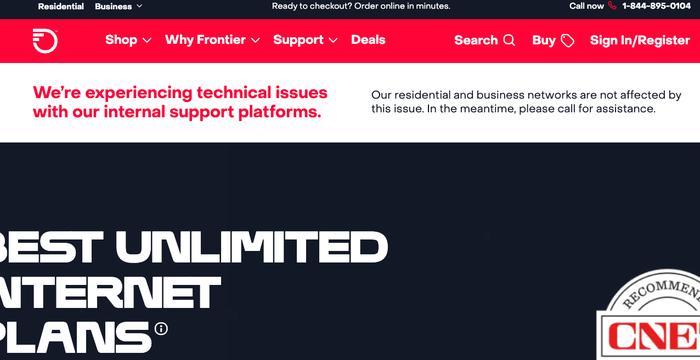

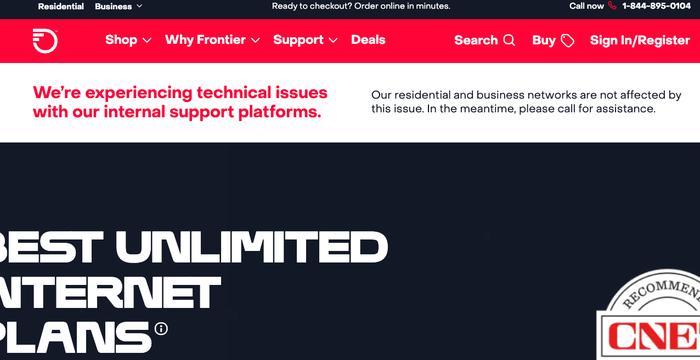

Frontier posted a warning on its website about "technical issues."

Security

Frontier warns of 'technical issues'Frontier warns of 'technical issues'

Frontier Communications said it's 'experiencing technical issues with our internal support platforms.' A company representative did not respond to questions from Light Reading about the situation.

Subscribe and receive the latest news from the industry.

Join 62,000+ members. Yes it's completely free.

.jpg?width=300&auto=webp&quality=80&disable=upscale)