Believe it or not, telecoms are now leading the market. Can it continue? Here are our picks...

January 18, 2007

It’s time for Light Reading's Top Ten Telecom Stocks list – a straight-to-the-gut take on what telecom and communications equipment stocks could blast off in 2007.

Here’s what we were trying to find: (1) The stock should be, ideally, related to the telecommunications market, and (2) has a decent shot at going higher.

Of course, it’s not easy to predict how Wall Street’s whims will treat telecom. For example, we just saw a period, 2002-2006, which was a healthy bull market by most measures, but one that yielded mixed results in telecom. In 2005, with the broader market rallying, large incumbent service providers were the “Dogs of the Dow.” Yet, in 2006, telecom service providers were the world’s fair – they exploded higher, leading the market.

Can telecom continue to rally? It seems so. After the telecom bust, it’s a subdued industry that is mostly drawn toward asset rationalization. Venture capitalists are no longer even very active in the space. So, in a contrarian sense, this lack of enthusiasm points to the potential for more gains.Supporting the market are several long-term trends:

Enormous growth in emerging market telecom networks, especially in mobile

Large demand for access bandwidth, including both fiber and wireless

A large-scale migration from copper fixed-line to fiber and broadband wireless

More efficient networks (and ongoing job cuts) will reduce costs

Consolidating carriers and equipment makers will make the industry more profitable

A reversion back to the “bigger is better” concept of the do-it-all carrier will yield stability

Relatively low investment expectations

With these trends firmly in place, we’re set up for a decent year in telecom. So here are our top ten stock picks for 2007:

10) American Tower Corp. (NYSE: AMT)

American Tower makes, um, uh, towers. But not just in America – globally! Several of our top-tier, behind-the-scenes Wall Street sources – you know, the kind of people who live in faux-French mansions in Connecticut and whose hobbies include collecting celebrity lingerie and refurbishing antique Rolexes – say that this stock is "under accumulation," and for good reason.

With all this 3G, WiFi, WiMax, and other McWiNot flying around, don’t you think the world will need more towers? We do. Here’s a futuristic prediction we will make: A more wireless world will need many more wireless towers.

The numbers don't tell the whole story, because American Tower had been losing money for a while before it recently broke back into the black. But it’s on the cusp of profitability for this year, and it’s growing revenue at a 25 percent clip. That should give it a good earnings leverage now that it has turned the corner.

Market Cap: $16.96 billion

P/E (Forward 12 months): 15

Year-over-year Earnings Growth: N/A

Annual Dividend Yield: N/A

9) Tellabs Inc. (Nasdaq: TLAB; Frankfurt: BTLA)

Tellabs!? We can hear your reaction right now. To which we say: exactly. This stock has become so unloved and beaten down that it seems likely that much of the bad news is built in. And, on a valuation basis, it’s getting cheap. It was recently trading at a enterprise value/EBITDA of 7, according to data provider Capital IQ, which might make it a tasty buyout to some bean-counters.

Recently Tellabs was hurt by the AT&T Inc. (NYSE: T) merger with BellSouth, which likely slowed down spending plans at BellSouth, where Tellabs gets a lot of dough. And certainly, there’s some risk ahead in the BellSouth business, with AT&T now calling the tech shots. But we think the market knows this. And the way you make money on Wall Street is to find out what the market doesn’t know.

What doesn’t the market know? Well, quite simply with the stock priced under $11, folks will start to comb over Tellabs as a buyout candidate. Under $10, it gets even tastier. Tellabs still sells plenty of cross connects, even if it is taking its time getting its ROADM and GPON stories together. So look for institutional buyers to support the stock on sell-offs, when the value radar screens blink buy.

Market Cap: $4.44 billion

P/E (Forward 12 months): 19

Year-over-year Earnings Growth: 40%

Annual Dividend Yield: N/A

Next Page

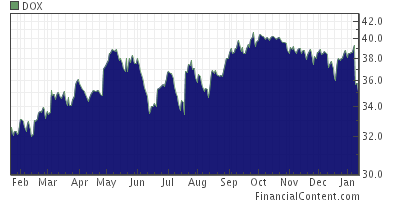

8) Amdocs Ltd. (NYSE: DOX)

Amdocs was considered as a finalist for our Leading Lights Best Investment category. (See Experts See Lengthy Cable-IMS Integration). It was not picked. Good thing, too, because last week the company warned on revenue guidance and the stock got taken out to the woodshed. (See Amdocs Guides, Stock Dives).

The recent reaction might be overdone. It's a good time to think about getting into Amdocs, one of the clear leaders in the OSS market, which is attractive because of steady licensing revenues. It has also broken into the increasingly important, and potentially very lucrative, managed services sector, striking a deal with the Dutch arm of mobile giant Vodafone Group plc (NYSE: VOD). (See Amdocs Lands Vodafone Deal.)

Amdocs has made some interesting acquisitions of late, including inventory-management software vendor Cramer Systems and content delivery specialist Qpass, both of which strengthened Amdocs's position as a provider of back office systems that support next-gen networks and real-time service delivery.

Market Cap: $7.14 billion

P/E (Forward 12 months): 14

Year-over-year Earnings Growth: 12%

Annual Dividend Yield: N/A

7) Emerging Market Telecom Fund (ETF)

This isn’t an individual stock, but a closed-end mutual fund – otherwise known as an Exchange Traded Fund (ETF) – that trades under the symbol ETF. Yes, that right, we said it’s an ETF with the ticker symbol ETF, if that confused you the first time.

This fund, managed by Credit Suisse (the bank that brought you the Corvis IPO), gives you exposure to a basket of emerging market players in telecom. Many investors are wary of the famously volatile and risky emerging markets – referred to in more hostile times as the “submerging markets” – so an ETF is a good way to play it if you are afraid of touching these volatile shares on a one-by-one basis.

Among the top holdings of the Emerging Market Telecom fund are some of the fastest growing telecom companies in the world, including América Móvil S.A. de C.V. , China Mobile Ltd. (NYSE: CHL), MTN Group Ltd. , and PT Telekomunikasi Indonesia Tbk. (Telkom) . Mexico, China, and Indonesia, all in one place? Think of it as a safe way to travel without getting food poisoning (or worse).

It’s true that the emerging market telecom stocks ran strong in 2006 and could be reaching lofty levels, but we think the emerging market telecom story is a long-term trend that’s likely to unfold for the rest of the decade. If you’re looking for growth, you’re going to find more in China and Brazil than you will in Illinois or Manchester.

Market Cap: $157.75 million

P/E (Forward 12 months): N/A 15

Year-over-year Earnings Growth: N/A< br>

Annual Dividend Yield: N/A

6) Cisco Systems Inc. (Nasdaq: CSCO)Um, what to say here? Well, it’s Cisco. If you are looking for a telecom equipment player in your portfolio, why bother with one of those large, messy, half-French legacy incumbents? Go for the king of the packet movers. Cisco gets routing, Ethernet switching, wireless, optical, consumer data, and more. It’s plowing into markets that should benefit from the move to IP video. With the explosion of new consumer devices and new domestic digital video offerings, Cisco's move into the consumer end of things is well timed.

Now, after nearly doubling in 2006, Cisco isn’t a super cheap stock anymore. But its finanicals are still attractive. Quarter year-over-year earnings growth has been running about 25 percent. It’s got nearly $20 billion in cash. With a forward P/E of 18, it seems like the bar is still set low enough so that this past over-achiever could beat expectations in 2007. With modest success in its set-top business, recent folded in through he acquisition of Scientific-Atlanta, Cisco could easily be a market-beater.

Market Cap: $161.17 billion

P/E (Forward 12 months): 18

Year-over-year Earnings Growth: 27.5%

Annual Dividend Yield: N/A

Next Page

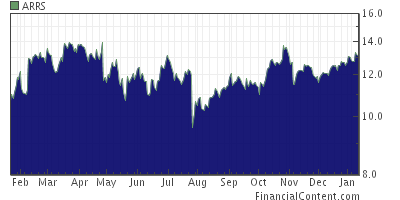

5) Arris Group Inc. (Nasdaq: ARRS)

Long before it made its $1.2 billion bid for digital video specialist Tandberg Television , Arris Group Inc. (Nasdaq: ARRS) had been impressing cable industry analysts with its largely popular data and VOIP equipment, savvy, seasoned management, solid finances, and consistent long-term growth strategy.

Although product sales fluctuate from quarter to quarter, Arris has particularly emerged as the worldwide leader in cable voice modems. In the third quarter of 2006, for instance, the vendor shipped just over 1.3 million voice modems, up from nearly 1.1 million the quarter before and 863,000 in the year-earlier period. As a result, it captured 42.5 percent of the growing worldwide market, up from 37.7 percent in the previous quarter and 42.1 percent a year ago, increasing its edge over previous category king Motorola Inc. (NYSE: MOT).

Arris has also profited handsomely from its close relationship with Comcast, the nation's biggest MSO. Analysts expect Comcast Corp. (Nasdaq: CMCSA, CMCSK), which accounted for a whopping 43 percent of Arris' third-quarter equipment sales, to fuel further revenue increases for the vendor as it continues its furious nationwide rollout of VOIP and upgrades the old Adelphia Communications cable systems that it inherited.

Bottom line: Arris is emerging as one of the bigger players in the growing market for next-generation cable equipment gear. That, in turn, will inevitably make it attractive as a snack for larger providers such as Motorola or Cisco.

Market Cap: $1.42 billion

P/E (Forward 12 months): 17

Year-over-year Earnings Growth: 41%

Annual Dividend Yield: N/A

4) Neustar Inc. (NYSE: NSR)"You can’t complete a telephone call in the U.S. without using NeuStar,” says NeuStar's Jeff Ganek. Damn good point, Jeff.

NeuStar has popped up on our lists before – including being a finalist for the 2005 Leading Light for Best Investment Potential. And it hasn’t quite live up to expectations. Maybe it’s just, like, taking a while.

What was originally attractive about NeuStar hasn’t changed – it’s got monopoly-ish position in a massive, growing industry: the software for controlling how telecom number databases interconnect with one another.

NeuStar is under new pressure from competitors such as VeriSign Inc. (Nasdaq: VRSN) and Telcordia. Investors recent got spooked with NeuStar renegotiated some of the pricing terms with the North American Portability Management LLC (NAPM), a carrier consortium with which it does most of its business. It’s true. The margins in this business are not likely to get fatter. But the volume is there. And NeuStar still holds the family jewels of number portability – seven exclusive contracts with NAPM.With Return on Equity of 30 percent, quarterly year-over-year revenue growth of 40 percent, and operating margins near 40 percent, the fact is that NeuStar still isn't sexy. But it is an attractive business.

Market Cap: $2.24 billion

P/E (Forward 12 months): 28

Year-over-year Earnings Growth: 30%

Annual Dividend Yield: N/A

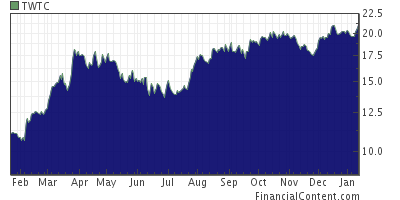

3) tw telecom inc. (Nasdaq: TWTC)Can you say, Metro Ethernet services? Time Warner earlier this year was nominated by our big-brained brethren over at Heavy Reading as a finalist for a Market Leadership award. This says something about why we like where the company is headed: Ethernet services are one of the fastest growing segment of the telecom industry.

This is one of the things that makes Time Warner Telecom one of the most interesting players in the metro market, which in fact could be the most coveted telecom market at the moment.

The company has also started to grow at a decent rate. For the quarter ending September 30, 2006, the company reported that total revenue grew 10 percent year over year and 3 percent sequentially. Cash flow is growing.

That’s all nice, but the real reason we think Time Warner’s going to do well is that metro access assets are in high demand, and the company will quite possibly be purchased at a higher price in 2007.

Market Cap: $3.04 billion

P/E (Forward 12 months): N/A

Year-over-year Earnings Growth: N/A

Annual Dividend Yield: N/A

Next Page

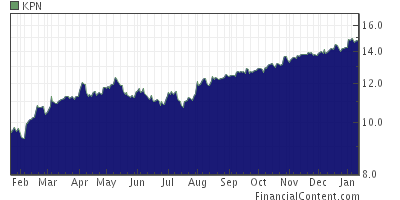

2) KPN Telecom NV (NYSE: KPN)

Our old grandma Internetabanktje used to tell us: "If you’re going to go broadband, go Dutch." Royal KPN, formerly known as Koninklijke PTT, is one of the larger European fixed and mobile carriers. One thing we’ve liked about KPN lately – it appears to go up every day. We smell something going behind the scenes.

For good reason: KPN is one of those strong, incumbent Euro telecoms that appears to be rolling up half of Western Europe. Lots of cash flow. Fat dividends. Incumbency and political connections – you know, the makings of a good old fashioned monopoly. It’s just to sort of things the private-equity guys are drooling over.

The cash flow situation is attractive. In fact, it led Barron’s to recently declare this stock one of Europe’s leading takeover candidates. It makes a lot of sense. Given the mad scramble to buy up market leading cash-flow producing telecoms, KPN will clearly become a target.

Better yet is the chart of KPN. Take a look: Back when we went to stock chart school, the old bearded Professor Getyard Shares used to call that the straight edge chart. “You buy a straight edge and ride it till it ain’t straight no more,” he used to say. Of course, he's dead now.

Back when we went to stock chart school, the old bearded Professor Getyard Shares used to call that the straight edge chart. “You buy a straight edge and ride it till it ain’t straight no more,” he used to say. Of course, he's dead now.

Market Cap: $30.49 billion

P/E (Forward 12 months): 15

Year-over-year Earnings Growth: 5%

Annual Dividend Yield: 3.60%

1) Verizon Communications Inc. (NYSE: VZ)After years of playing the role of Death in the stock market, U.S. incumbent telcos finally found their way back into favor in 2006. Given that telecom cycles are notoriously long, do you think that they we suddenly swing back out of favor? Seems doubtful.

Clearly, the world is migrating back toward large incumbent players, and we expect Verizon to continue to say on Wall Street’s radar.

The cable war is overdone, and frankly, it's all the gloom and doom. The bottom line is, plenty of people are still using copper access lines, and Verizon now has a clear next-generation strategy with FiOS. Those who own the last mile are in a nice position, whether it be cable companies or RBOCs.

Then there's all the cash. Looking at reasons why you would still want to buy this stock the place to start is the yield: Verizon pays a 4.6 percent annually dividend. It generates an astounding $22 billion in annual cash flow. It’s expected to earn $2.60 per share in 2007 despite its ongoing capex investment in its fiber access network. Its forward price/earnings ratio, based on the latest analyst estimates is a modest 15, according to Capital IQ. It deserves a premium for the Verizon Wireless business. We'll stick our necks out (though not very far): Verizon will most likely trade North of $40 at some point in 2007.

Market Cap: $109.69 billion

P/E (Forward 12 months): 15

Year-over-year Earnings Growth: 3%

Annual Dividend Yield: 4.3%

So, what do you think? Feel free to let us hear about our hits and misses by sending a note to [email protected], or just post something smart on the boards below.

— The Staff, Light Reading

You May Also Like