Using Airwaive's service, network operators outline the locations where they need sites and the amount they're willing to pay. The offers are then delivered to property owners, who can decide if they're willing to host the equipment.

Charter Communications and Carolina West Wireless are among dozens of wireless network operators represented in the users that have signed up to use a cell site matchmaking service from startup Airwaive, according to the company's officials.

Airwaive also initially named Dish Network as a customer, but then subsequently said Dish isn't a customer.

But Airwaive CEO Jeff Yee said it's still early days for the company. He told Light Reading that Airwaive has a few cell sites commercially operational in Dallas, with another 50 in the works. The company expects that number to rise to around 100 by the end of 2022.

"We expect that to really pick up" in 2023, said Beau Peters, Airwaive's SVP of strategy and partnerships.

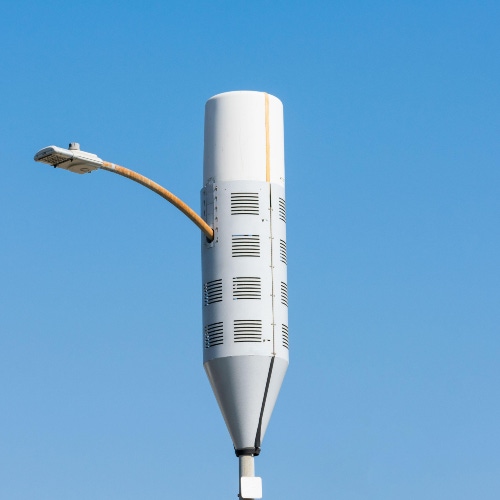

Figure 1:  (Source: Michael Vi/Alamy Stock Photo)

(Source: Michael Vi/Alamy Stock Photo)

Airwaive, which launched in September last year, has around 14 employees and has received $3.5 million in venture funding. Its basic premise is to connect network operators with property owners willing to host their equipment – a sort of Airbnb for the wireless industry.

Yee said Airwaive today counts fully 6.7 million locations – mostly in the US but also in some international locations – where network operators can potentially install their equipment. The locations cover all types of properties, with retailer Walgreens as one big-name participant that Airwaive can name publicly, Yee said.

Like Airbnb, Airwaive essentially operates a marketplace. Network operators first outline the locations where they need sites and the amount they're willing to pay in rent for those locations. The offers are then delivered to relevant property owners, who can decide to host the equipment on rooftops or other locations.

"We're now starting to see ... a nice offer flow through the platform," Peters said. He noted that Airwaive is seeing significant interest from wireless Internet service providers looking to use its platform to expand the range of their services.

Small cells and cryptocurrency

Airwaive is primarily focused on the market for small cells, though Yee said the company lists some bigger macro cell tower sites. He acknowledged that interest in small cell locations has waned in recent years as big US network operators focus on their midband 5G spectrum buildouts via macro cell towers. But he said interest in small cells appears set to ramp up again as those midband buildouts conclude over the next few years.

Indeed, research and consulting firm Dell'Oro recently reported that demand for small cells remains strong globally. The firm said revenues for small cell radios advanced 15% year-over-year in the first quarter of this year, growing at a faster pace than the broader market for small cell plus macro radio equipment.

As Airwaive generates momentum behind its marketplace, Yee said the company is turning its sights to a new concept: cryptocurrency. Later this year, the company will introduce a blockchain-based cryptocurrency service – using tokens developed by Airwaive – that will allow network operators to pay equipment hosts in digital currency, he explained. The service will also include a mechanism that will allow the hosts themselves to pay for the equipment necessary for network operators to expand their service.

Yee acknowledged that the model is similar to the one being used by startup Helium. Helium promises to reward users – via its own cryptocurrency tokens – who purchase Helium-compatible equipment and broadcast its wireless signals, whether that's LoRa or 5G.

However, those payments are based in part on the data traffic traveling over Helium's network. In the case of Airwaive, Yee said the company will dole out cryptocurrency tokens based on the revenues it gets from network operators looking for suitable cell sites.

"All this is backed by real revenues," he said, adding that Airwaive's network operator partners will be able to choose to use regular money or cryptocurrency for their transactions with cell site hosts.

Related posts:

— Mike Dano, Editorial Director, 5G & Mobile Strategies, Light Reading | @mikeddano

About the Author(s)

You May Also Like