Light Reading podcast logo

Video Broadcast

Verizon taps into 5G, the edge and the cloud to cut live TV sportsVerizon taps into 5G, the edge and the cloud to cut live TV sports

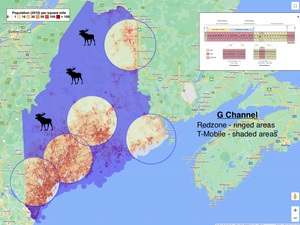

At NAB, Verizon Business showed off the future of live TV production by using its public 5G network, in tandem with its edge compute capabilities and AWS's cloud, to cut and edit a live NHL game.

Subscribe and receive the latest news from the industry.

Join 62,000+ members. Yes it's completely free.

.jpg?width=300&auto=webp&quality=80&disable=upscale)