Lost in the RFoG? Who's in it? What are they up to?

November 23, 2009

This month we're taking a rest from trying to nail down immense technologies involving scores of vendors across a range of subsectors, such as in Who Makes What: 40- & 100-Gbit/s Systems and Who Makes What: LTE Equipment.

Instead, this Who Makes What takes a narrow look at some aspects of a highly specific technology that nevertheless looks set to push another chunk of access networks into the fiber world. This is Radio Frequency Over Glass (RFoG), and it properly refers to the looming Society of Cable Telecommunications Engineers (SCTE) SP910 standard for replacing coax in today's hybrid fiber/coax (HFC) cable networks with fiber all the way to the customer's premises.

The RF part comes about because the whole point of the exercise is to preserve the 1-GHz-bandwidth analog RF signals and channel structures that support current cable services – TV, switched video, VoD, VoIP, Docsis data, and all the rest. So it's the minimum possible change to take cable into the fiber world – the big hassle and costs of replacing CPE and operator backoffice systems, for example, are avoided. In a way, it is the converse of telco DSL. That kept the copper pairs, but changed the signals; RFoG keeps the signals, but changes the coax.

It's an idea whose profile has been on the rise for some time, a trend underlined by the recent spate of approvals of vendors' RFoG equipment by the U.S. Department of Agriculture's Rural Utilities Service (RUS) for use on projects funded by the Rural Telecom Infrastructure and by the Broadband Loan and Loan Guarantee Program. Alloptic Inc. , Aurora Networks Inc. , CommScope Inc. , and Hitachi Communication Technologies America Inc. (Hitachi-CTA) have been some of the lucky recipients of such status this year. Such approvals also allow the equipment to be deployed under the Broadband Initiatives Program (BIP), which the Department is managing within the American Recovery and Reinvestment Act (ARRA) to construct broadband infrastructure in unserved and underserved rural areas.

Why RFoG?

The irruption of U.S. rural politics into the story makes the point that RFoG looks a prime candidate for a win/win quick fix to the vexing problem of kick-starting the building of next-generation fiber networks (which just about every policymaker wants now) in areas where the economics are shaky or the operator has limited resources. And, since many of the smaller U.S. cable operators are also divisions of their local telcos, there is a nice synergy, as the resulting all-optical access network is what the telco business wants, anyway.

Further, the general logic of an RFoG-based incremental upgrade to all-fiber cable seems to be acquiring wider appeal, and many cable operators (telco-owned or not) are now interested in the possibilities of RFoG.

"I think that MSOs are very enthusiastic – more enthusiastic today than they were even six months ago," says Tom Williams, VP marketing, of cable-equipment vendor Arris Group Inc. (Nasdaq: ARRS). "This comes from their realizing what is possible with an RFoG deployment in the additional applications that are made available to them, which equates directly to additional revenue. In addition, the capex costs continue to decrease, allowing a lower cost of entry for the MSO. In our own solution, for example, we have continued to innovate our headend optics to drive cost out, giving an almost a 50 percent cost differential from our earlier solution. And in addition to the capex savings there are also opex savings through the reduction in maintenance and powering of an active infrastructure."

However, it is still early days for RFoG, and it is still a small business for those vendors with pre-standard versions of the technology. Furthermore, interest is mainly about small systems, particularly small-scale, incremental new build, and no one appears to be looking at retrofitting existing large HFC deployments. This is hardly surprising as much of the coax in U.S. HFC networks is fairly new, and it could easily be another 10 to 15 years before a big switchout might start to be needed from the point of view of physical deterioration and investment amortization.

So, essentially, RFoG right now is seen both as a way of future-proofing new build and also of making more bandwidth available to added customers (business and residential) via new PON-type services.

Now that telco fiber is becoming mainstream, cable operators have little choice but to respond, and this helps to make the RFoG option attractive. Many cable operators have already been deploying PON overlays for business data services for several years in the U.S., while continuing to serve residential customers with standard HFC. An evolution that would cap the expansion of HFC while increasing fiber would make a lot of sense.

"Operators know that competition is out there, and they are searching for the best ways to answer it," says Jim Farmer, chief technology architect of optical telecom vendor Enablence Technologies Inc. (Toronto: ENA). "Options include, of course, RFoG, Docsis 3.0 over RFoG and/or HFC, going directly to EPON or GPON, waiting for 10-Gbit/s PON, further subdividing nodes, rebuilding systems to 1-GHz, analog reclamation, and switched digital video. All these options one way or another expand a cable operator's ability to compete with others who are putting in FTTH today, but all come with their unique prices and opportunities in terms of dollars, new procedures, training needs, subscriber disruptions, service tradeoffs and operational expenses."

For its supporters, a further, very strong characteristic of RFoG is that it is (or will be) a standard, in a way that other approaches are not (yet, if ever for some of them).

"We are attempting to make the 910 standard the universal standard for RF-only-based PON systems," says Farmer, who is involved in the development of the RFoG standard. "This is to ensure that an operator can remove vendor A's R-ONU from a home and replace it with vendor B's R-ONU and have everything work exactly as it did with vendor A. Beyond that, the detailed system design is up to the operator, just as in HFC design. We are defining the system such that it can be overlaid or replaced by EPON or GPON, without the need to change any of the fiber."

Other approaches (see next page), such as those based on placing the RF return path into the upsteam EPON or GPON baseband data, are essentially still proprietary.

And, policy and standards apart, RFoG resonates with some other perennial and also new concerns for cable operators.

"The technology is very environmentally friendly," says John Dalquist, VP marketing, Aurora Networks. "It is very green and very low power consumption for the cable operator. So some cable operators focused on reducing their power consumption and carbon footprint see our Fiber Deep solution (which is one of our key coaxial-to-the-home solutions) and RFoG PON as being a tremendous way also to reduce their costs and carbon footprint."

RFoG thus sounds very promising, but it is still early days for a fairly specialist technology. So what's on the market, and what has the small group of vendors involved been doing recently? And where do they think it may be going?

Here's a hyperlinked contents list:

Page 2: RFoG Technology

Page 3: Standards & Other Approaches

Page 4: Vendors & Products

Page 5: Vendor Angles & Activities I

Page 6: Vendor Angles & Activities II

— Tim Hills is a freelance telecommunications writer and journalist. He's a regular author of Light Reading reports.

Next Page: RFoG Technology

RFoG is being standardized as the eventual SP910 by the SCTE through its Standardization Committee, Interface Practices Subcommittee, Working Group 5. This specifies the system overview and is due for completion in late 2009; some specific aspects of RFoG, such as those for Gateway Optical Input and Output RF Levels and Wavelengths (SP908), have been available for a couple of years. The main content of SP910 is, however, reasonably clear and, typically, vendors have been tracking it with their products, although work is still needed, for example, on Docsis 3.0 support.

It should be stated immediately that RFoG, although it shares some of the concepts of RF overlay as used by some telcos in their GPON/EPON deployments to offer broadcast cable TV services, is a different technology and is essentially specific to cable networks and operators. Essentially, it allows current HFC-based cable services to be run over fiber all the way to the home without any change to the current services or Docsis-based management system, for example.

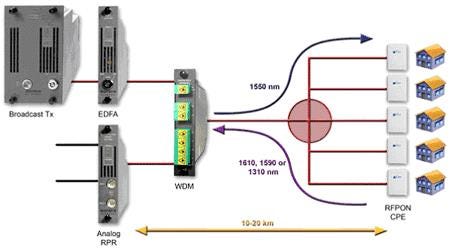

The basic idea of RFoG is very simple, and is illustrated in Figure 1 when applied in a cable PON environment. The standard HFC tree-and-branch coax structure that runs between the headend (or distribution hub or optical node, depending on the architecture) and the subscriber residences is replaced by a topologically equivalent fiber PON. Over this is carried the standard 1 GHz (or 750 MHz) cable analog RF signal used in HFC systems. This signal comprises two parts: in North America, the lower 5 to 42 MHz carrying the upstream return path from subscribers to the headend, and the higher 54 to 1000 MHz downstream broadcast channels. The lower part is used for such TV and video requirements as interactive program guides, impulse pay-per-view and video on demand, and, of course, upstream cable data and VoIP, while the higher part is used for broadcast TV channels and downstream cable data and VoIP. The broadcast downstream part of the RF signal is placed on a modulated 1550nm-band wavelength (typically 1555 - 5nm) transmitted by the headend, and the splitting action of the PON broadcasts this to all subscribers – essentially as for HFC. Note that this is analog modulation, not on/off baseband digital modulation; the lasers are analog modulated directly by the RF carrier signals, although the carriers themselves may be analog or digitally modulated.

The broadcast downstream part of the RF signal is placed on a modulated 1550nm-band wavelength (typically 1555 - 5nm) transmitted by the headend, and the splitting action of the PON broadcasts this to all subscribers – essentially as for HFC. Note that this is analog modulation, not on/off baseband digital modulation; the lasers are analog modulated directly by the RF carrier signals, although the carriers themselves may be analog or digitally modulated.

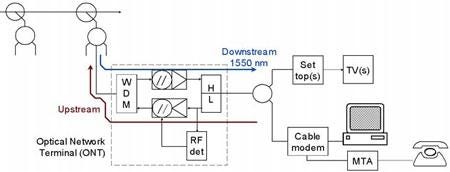

The subscriber network CPE – dubbed RFPON CPE in Figure 1, but essentially a special optical network termination or unit (ONT/ONU) and often also referred to as an optical micronode in cable parlance – demodulates the RF signal from the 1550nm wavel's set-top-box/cable modem setup. The ONT may be designed for internal or external mounting (see Figure 2). The 1550nm band is universally used in all technologies for transmitting downstream broadcast RF signals over fiber, because amplification is essential (due to long reaches and the division of power over multiple subscribers), and this wavelength band has the most mature and lowest-cost amplification technology.

The 1550nm band is universally used in all technologies for transmitting downstream broadcast RF signals over fiber, because amplification is essential (due to long reaches and the division of power over multiple subscribers), and this wavelength band has the most mature and lowest-cost amplification technology.

The complications arise from the need to support the standard HFC upstream RF return path signal from the subscribers to the headend, and this is done by using a different optical wavelength to carry this signal (at 1610nm in SP910, but other wavelengths, such as 1310 or 1590nm have been used in various earlier proprietary systems). Obviously, WDM equipment is needed at both the CPE and the headend to separate/combine the two wavelengths and their respective RF signals.

Next Page: Standards & Other Approaches

One issue that IS910 set out to resolve was that the most obvious upstream wavelength for the necessarily lower-specified CPE lasers is the zero-dispersion 1310nm, but this was already claimed by GPON and EPON for their upstream. As a key point of RFoG is to maintain compatibility with the telco PON world and allow cable operators the option of offering these technologies in parallel with RF-based ones, a new upstream wavelength band at 1610nm (actually 1610 - 10nm) was selected. But it does mean that an RFoG-compatible GPON or EPON ONT is optically somewhat challenging, as it has to handle four wavelengths: two for RFoG and two for the PON.

Because 1610nm is well away from the zero-dispersion wavelength, lasers may have to be DFB types, and this will push up CPE costs, at least initially until volumes grow. Because of this, SP910 keeps 1310 nm as an option for implementations that want the lowest-cost components and do not combine RFoG with GPON or EPON, for example.

However, the PON-compatibility option is really the big long-term idea behind RFoG: Cable operators can continue with their current video/voice/Docsis offerings and systems, but also offer PON-type services (such as high-speed data and IPTV) in selected areas, and even potentially migrate fully to a converged-service, all-PON architecture one day.

Typically, SP910 envisions a splitting factor of 32 to 64 in the downstream direction, although the industry is likely to try to push power budgets higher by various means to reach higher factors such as 128. Both splitter and tapped architectures may be used. The standard has also plumped for the term R-ONU (RFoG Optical Network Unit) for differentiation from the ONTs used in other standards.

A complication of using RFoG-type upstream optical transmission from a group of separate ONTs to the headend is the possibility of interference if two or more transmissions occur at the same time on specific inband wavelengths that are too close. Obviously, the ONT optical transmitters can be switched off when there is no signal to transmit (the RF detection function in Figure 2), and retransmission can be used, though it does not yet appear to be settled whether more may be needed. But it is clear that upstream transmission activity is likely to increase as set-top boxes and their applications become more sophisticated, for example. And Docsis modems do generate a lot of upstream transmissions.

"A solution would be to use set tops using Docsis set-top gateway (DSG), an internal modem, for their upstream," says Enablence's Farmer. "This would work, but limits the set tops you can use, and, because of cost, it is not likely that low-end set tops will use DSG."

He also points out that the RFoG upstream optical transmitters will need to work with Docsis 3.0, which can have several active upstream data channels simultaneously, thus adding to the performance required of the upstream optical transmitter. However, Docsis 3.0 is likely to work better with RFoG than with HFC because there are fewer sources of distortion, and the RF detector in the ONT will prevent noise funneling back to the headend.

Other approaches

To put RFoG into context, it is worth noting that there are several other approaches to the question of providing an RF return path for video from a set-top box in a PON environment, such as GPON. One, already mentioned, is the Docsis Set-Top Gateway (DSG), but others include Ethernet, MoCA/HPNA, RF-digital-RF, and SCTE-55x emulation.

Docsis set-top gateway: This is an extension to the Docsis standard that allows set-top boxes to use Docsis for the RF return path.

Ethernet: Essentially, the set-top box uses an Ethernet connection within the PON's normal upstream data path to provide the RF return path, so the RF return signals in their digital form are put through the CPE broadband router with all the other data. The headend OLT subsequently recovers them and switches them appropriately.

MoCA/HPNA: These two standards for home networking – Multimedia over Coax Alliance (MoCA) and Home Phoneline Networking Alliance (HomePNA) – use the same basic idea of in-data transport as for Ethernet, but use a MoCA or HPNA connection to the ONT.

RF-digital-RF: This is another variation on the same theme. It uses an ONT with a special module to convert the direct RF signal from the set-top box into an Ethernet signal.

SCTE-55x emulation: This one is slightly more recondite to non-cable-engineers. SCTE-55-1 and 55-2 are the two standard protocols used by the cable industry within the RF return path for communications with the headend (or distribution hubs). A special ONT module demodulates the RF signal, extracts the 55-x protocol data stream, and puts it into the PON's upstream data as usual for extraction and handling by the OLT.

PONs themselves are not standing still, and new types are being promoted or developed. Some relevant examples for cable operators are:

Docsis PON (D-PON/DPON): Some vendors propose adding a Docsis service layer interface onto EPON or even 10G EPON MAC and PHYs, thereby making the EPON OLT emulate a standard Docsis Cable Modem Termination System (CMTS).

10G EPON (802.3av): This is the high-speed version of the Ethernet PON standard (approved September 2009), offering 1 or 10 Gbit/s upstream, and likely to become real hardware in 2010.

10G GPON (G.987): Ditto for GPON, but likely to be a little later in reaching the market than its Ethernet cousin.

There are a couple of implications from all these examples. Obviously, RFoG is just one technological approach among many, and a cable operator's particular circumstances will be critical in determining just how relevant it is.

Less obviously, as Enablence Technologies' Farmer points out, there may be practical issues raised by trying to accommodate RFoG with the emerging 10-Gbit/s PONs. For example, both use a downstream data carrier nominally at 1577nm (but down to 1575nm is allowed). This may be only 15nm away from the bottom of the range allowed by the 1550nm band of RFoG, so very precise filtering will be needed to keep the two apart. This is certainly feasible, but how much it will cost to realize is still unclear.

Next Page: Vendors & Products

RFoG's rising profile has been accompanied by a burst of industry alliances and the like, as players fill out their product portfolios with the new technology.

Among the larger names reported by Light Reading, last year (June 2008) CommScope allied with optical transmitter/receiver/amplifier vendor Harmonic Inc. (Nasdaq: HLIT) to introduce the latter's MAXLink forward-path transmitters and return-path receivers into CommScope's BrightPath system to support RFoG for greenfield deployments. While this year (2009), RFoG specialist Alloptic bagged both Motorola Inc. (NYSE: MOT) and Zhone Technologies Inc. (Nasdaq: ZHNE) with deals to include its RFoG products in their PON and cable PON systems.

Not to be outdone, Hitachi Communication Technologies America and Pacific Broadband Networks (PBN) announced in March 2009 that they had formed a technology partnership to develop fiber-to-the-premises solutions for HFC network operators. The companies had clearly solved the problem of time travel as well, as the first fruit of the partnership, the Node+Zero RFoG module, had been released nine months earlier in June 2008.

Given such activity within a technology that is essentially intended as a transparent bolt-on to existing PON and optical systems, this Who Makes What does not attempt a detailed and purist interpretation of what is, and what is not, an RFoG-specific network element. Moving from the CPE to the headend, an RFoG-capable network includes all of the following:

ONU/ONTs of various types

Equipment at the intermediate optical nodes (such as optical amplifiers, return path transmitters)

Equipment at the headend (such WDM devices, return path receivers, optical transmitters and amplifiers)

All the passive optical devices in between

Instead, Table 1 concentrates on what are the two big practical categories for a cable operator: (a) complete systems or implementable solutions; and (b) ONTs/ONUs, as these are the most visible and crucial product from the point of view of deployment.

Because RFoG is a cable technology, Table 1 also is biased towards vendors that are oriented towards cable operators (although not all of them are). The point here is that there are many vendors of PONs aimed mainly at the telco market (see, for example, Who Makes What: GPON & WDM-PON Equipment), and many of these currently support downstream RF video by means of a 1550nm optical overlay, which is precisely the same as the RFoG downstream approach. Such vendors may well add an RFoG option at some time, particularly if they are targeting smaller combined telco/cable operators.

Table 1: Selection of RFoG Vendors

Vendor | Product areas include | Products include |

Alloptic | Full system | Micro Node family |

Arris | Full system | FTTMax RFoG Optical Network Units, TransMax RFoG Repeater, CORWave II, EPON OLT, FTTMax EPON ONU |

Aurora Networks | Full system | VHub, OR4168 VHub module, CP8013U CPE, Node PON module, GEPON CPE, CP8013 Series RFoG CPE Transceivers |

Calix Networks | Full system | RF Return ONTs, C7 and E5 Series MSAPs, RFOG EDFAs |

Cisco Systems | Full system | Prisma D-PON |

CommScope | Full system | BrightPath System |

Electroline | ONTs, headend transmitters, receivers, and optical amplifiers | EDX optical mininode and SFU micronode ONTs, ELink Optical Transmission Platform |

Enablence Technologies | OLTs, ONTs | Trident7 OLTs, ONT-G22x/G88x series ONTs |

Hitachi Communication Technologies America | Full system | Node+Zero RFoG module |

Motorola | Full system | OmniStar GX2 Optical Broadband Transmission Platform, SG4000 Modular Optical Node Platform, Alloptic ONTs |

Tellabs | RFoG compatible MSANs and GPON ONTs | 1150 Multiservice Access Platform (MSAP) has RF return compliant with RFoG standards. 1600 Series of GPON ONTs have RF video interface |

Zhone | GPON ONT + OLT with integrated RFoG | zNID ONT, MXK GPON OLT |

Source: Light Reading, 2009 |

Next Page: Vendor Angles & Activities I

There are working pre-standard systems on the market, and these differ in various ways, such as in the upstream wavelength and certain key gain parameters; and one of the drivers of the SP910 work is to have a base standard out soon in order to allow migration to it before a lot of diverse equipment is deployed. However, some vendors appear confident that they are very near to the final output and that accommodating it will not be a problem.

“We are a part of the SCTE standards body and we continue to watch daily for any changes, so I am confident that our products are right there as the different specs have been approved,” says Arris’s Williams. “But we continue to innovate on the current technologies, so that we not only meet the current standard, but have enhanced capabilities – as in our new Low Noise Receiver, which exceeds the specifications.”

Certainly, the prospect of a standard has not stopped the flow of new products from the industry. In 2009 date order, as Light Reading has reported, these included:

Alloptic: Claimed in March the release of the industry’s first Docsis-enabled PON via its Docsis PON Controller (DPC) software, which enables Docsis provisioning and control of its EPON system. The company says that DPC facilitates the acceleration of PON rollouts by MSOs and others using Docsis for service delivery, and enables them to address a broader set of business needs for enhanced Ethernet and TDM services while continuing to use their OSS and billings systems. (See Alloptic Powers Up Docsis PON.)

Aurora Networks: April saw a new month and a new claim for an industry first, this time for a single-fiber end-to-end RFPON solution, formed by the company’s new OR4168 Virtual Hub (VHub) module and CP8013U customer premises equipment, together with the existing VHub, Node PON module, and GEPON CPE. The VHub OR4168 module enables operators to extend network reach from 10-20km to over 60km by using a single fiber to provide a local service area concentration point for management of both downstream and upstream RFoG and PON wavelengths. The module also facilitates route redundancy for high network reliability and increases VHub efficiency and cost savings by consolidating the functionality of three separate products. The CP8013U RFoG CPE is a field-hardened device enabling triple-play video, voice, and data services, including Docsis 3.0 cable-modem traffic. A month later, Aurora released the NC2000 optical node, its first 2x2 segmentable, wall- or cabinet-mounting node platform intended specifically for the European cable market. (See Aurora Unveils 'RFPON' System.)

Electroline Equipment: Released in June, and much more into the nitty-gritty of hardware, the ELink Headend Optics Platform is based on a 17-slot 3RU-chassis that can be configured with any combination of transmitters, receivers, fiber amplifiers, and redundant power supplies. All modules are hot swappable, and the company says ELink provides a cost-effective solution for node splits in HFC, RFoG, or PON overlay applications. (See Electroline Turns on Headend Optics .)

TriAccess Technologies: Announced in July 2009 the TAT6254D amplifier for RFoG applications. This incorporates all the downstream receiver requirements for RFoG services, providing a single-chip solution for R-ONUs (residential optical network units). The company says that the integration of TIA and output stage amplification for RFoG-specific levels enables a highly economical solution, and that the low-noise and high-gain performance optimize the optical input range for a balance of low-cost equipment and full 20km downstream reach. Technical specifications include: 30dB gain, 50-1002 MHz; analog and all-digital modes; -6 to +1dBm optical input range; optical and RF AGC gain control; better than 18dB return loss; up to 20dBmV/ch RF output; 5 and 12V power options; and better than -58dBc composite second-order and composite triple-beat distortion. (See TriAccess Amps Up RFoG.)

Calix Networks: Launched a blizzard of 15 new ONTs of various types in September, including the 763GX / 763GX-R (with 8 GE, 8 POTS, 8 RF ports up to 1 GHz, integrated SCTE RFoG micronode) for MDUs, and the 725GX (with 1GE, 2 POTS, 1 RF port up to 1 GHz, embedded and managed SCTE RFoG micronode) for single-family homes. The new single-family device is essentially an update to reflect developments in the RFoG standard. There is also an device aimed specifically at business that offers 4 GE ports, 8 T1 ports, and 8 RF video ports. The company points out that T1 is still very popular among businesses, and that broadcast TV and video are very widespread in North American businesses – from bars and hairdressers all the way up to corporate reception areas. (See Calix Debuts Batch of ONTs.)

Titan Photonics: Also in September released the Optical NanoNode RFoG ONT. Characteristics include: Docsis 3.0 upstream bonding; typical 128 homes or up to 512 splits for virtual home nodes; 1610nm DFB laser-diode optical diplexer; optional 1310nm DFB and FP optical sources for alternative return-path solution; low equivalent input noise front-end receiver; transmitted optical modulation index (OMI) of 3.3% per channel. (See Titan Demos 'NanoNode'.)

Such examples display some of the diversity of vendor approaches to RFoG, but also hint at some common themes...

Next Page: Vendor Angles & Activities II

One of the common ideas might be termed complete or tailored RFoG solutions. Arris, for example, bills itself heavily in being a supplier for everything RFoG related, from the headend transmitters, receivers, EDFAs, and EPON OLTs, down through the optical distribution network plant and RFoG repeaters, and out to the RFoG and EPON ONU and its associated enclosures, splitters, and jumpers.

Arris’s Williams reports that cable operators do seem to be buying into the complete end-to-end solution. “We are still early in RFoG deployments, and it is widely known that Arris is expert in this space,” he says. “By having all of the products necessary to deploy RFoG it makes it very easy for us to design the entire network for an operator, as opposed to just different portions of the network.”

The recently renamed Hitachi Communications Technologies America (HCTA) also sees the need for a comprehensive and flexible product portfolio to address the cable operators. Jeffrey Stribling, VP for marketing and customer service at HTCA, argues that the cable operators are tending to take one of three positions on RFoG:

Enthusiasm – I am embracing RFoG right now.

Forget RFoG – I am going to go straight to PON; it is the long-term evolution.

Resignation – I’m not keen on RFoG, but I am going to deploy it anyway.

“So our philosophy is to offer all the alternatives, as we recognize that the cable industry itself is in incremental change – they can’t just rip out their network and put in something new,” says Stribling. “We are thus creating a portfolio of products that work together and are compatible with existing infrastructures. For example, the RFoG units are compatible when overlaid with a PON technology. You can use our RFoG module and overlay our PON either now or at some point in the future. So you don’t have to worry about coexistence problems or ripping out old units.”

Another example of the approach is the company’s espousal of Docsis Over EPON (DePON). Essentially, this is an EPON system with a front-end Docsis proxy, so it looks like a 1-Gbit/s symmetric cable modem to the cable operator’s system.

“It is still early days for this approach – we are in lab trials with the big MSOs, but the feedback we are getting is very encouraging,” says Stribling. “It works very well with the MSOs in transitioning them to the next level incrementally, and also fits well with the big question of how to solve the video return-path problem. We have created a triple-play box by embedding an RFoG module within our ONU end device, giving a one- rather than two-box solution.”

Calix Networks has integrated a managed RFoG micronode into its ONT technology because the GPON standard does not include an RF return path. It, too, sees the need to be flexible even in just a single segment of the market.

“We are going to continue to introduce very applications-specific products. The days of the generalized ONT are over, and so we expect to add other versions of RFoG-based products designed for specific market opportunities,” says Dave Russell, responsible for Solutions Marketing Direct. “For example, I think we see ourselves definitely embracing a MoCA approach to the return path, and as MoCA starts to spread through the set-top, that is going to become something that we would like to see.”

Calix has already been talking to Broadcom Corp. (Nasdaq: BRCM) and other device vendors about the necessary MoCA integration into the ONT.

Technology improvements

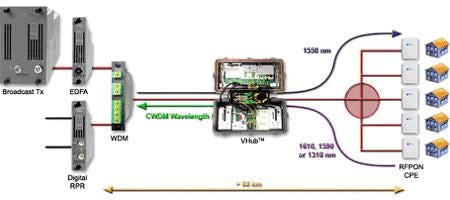

A second strand of ideas is to improve the basic RFoG technology in some way. Aurora Networks, for example, argues that the basic approach as illustrated in Figure 1 has several limitations, particularly:

A limited upstream range of about 20km when used with low-cost Fabry-Perot lasers in the R-ONUs

A fiber-intensive architecture that requires a unique fiber back to the optical node or headend for each group of 32/64 R-ONUs served, and which provides no route redundancy

The company’s solution is to insert a new element into the architecture, termed a "virtual hub," that essentially creates a small remote hub serving up to 256 customers that can be deployed in a weatherproof enclosure nearer to the customer, and connected by Coarse Wavelength-Division Multiplexing (CWDM) – providing both fiber efficiency and switched route redundancy – to the headend (Figure 3). “One of the things that we do in the return path is use low-cost lasers at the side of the home, because that is where it is most critical to make it a cost-effective solution,” says Aurora’s Dalquist. “We bring the optical signal back to our virtual hub, where we convert it back into an electrical signal and digitize for onward transmission. That gives the ability to go 100 to 200km. Especially in fringe areas, where a lot of RFoG is being deployed today, the reach issue is very critical, and most PON or RFoG systems without some sort of hub in the middle are limited to 10 to 20km.”

“One of the things that we do in the return path is use low-cost lasers at the side of the home, because that is where it is most critical to make it a cost-effective solution,” says Aurora’s Dalquist. “We bring the optical signal back to our virtual hub, where we convert it back into an electrical signal and digitize for onward transmission. That gives the ability to go 100 to 200km. Especially in fringe areas, where a lot of RFoG is being deployed today, the reach issue is very critical, and most PON or RFoG systems without some sort of hub in the middle are limited to 10 to 20km.”

In contrast, Arris has developed an alternative intermediate device – the TransMax RFoG Repeater – to extend the reach of its system beyond the 20km of its standard Dense Wavelength-Division Multiplexing (DWDM) optical transmitter. This is placed remotely and amplifies the 1550nm broadcast signal so that it can be split further to support 256 customers.

“We know when speaking to a lot of operators that the real savings of RFoG from a capex perspective start to come in at around the 40 homes per mile and less – and that is typically further than 20km from a headend,” says Arris’s Williams. “On the reverse path, there is an analog receiver inside the repeater, and a digital transmitter back into the headend. So we are able to get about 70km in distance with a TransMax RFoG Repeater in place.”

The longer term

There is little doubt that vendors see a viable market now for RFoG because it addresses so many issues facing cable operators – such as legacy network infrastructure, budget requirements, amortization schedules, and technical innovations like switched digital video – and has lots of practical plus points, including use of the existing RF skills of field personnel, and leveraging Docsis 3.0 investments.

Vendors also appear to be pretty unanimous that the future of RFoG lies in its ability to integrate with PONs of various types. Aurora’s Dalquist provides a typical summary:

“We see it as being a platform that is going to continue to grow,” he says. “We have what we call our RFPON solution, which includes the capabilities and benefits of RFoG with the ability to add PON service later. Or you can deploy the PON immediately for business services in a more highly developed area or an industrial park and later evolve it to an RFoG system for residential services. It is a very adaptable type of solution.”

But this also suggests that RFoG may in the longer term prove to have a more transitional role because, once an appropriate PON is in place, there is the basis on which to make a final transition from the traditional RF world to an all-digital, all-IP one that even the most diehard of cable operators will admit to being eventually inevitable. The issue of RFoG’s future is thus perhaps more along the lines of how long the eventual migration to the all-PON-based cable network might be.

If the cable-modem/Docsis 3.0 approach holds up well as very-high-speed broadband access becomes more common, and does not meet mass-market applications it cannot handle because of bandwidth issues, for example, transitional need not equate to transitory, as the migration could take many years. But, if future, faster, telco-type PONs or Active Ethernet accesses should start to widen a bandwidth gap crucial to some must-have applications, cable operators would be under pressure to speed up that migration.

Calix Networks’ Russell makes a similar point on the transitional nature of RFoG: “I think it is viewed as a transition technology and not the end solution. A fair number of people look at it and say, I know that it works, but it is a little inelegant and perhaps expensive. And it is a little fiber hungry and not really efficient on the fiber side. If you haven’t built out your plant sufficiently with fiber, it may not be viable for you.”

On this view, the big questions, of course, are which PON technology might form that basis, and how video would be supported over it, given some of the possibilities already mentioned. There seems to be a fairly strong argument that the major cable operators and MSOs in North America would prefer a 10-Gbit/s PON technology for any large-scale commercial rollout. The recent completion of the Institute of Electrical and Electronics Engineers Inc. (IEEE) 802.3av 10GEPON standard in September 2009 might suggest that Ethernet PONs, already used by many cable operators worldwide, would be in pole position, but Russell is not so sure.

He suggests that one problem with both 10GEPON and the ongoing parallel development of 10GPON is that neither originated in the cable industry nor has been developed with cable requirements specifically in mind. More likely, because more acceptable, would be a CableLabs -driven process for a specific cable-industry standard that takes some of the best elements of 10GEPON and 10GPON so that the industry can benefit from the high volumes that these standards will ultimately create.

“It will be much more Docsis-like in supporting all the Docsis and Packet Cable features,” Russell says. “I think they will use the same wavelengths, the same lasers, and all those PHY things, and they will take some aspects of the MACs from the different standards, but they will imprint their own additions and requirements. To me, that would be the logical thing for the cable industry to do, for then they control the standard and can run the interoperability testing.”

But, until that happens, as Enablence’s Farmer points out, there is a lot of ground to cross.

“We, along with the rest of the industry, know that an all-optical network is the way to go, and that EPON and GPON are much more capable than are HFC or RFoG,” Farmer says. “But there are a lot of routes to get from where we are today to that ultimate goal of E/GPON at whatever speed is optimum at a given time – and there is a place for RFoG on the route. We have some tricks up our sleeves that can make RFoG better while staying within the specification, should the industry need to go in those directions. But the first step is reliable, competitively priced equipment that meets the specification and brings in revenue for the operator.”

— Tim Hills is a freelance telecommunications writer and journalist. He's a regular author of Light Reading reports.

Back to Introduction

You May Also Like