Enhancements to DOCSIS 3.1 networks and prep for DOCSIS 4.0 upgrades have the cable outdoor plant equipment market poised to pull down almost $10B through 2023, predicts Dell'Oro Group.

Led largely by cable operators in North America, coming enhancements to DOCSIS 3.1 networks or full upgrades to DOCSIS 4.0 are expected to create a nice glide path for suppliers of network virtualization software and new nodes and modules that support a new distributed access architecture (DAA).

But another part of the cable tech sector – outdoor plant equipment that includes components such as amplifiers, taps and node housings – are also poised for growth in the coming years as the bandwidth of hybrid fiber/coax (HFC) networks are raised to 1.2GHz and 1.8GHz to help operators deliver symmetrical, multi-gigabit broadband speeds.

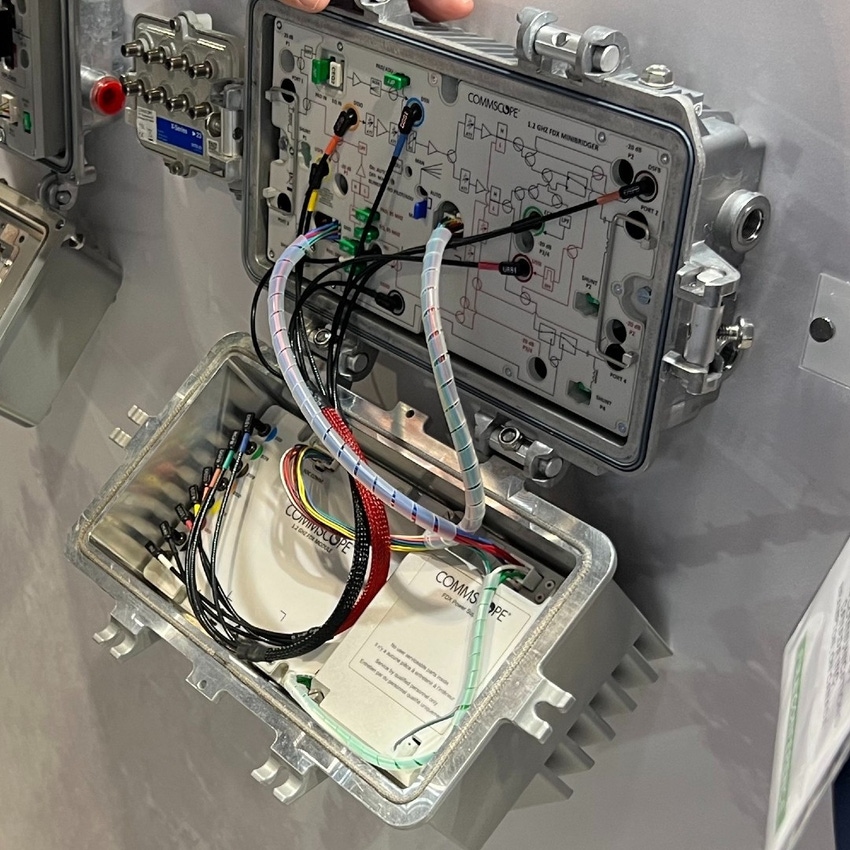

Figure 1:  Comcast has tapped CommScope to build FDX amplifiers that will play a role in its coming DOCSIS 4.0 network upgrades. Pictured is an FDX amplifier prototype that CommScope showed at last fall's SCTE Cable-Tec Expo in Philadelphia.

Comcast has tapped CommScope to build FDX amplifiers that will play a role in its coming DOCSIS 4.0 network upgrades. Pictured is an FDX amplifier prototype that CommScope showed at last fall's SCTE Cable-Tec Expo in Philadelphia.

(Source: Jeff Baumgartner/Light Reading)

According to a new forecast from Dell'Oro Group, spending on cable outside plant equipment is expected to eclipse $9.9 billion through 2030. For 2023, Dell'Oro forecast that the cable outside plant sector will generate spending of just over $1 billion. Spending on that segment is expected to peak at about $1.4 billion in 2027, when the largest number of tier 1 operators in North America are in the middle of amplifier and node upgrades for DOCSIS 4.0.

Dell'Oro's view of the outside plant equipment market category includes amplifiers (line extenders and trunk amplifiers), hardline splitters, passives, taps, power inserters and the node housings that contain elements such as amplifier modules. Dell'Oro's outdoor plant focus does not include elements such as remote PHY and remote MACPHY devices and remote OLTs (optical line terminals) that come under a "cable access concentrator" segment that also includes virtual cable modem termination system (vCMTS) software and more traditional CMTS chassis and line cards.

Dell'Oro expects 1.2GHz Full Duplex DOCSIS (FDX) and 1.8GHz amplifiers to start shipping this year, with "significant volumes" of them set to move in 2024. That will come together as operators push ahead on HFC upgrade projects that beef up the overall bandwidth of HFC networks alongside "mid-split" and "high-split" upgrades that expand the amount of capacity dedicated to the upstream.

Spending concentrated in North America

This year, about 75% of that cable outdoor plant spend will originate from the North American cable market, Dell'Oro VP and analyst Jeff Heynen said. Spending in this category is expected to be more muted in Europe, where many operators have already upgraded HFC to 1.2GHz or are pushing ahead with fiber-to-the-premises (FTTP) upgrades.

Heynen said he extended this particular forecast out to 2030 in order to capture global DOCSIS 4.0-related spend. D4.0 activity in some regions, such as Latin America and certain pockets of Europe, aren't expected to perk up until 2027, he points out.

Heynen also notes that spending on cable outdoor plant equipment could be somewhat lumpy in the coming years due to potential supply chain constraints, the sporadic availability of labor and how rapidly operators ultimately decide to pursue HFC upgrades.

"There are a lot of components and a lot of moving parts that need to be upgraded. But that also presents these operators flexibility in how they approach the upgrade process," Heynen said. "They [the cable operators] know the end game in terms of the percentage of homes to hit with 1.8GHz or 1.2GHz... but there's still some dependencies in the market like labor that will force them to be flexible in how they follow this path to DOCSIS 4.0."

Suppliers poised to benefit

Dell'Oro's new forecast doesn't break down the outdoor plant segment by supplier, but these coming upgrades should benefit several vendors of these various components. That group includes Antronix, ATX Networks, CommScope, Technetix, Teleste and Vecima Networks, among others.

Within that group, a couple based in Europe have made recent moves to shore up their position in North American cable ahead of anticipated HFC upgrade activity.

For example, Teleste, which already has a partnership with Antronix, is increasing its investment in the North American region. Additionally, Technetix's acquisition of Canada-based Lindsay Broadband will expand Technetix's presence in both North and South America.

Related posts:

— Jeff Baumgartner, Senior Editor, Light Reading

About the Author(s)

You May Also Like