Last year, Verizon and T-Mobile offered very different viewpoints on the expected performance of their respective midband 5G networks. Each argued that it would outclass the other in terms of coverage.

Now, in 2022, there's a chance to update the debate with actual, real-world performance metrics. The results – courtesy of the analysts at Signals Research Group (SRG) – indicate that the truth lies somewhere between each operator's stated position.

"My results don't defy the laws of physics so all things being equal 2.5GHz should have some advantage," wrote SRG's Michael Thelander in response to questions from Light Reading. The firm recently conducted a new, detailed test of Verizon's C-band network and T-Mobile's 2.5GHz network in Minneapolis.

He continued: "However, these results indicate that at a minimum the differences are moot in the real world where all things aren't equal. T-Mobile had a Band 41 [2.5GHz] network in a slightly larger area than Band 77 [Verizon's C-band] but in those areas where the operators had coverage, Band 77 uplink coverage and performance was better, except close to the cell site where the 100MHz Band 41 carrier delivered higher downlink/uplink speeds."

A question of density

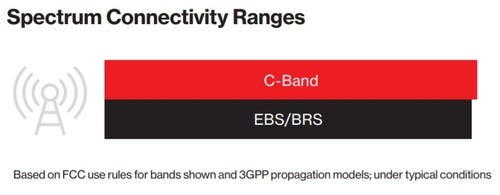

At issue are the propagation characteristics of 5G signals in the C-band spectrum versus the 2.5GHz spectrum. Verizon is using the C-band spectrum for its big midband 5G buildout. The A Block of the C-band spectrum that Verizon is deploying today sits between 3.7GHz and 3.8GHz. T-Mobile, meanwhile, is using the 2.5GHz spectrum it acquired through Sprint for its own midband 5G buildout. In general, signals in lower spectrum bands travel farther than signals in higher spectrum bands – and, as Thelander pointed out, Verizon's C-band holdings sit more than 1GHz above T-Mobile's midband holdings.

However, just after the close of the C-band auction, Verizon argued that its C-band 5G signals will actually travel farther than T-Mobile's 2.5GHz 5G signals.

Figure 1:  (Source: Verizon)

(Source: Verizon)

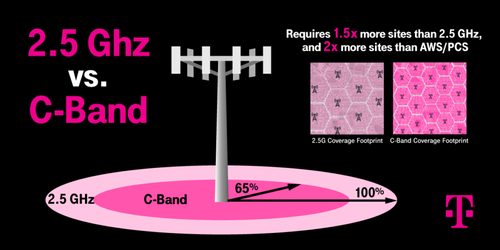

Not to be outdone, T-Mobile last year released a chart of its own showing the opposite: That signals in its 2.5GHz holdings actually travel much farther than signals in Verizon's C-band holdings.

Figure 2:  (Source: T-Mobile)

(Source: T-Mobile)

The issue is important considering a smaller coverage area could require Verizon (if you buy T-Mobile's argument) or T-Mobile (if you buy Verizon's argument) to install more cell towers to sufficiently cover a given area.

Verizon said last year that it will not have to build more cell sites beyond its estimated 68,000 to deploy a widespread C-band network. Meanwhile, T-Mobile is in the process of merging its network with Sprint's network, which the company has said will include decommissioning 35,000 unnecessary cell sites, building 15,000 new cell towers, and eventually ending the project with a grand total of 85,000 cell sites.

Dense enough

So, what did SRG find in terms of Verizon's cell site density and network coverage following its recent C-band network launch?

"Results indicate a one-for-one overlay of [Verizon's] Band 77 on top of the existing LTE cell grid with no obvious gaps in outdoor coverage," SRG wrote in its report. Perhaps not surprisingly, Verizon CEO Hans Vestberg took to Twitter to specifically point out that finding.

"Data suggested a one-to-one overlay build of C-Band onto the existing LTE site grid."

— Hans Vestberg (@hansvestberg) February 8, 2022

SRG: With C-Band addition, Verizon’s 5G network is now ‘nothing like its predecessor’ via @rcrwirelessnews https://t.co/I7bbuKgh2C

"One thing to keep in mind is that midband 5G is largely being deployed in areas where the LTE cell density is already quite tight due to capacity needs, hence midband 5G works well with a one-one [cell site] overlay," Thelander told Light Reading. "I imagine if I ventured deep into some buildings I'd lose both midband 5G networks, but from an outdoor/drive test perspective both frequencies were more than adequate."

Thelander also noted that his initial tests appeared to help reinforce some of Verizon's arguments, but that each operator's network performed well.

"In my tests, the [Verizon] Band 77 distance was greater than [T-Mobile] Band 41, but that could have been the luck of the draw," he explained. "Both networks had radios on different water towers so perhaps terrain played a factor. It was much easier to find Band 77 coverage in my neck of the woods than Band 41 coverage so I was a bit limited in where I could test Band 41. Ultimately, both operators will do just fine in most cases with FWA [fixed wireless access] from a coverage perspective. If anything, I'd be more worried about capacity, hence the value of complementing midband 5G with mmWave [millimeter wave] in those areas where it makes sense, like in my backyard."

Related posts:

— Mike Dano, Editorial Director, 5G & Mobile Strategies, Light Reading | @mikeddano

About the Author(s)

You May Also Like