Remember when telco TV was a good business?

There's no sugarcoating it: AT&T had a rough video quarter.

The telco lost 251,000 DirecTV satellite customers and another 134,000 U-verse IPTV subscribers. That's 385,000 traditional TV subs gone and only partially replaced by new DirecTV Now subs.

Ah, but that's the good news right? AT&T Inc. (NYSE: T) added 296,000 customers for its DirecTV Now over-the-top video service.

Unfortunately, the DirecTV Now additions aren't a financial offset. As the analysts at MoffettNathanson LLC have pointed out repeatedly, there's almost no way AT&T is earning a profit from the service given programming costs and heavy price discounts. Instead, as the analyst firm states in its latest report, DirecTV Now customers "are almost certainly coming in at a negative margin, making their gains worthless at best and deeply dilutive at worst."

The negative financial impact of DirecTV Now shows up in AT&T's EBITDA (earnings before interest, tax, depreciation and amortization) numbers. Across the entire entertainment segment -- which includes video, voice and data services -- EBITDA dropped to roughly $2.70 billion from $2.99 billion a year ago.

AT&T isn't doing nothing while it bleeds video subscribers. CEO Randall Stephenson has talked publically about the fact that the company is developing yet another OTT video service designed specifically for the home. According to Stephenson, that service will include thin-client hardware and will be available for bundling with any broadband connection -- either from AT&T or from a competitor. (See AT&T Wants to Ditch the Dish.)

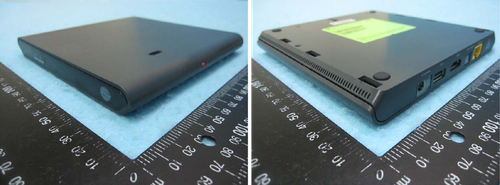

Figure 1:  Source: FCC

Source: FCC

Variety's Janko Roettgers found further evidence of these OTT plans this week with the discovery of an FCC filing highlighting a new AT&T box based on the Android TV platform. The wireless set-top supports 4K Ultra HD content and comes with a voice-controlled TV remote.

The company is also still working to close its deal to acquire Time Warner Inc. (NYSE: TWX), which in theory should boost AT&T's video business through new advertising opportunities. There is still much uncertainty, however, over how well the telco will be able to execute on its long-term video strategy. And in the meantime, the traditional TV business appears to be in freefall.

— Mari Silbey, Senior Editor, Cable/Video, Light Reading

About the Author(s)

You May Also Like