Light Reading presents its annual list of the top movers and shakers in telecom

July 19, 2010

It's time to shake things up.

And here to do just that is our latest list, Light Reading's Top 10 Movers & Shakers. This list presents our factually sound, subjectively written look at the individuals who, at this very moment, appear to be the biggest influencers in the global telecom next-generation communications space.

What's the point of this list? This is our attempt to shed light on the personalities in this industry, rating the top influencers as we see them by their perceived power, not necessarily their popularity. Also, while we do look at titles, we don't get hung up on them. We get that a Mover & Shaker doesn't necessarily have to be a CEO. Indeed, this list has a couple of technologists and business development specialists to go along with the C-level decision makers.

Now, let's get to the list, which is presented in no particular order: All the folk listed here are movers and shakers, but we're not saying that any one of them is a bigger mover and shaker than the others.

Once you've read it and want to set us straight, we welcome your fits and missives. Send a note to [email protected] or reply on the message board below. If you think your boss is all that, you can also nominate them for an even greater honor -- Light Reading's Hall of Fame -- by visiting this page right here.

Our list begins on the very next page. Here's a link to the report's contents:

Page 3: Bill Morrow, CEO, Clearwire

Page 4: Tony Werner, EVP & CTO, Comcast

Page 10: Paul Maritz, CEO, VMware

— The Staff, Light Reading

Next Page: Charlie Vogt, President & CEO, Genband

Genband Inc. CEO Charlie Vogt has built a one-product company into an IP transformation empire.

It's not a sexy empire, mind you. You won't see any mobile handsets, social-networking sites, or app stores. What you will find are the remnants of at least six acquisitions since 2006, the latest being that of Nortel's Carrier VoIP and Application Solutions Business (CVAS) business, which vaulted Genband into another league. (See Genband CEO Sees Opportunity in a Complex Deal and The New Genband: Day One.) Indeed, the real power of the new Genband is in its reach. By its acquisitions, the company has gained access to the switching heart of many of the world's largest networks. Most of those networks are moving to IP services, and Genband is in a prime position to help with that transition, be it directly or through partners.

Indeed, the real power of the new Genband is in its reach. By its acquisitions, the company has gained access to the switching heart of many of the world's largest networks. Most of those networks are moving to IP services, and Genband is in a prime position to help with that transition, be it directly or through partners.

Why is Vogt so interesting? We like his focus and single-mindedness. It's been said he's tough to work for. Well, in baseball parlance, he may not be a "clubhouse guy," but he gets big hits when Genband needs them and winners get along with everyone. With so many moving parts in Genband -- and a growing army of competitors, including Acme Packet Inc. (Nasdaq: APKT), Metaswitch Networks , and BroadSoft Inc. , to name a few -- Vogt's drive and leadership skills are finally being put to the test.

Next Page: Bill Morrow, CEO, Clearwire

Bill Morrow has staked out a wide open broadband future for Clearwire LLC (Nasdaq: CLWR): one that allows the company to switch from its WiMax niche to the industry standard Long Term Evolution (LTE) technology. This gives Clearwire both a first-mover advantage in proto-4G networks and the staying power to compete when all the other carriers catch up. What's more, Morrow has positioned Clearwire as a wholesale "network of networks" for its various partners. Morrow has been at Clearwire less than 18 months, but during that time he has been in control of the most important greenfield network deployment in the US.

What's more, Morrow has positioned Clearwire as a wholesale "network of networks" for its various partners. Morrow has been at Clearwire less than 18 months, but during that time he has been in control of the most important greenfield network deployment in the US. Clearwire now covers more than 40 million people in the US, and will reach up to 120 million people by the end of 2010, with new launches due in New York City, Los Angeles, and the San Francisco Bay Area. The company still has a tough battle ahead with Verizon Wireless 's planned launch of its LTE network this year. The Craig McCaw-backed venture, however, looks to be in safe hands with Vodafone Group plc (NYSE: VOD) veteran Morrow.

Clearwire now covers more than 40 million people in the US, and will reach up to 120 million people by the end of 2010, with new launches due in New York City, Los Angeles, and the San Francisco Bay Area. The company still has a tough battle ahead with Verizon Wireless 's planned launch of its LTE network this year. The Craig McCaw-backed venture, however, looks to be in safe hands with Vodafone Group plc (NYSE: VOD) veteran Morrow. Next Page: Tony Werner, EVP & CTO, Comcast

Next Page: Tony Werner, EVP & CTO, Comcast

Tony Werner helped turn Docsis 3.0 (D3) and its promise of up to 100-Mbit/s broadband connections into cable's global answer to growing fiber-to-the-home (FTTH) competition from the telcos.

In 2006, while still at Liberty Global, Werner was chairman of the Docsis Business Team at CableLabs, where the D3 spec was born and bred. But we're giving Werner long overdue credit for sticking with it, and his work at Comcast has added to D3's momentum as a worldwide standard for cable operators hoping to upgrade their networks for the broadband video age.

While major MSOs such as Time Warner Cable Inc. (NYSE: TWC) stayed on the sidelines early on, Werner and Comcast jumped in, first launching D3 services in April 2008. (See Comcast Enters the Wideband Era .)  Comcast has since completed D3 network upgrades on more than 83 percent of its plant, and expects to complete the job later this year. That work has quickly brought Docsis 3.0 to scale, setting the table for less costly network equipment, modems, voice modems, and, later this year, brainy residential gateways. (See Cable Winks, Giggles at TR-069 .)

Comcast has since completed D3 network upgrades on more than 83 percent of its plant, and expects to complete the job later this year. That work has quickly brought Docsis 3.0 to scale, setting the table for less costly network equipment, modems, voice modems, and, later this year, brainy residential gateways. (See Cable Winks, Giggles at TR-069 .)  Now Werner and his team are developing product specs for a new super-dense access device that's akin to a souped-up cable modem termination system (CMTS) and edge QAM combo. The resulting network elements will be more energy efficient and may give Comcast and others a pathway to a much more flexible, all-IP service infrastructure.

Now Werner and his team are developing product specs for a new super-dense access device that's akin to a souped-up cable modem termination system (CMTS) and edge QAM combo. The resulting network elements will be more energy efficient and may give Comcast and others a pathway to a much more flexible, all-IP service infrastructure.

Next Page: César Alierta, Executive Chairman, Telefónica

After leading a decade-long international expansion strategy, César Alierta, executive chairman of Telefónica SA (NYSE: TEF), is in our list because he's stirring up an industry debate that could radically change the rules of the game for content delivery business models. Earlier this year, Alierta said he wanted to start charging Internet search engines for using his network, a move that's referred to as the so-called "Google-tax."

Earlier this year, Alierta said he wanted to start charging Internet search engines for using his network, a move that's referred to as the so-called "Google-tax."

Other operators have backed Alierta's idea, and have called for the European Commission to help broker such deals between network operators and content owners.

Heavy Reading senior analyst Gabriel Brown says Alierta's idea might not be the best one, but "he's someone that people listen to. He [can] move the debate along." On the expansion front, Alierta is now fighting to boost Telefónica's position in Brazil. The operator has offered €7.15 billion ($9.5 billion) to buy partner Portugal Telecom SGPS SA (NYSE: PT) out of their Brazilian joint venture, Brasilcel, which would give Telefónica control of Brazilian mobile giant Vivo Participacoes SA . Alierta is likely to land his prey, despite the barriers put in his way. (See Is Vivo Deal Back On?, Telefónica Ups Its Vivo Offer, and Telefónica €5.7B Bid for Vivo Rejected.)

On the expansion front, Alierta is now fighting to boost Telefónica's position in Brazil. The operator has offered €7.15 billion ($9.5 billion) to buy partner Portugal Telecom SGPS SA (NYSE: PT) out of their Brazilian joint venture, Brasilcel, which would give Telefónica control of Brazilian mobile giant Vivo Participacoes SA . Alierta is likely to land his prey, despite the barriers put in his way. (See Is Vivo Deal Back On?, Telefónica Ups Its Vivo Offer, and Telefónica €5.7B Bid for Vivo Rejected.) Latin America isn't Alierta's only overseas playground, though. The operator also has a significant footprint across Europe, following the 2005 acquisition of mobile operator O2, which covers the United Kingdom, Ireland, Germany, the Czech Republic, and Slovakia. Alierta also leads a consortium that holds a controlling stake in Telecom Italia, while much farther east Telefónica holds a stake in China Unicom. (See Is Italian on Telefónica's Menu? , China Unicom, Telefónica Strengthen Ties, and Telefónica Takes Stake in Telecom Italia.)

Latin America isn't Alierta's only overseas playground, though. The operator also has a significant footprint across Europe, following the 2005 acquisition of mobile operator O2, which covers the United Kingdom, Ireland, Germany, the Czech Republic, and Slovakia. Alierta also leads a consortium that holds a controlling stake in Telecom Italia, while much farther east Telefónica holds a stake in China Unicom. (See Is Italian on Telefónica's Menu? , China Unicom, Telefónica Strengthen Ties, and Telefónica Takes Stake in Telecom Italia.)

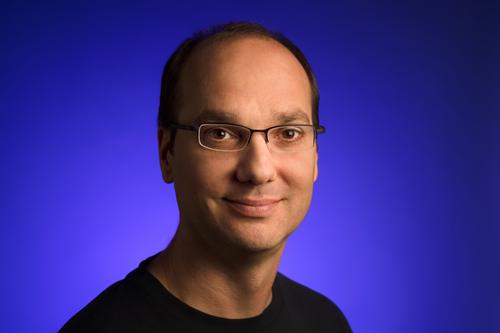

Next Page: Andy Rubin, VP of Engineering, Google

Google (Nasdaq: GOOG)'s VP of Engineering Andy Rubin has taken what he learned developing the Sidekick device as CEO of Danger Inc. and transferred it into the search giant's most successful mobile venture yet, the open-source smartphone operating system called Android. Since the first phone using the OS -– the T-Mobile US Inc. G1 -- was launched in the fall of 2008, Android has grown to challenge Apple Inc. (Nasdaq: AAPL) and BlackBerry for the smartphone crown in the US and beyond.

Since the first phone using the OS -– the T-Mobile US Inc. G1 -- was launched in the fall of 2008, Android has grown to challenge Apple Inc. (Nasdaq: AAPL) and BlackBerry for the smartphone crown in the US and beyond.

Most of the globe's major operators and all of the world's top-tier phone vendors, except Nokia Corp. (NYSE: NOK), now have Android on their rosters. Indeed, Motorola Inc. (NYSE: MOT) and High Tech Computer Corp. (HTC) (Taiwan: 2498) are presently engaged in pumping out a snazzy new Android smartphone every few months. Despite the relative failure of Google's own-brand Nexus One phone, Rubin is firmly planted at the head of a mobile revolution for Google that will affect the company for years to come and is already reshaping the future of mobile computing.

Despite the relative failure of Google's own-brand Nexus One phone, Rubin is firmly planted at the head of a mobile revolution for Google that will affect the company for years to come and is already reshaping the future of mobile computing.

Next Page: Ashish Chowdhary, Head of Global Services, Nokia Siemens Networks

Nokia Networks isn't the biggest fish in the managed services game, but it's the one to watch, as we're picking the group's boss to be the catalyst for growth in the coming months.

Indeed, Ashish Chowdhary is on a very interesting perch. He is, effectively, presiding over the delivery of telecom services to more than 300 million subscribers, though most of them will never know. While NSN is still chasing Ericsson for the telecom managed services lead, Chowdhary's group has six publicly announced managed services customers in India, where subscriber growth for all kinds of telecom services continues. According to Pyramid Research, Bharti's contracts with NSN and Ericsson alone are valued in excess of $4 billion.

While NSN is still chasing Ericsson for the telecom managed services lead, Chowdhary's group has six publicly announced managed services customers in India, where subscriber growth for all kinds of telecom services continues. According to Pyramid Research, Bharti's contracts with NSN and Ericsson alone are valued in excess of $4 billion. Why do we like Chowdhary? Two reasons. He's hungry: At some point he'll tire of playing second-fiddle to Ericsson. He's influential: The man previously holding his current title is now CEO, and global services is the biggest source of NSN's growth.

Why do we like Chowdhary? Two reasons. He's hungry: At some point he'll tire of playing second-fiddle to Ericsson. He's influential: The man previously holding his current title is now CEO, and global services is the biggest source of NSN's growth.

Next Page: Håkan Eriksson, SVP & CTO, Ericsson

If the North American market is going to be a center of growth for Ericsson AB (Nasdaq: ERIC), the man to credit, blame, watch, and wonder about is its CTO, 23-year vet Håkan Eriksson, who is now in charge of Ericsson's Silicon Valley research offices. As LTE deployments begin in the US, data traffic will grow exponentially, base stations will shrink (and multiply), and the whole mess will be more difficult to manage. We're watching with interest the CTO's push behind advanced adaptive beamforming -- a technology that could bring dedicated capacity to multiple subscribers.

As LTE deployments begin in the US, data traffic will grow exponentially, base stations will shrink (and multiply), and the whole mess will be more difficult to manage. We're watching with interest the CTO's push behind advanced adaptive beamforming -- a technology that could bring dedicated capacity to multiple subscribers. Indeed, Eriksson's background in research is intriguing. And we know he's already helped transform Ericsson's IP business in Europe, so we're comfortable predicting he can make a dent with a new emphasis on North America, even as competition from the likes of Alcatel-Lucent (NYSE: ALU) and Nokia Networks intensifies.

Indeed, Eriksson's background in research is intriguing. And we know he's already helped transform Ericsson's IP business in Europe, so we're comfortable predicting he can make a dent with a new emphasis on North America, even as competition from the likes of Alcatel-Lucent (NYSE: ALU) and Nokia Networks intensifies.

Next Page: Manoj Kohli, CEO & Joint Managing Director, Bharti Airtel

Manoj Kohli is the man of the moment, having recently closed the much publicized Zain acquisition deal. (See Bharti Secures $10.7B African Acquisition.)

Probably the most soft-spoken person in the Indian telecom industry, Kohli is delivering the vision of Sunil Bharti Mittal, founder of Bharti Airtel.

Before the Zain deal, Kohli was responsible for Bharti's operations in the Indian subcontinent. He is credited with ensuring Bharti Airtel's supremacy in the Indian market, where the carrier beat state-owned Bharat Sanchar Nigam Ltd (BSNL) in terms of revenue as well as subscribers. He is also credited with crafting a business model that allowed the carrier to outsource major parts of its IT operations, network, and call centers so it could offer the cheapest tariffs possible to the Indian consumer without giving up profits. This model was copied by operators across the globe.

He is also credited with crafting a business model that allowed the carrier to outsource major parts of its IT operations, network, and call centers so it could offer the cheapest tariffs possible to the Indian consumer without giving up profits. This model was copied by operators across the globe. Indeed, Bharti has lofty ambitions as it aims to replicate its Indian success in Africa as well. It won't be easy and the challenges are already piling up. But given his record, we aren't about to bet against Manoj Kohli now. (See Bharti Shows Off New Physique.) Next Page: Paul Maritz, CEO, VMware

Indeed, Bharti has lofty ambitions as it aims to replicate its Indian success in Africa as well. It won't be easy and the challenges are already piling up. But given his record, we aren't about to bet against Manoj Kohli now. (See Bharti Shows Off New Physique.) Next Page: Paul Maritz, CEO, VMware

When executives from long-standing telecom software companies agree with the suggestion that "everyone wants to be VMware," you know something's up.

The main reason for that well-meaning envy is that, more than any other Service Provider Information Technology (SPIT) specialist, VMware Inc. (NYSE: VMW) is riding the telco cloud wave better than anyone, and currently there's no sign that the company is going to end up on the rocks with a mouthful of sand and seaweed wrapped around its neck.

That puts CEO Paul Maritz in a unique position.  Because while there are plenty of companies knocking at the doors of the telecom service providers, offering them ways to get in on the cloud services action and compete with the likes of Google (Nasdaq: GOOG), Amazon.com Inc. (Nasdaq: AMZN), and Microsoft Corp. (Nasdaq: MSFT) in offering cloud-based services to enterprise users, VMware is already doing it, and has some rather influential friends helping to take it places -– Cisco Systems Inc. (Nasdaq: CSCO) and EMC Corp. (NYSE: EMC) (which owns about 80 percent of VMware's stock). (See Cisco, EMC, VMware Team Up.)

Because while there are plenty of companies knocking at the doors of the telecom service providers, offering them ways to get in on the cloud services action and compete with the likes of Google (Nasdaq: GOOG), Amazon.com Inc. (Nasdaq: AMZN), and Microsoft Corp. (Nasdaq: MSFT) in offering cloud-based services to enterprise users, VMware is already doing it, and has some rather influential friends helping to take it places -– Cisco Systems Inc. (Nasdaq: CSCO) and EMC Corp. (NYSE: EMC) (which owns about 80 percent of VMware's stock). (See Cisco, EMC, VMware Team Up.)

We don't think Maritz is just lucky. Check any serious telco cloud offering around right now, and you'll almost certainly find VMware's virtualization software as part of the mix. (See Colt Reaches for Clouds , Orange Business Joins VMware Group, Bharti Joins the Cloud Crowd, Eircom Offers IaaS, Saudi Telecom Offers Data Center Services, and AT&T Joins Cloud Computing Set, for example.)

Someone's been behind the scenes, spotting the trends, and executing a targeted strategy.

That means, though, that if VMware coughs, the global cloud services market might catch a cold. And Maritz, an IT stalwart with history at EMC and Microsoft, will become an increasingly important individual in the telco cloud community.

Let's hope he stocks up on Vitamin C.

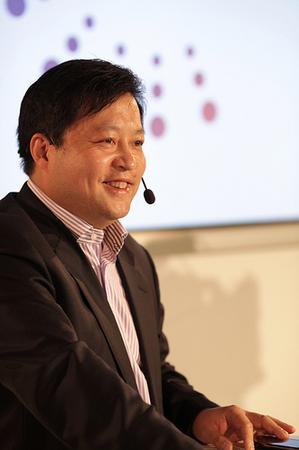

Next Page: Bill Huang, General Manager, China Mobile's Research Institute

If ever a man was on a mission, it's Bill Huang, general manager at China Mobile Ltd. (NYSE: CHL)'s Research Institute (Also known as China Mobile Labs).

His task is tough. He's aiming to get the global service provider community to embrace the time division flavor of Long Term Evolution (LTE), also known as TD-LTE. Many of the world's main mobile operators have already committed to LTE, but mainly for the frequency division duplex flavor (FDD-LTE), which will suit the spectrum they have (or will be awarded) as they migrate from 3G/HSPA to LTE.

Many of the world's main mobile operators have already committed to LTE, but mainly for the frequency division duplex flavor (FDD-LTE), which will suit the spectrum they have (or will be awarded) as they migrate from 3G/HSPA to LTE.

But China Mobile is building out a 3G network based on China's home-grown TD-SCDMA technology, which steers its next-generation roadmap toward TD-LTE rather than FDD-LTE. As a result, China Mobile has been working hard with the vendor community on the development of TD-LTE products, and showcasing them at every possible opportunity. (See China Mobile Selects Sequans for LTE Chips, AlcaLu Joins China Mobile LTE Trial, and China Mobile Fast-Tracks TD-LTE .)

Not only that, China Mobile wants to ensure that it's not the only carrier rolling out TD-LTE networks and services, because it needs to source its technology and applications from a broad base of competitive suppliers that are supporting a global market to get the economies of scale and purchase prices it needs to support its business plan. It already knows what it's like to be the odd one out in the 3G world, and it doesn't like it.

Huang, then, has been doing all he can to spread the word about the benefits and possibilities of TD-LTE, and to get the vendor community to support the development of dual-technology chips that can support both flavors of LTE. And there are definite signs that China Mobile will be far from alone in the TD-LTE world, with the Indian market in particular spreading some TD-LTE love, while other major markets such as Japan and the US are also checking it out. (See India's Billion-Dollar LTE Question, India's BWA Auction Ends in $8.2B Drama, TD-LTE in Japan?, Clearwire Paves Way for LTE in US, and Qualcomm Unveils LTE Plans for India.)

Huang's work is far from done, but the emergence of TD-LTE as a next-generation mobile technology that has support from the carrier and vendor communities is testimony (in part, at least) to his hard work and tremendous influence in the wireless world.

Page 12: Almost Famous: Why These Execs Just Missed the Big List

The problem with these lists is that there's always a plethora of talented folks we'd like to include, but simply can't, otherwise the list becomes somewhat meaningless. (And in a Top 10, the space is limited.)

So on this page, we thought it'd be nice to name-check the folks we regarded highly, but ultimately left out for one reason or another. Oh, and to add a bit of fun (and for the sake of brevity), we listed our reason for leaving out each exec using the Twitter standard of about 140 characters.

In no particular order, a hearty pat on the back to the "nearly, but not quite" folks:

Cablevision's Tom Rutledge: He took the programmers to the mat (and won) over an ambitious RS-DVR project. Now where's the big launch?

Time Warner Cable's Peter Stern: Stern's beating the 'TV Everywhere' drum, but it's not really everywhere, is it?

Comcast's Amy Banse: Banse has helped get Comcast's TV Everywhere service going. But outside of that pond, we found some much bigger fish.

Comcast's Cathy Avgiris: Avgiris will one day mesh the MSO's wired and wireless plays. That day hasn't come yet, to say the least.

Verizon's Anthony Lewis: The open mobile push isn't a worldwide winner yet. We bet it'll take off in an LTE world.

Motorola's Sanjay Jha: The Droid army shook Moto out of a RAZR hangover. But more is needed to revive the Moto Mobility culture.

CenturyLink's Glen Post: Glen Post could be creating a major new US telecom player, but he seems determined to do it quietly, so mum's the word.

Huawei's Matt Bross: As Huawei CTO, Bross had to be considered. But he's gone into hibernation. So while he might be shaking, he's not moving too much.

Metaswitch's Kevin DeNuccio: DeNuccio has grand plans to make Metaswitch a major player. We've seen some progress so far, but it's debatable if we'll see any seismic shifts.

Alcatel-Lucent's Basil Alwan: Basil still gets top marks, but we've given him his due. We'll be likely to say some more when we've seen something new.

Brevity is brutal, ain't it? Give us your assessment of our list, our misses, and our Twittery-honorable mentioned page in the message boards below or by sending a note to us on Twitter: @Light_Reading.

Back to Introduction

You May Also Like

.jpeg?width=300&auto=webp&quality=80&disable=upscale)