The outgoing CEO sees consolidation potential in Spain, and highlights the failed Bouygues Telecom merger as one of his biggest regrets.

Stéphane Richard only has a couple of months left at Orange, but the outgoing CEO and chairman made use of his final results presentation to set out his hopes and expectations for the group in the coming years, while taking the opportunity to express some of his biggest regrets from his time with the French group.

He wanted to make one thing absolutely clear: he thinks that Christel Heydemann, who is taking over the helm from April 4, will make a great CEO.

"I am sincerely happy to have Christel on board," Richard said during today's earnings call, noting that he and his team are preparing her so that she is able to hit the ground running in April.

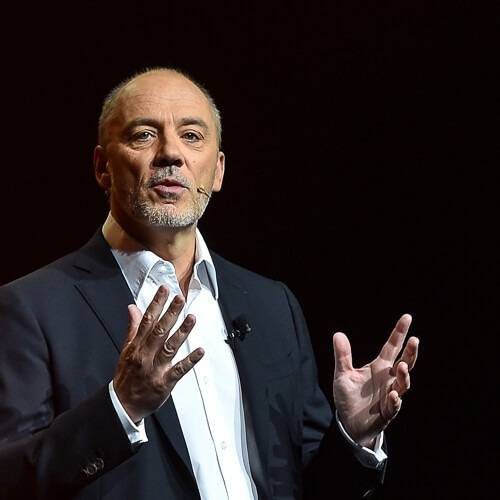

Figure 1:  So long, farewell: Outgoing CEO Stéphane Richard sees consolidation potential in Spain, and highlights the failed Bouygues Telecom merger as one of his biggest regrets.

So long, farewell: Outgoing CEO Stéphane Richard sees consolidation potential in Spain, and highlights the failed Bouygues Telecom merger as one of his biggest regrets.

(Source: Orange)

"I do think that she's very lucky," he added. "She's very lucky because she's going to be the CEO of the best European telco today."

Richard cited a number of reasons why he thinks Orange has such a good position in Europe, including its early move to fiber networks, the disciplined management of its balance sheet over the years, its strong position in the Middle East and Africa, and the opportunities that lie ahead with new services such as mobile banking and cybersecurity.

He also sees Orange's new towers venture, Totem, playing a significant role in any towers combination in Europe. What's more, he believes Orange will be a critical player in a "new cycle" of market consolidation in Europe.

Here, Spain remains an obvious contender for in-market consolidation. The highly competitive market has been a drain on Orange's finances for some time, dragging down revenue and profit figures in its European business. In 2021, Orange was also forced to make a €3.7 billion (US$4.2 billion) impairment charge on its Spanish business.

"We are actively working on being involved in the possible in-market consolidation in Spain. We are not passive, we are not waiting for things to happen, we are actively involved," Richard said.

Although he did not comment on recent speculation that Orange is plotting a merger with Másmovíl, Spain's fourth-largest operator, he noted that virtually any combination would be possible from a European antitrust perspective - except one that involves Telefonica.

On the subject of mergers, Richard clearly rues the fact that he was unable to achieve a market consolidation in France, Orange's biggest market. In 2016, Orange attempted to merge with Bouygues Telecom, but ultimately failed to reach an agreement.

"If I have maybe a major regret in the past 10 years, it's undoubtedly the French in-market consolidation that we missed. To be honest, I don't think that I am the main person responsible for this failure," he said.

Richard hopes that Orange will be able to benefit from some form of in-market consolidation in France in the coming years, although he stressed that the group would also thrive as a standalone entity.

In terms of other major changes, Richard clearly believes that the French state is unlikely to remain an Orange shareholder in perpetuity.

Whether or not the state would sell all or part of its current 23% shareholding remains to be seen, he added. He conceded that such a move would also present a huge challenge for the future CEO, while also opening up new opportunities.

The good, and the bad

Richard is certainly handing over an Orange that is very different to the one he took over in 2011. For one thing, the group was still called France Telecom, finally adopting the Orange brand in 2013. He also had to deal with the fallout of a restructuring policy linked to suicides among employees in the 2000s.

"The situation of this company when I joined 12 years ago was very difficult, very challenging," Richard said, in what some might see as an understatement.

He indicated that management was forced to take a step back from transforming the company and instead "restore a collective mindset, that collective capacity of coping with the challenges of the future in this company. It took time. I think that now, from a social and cultural point of view, we're in a situation where this transformation is now ready to be accelerated."

Richard's assessment of 2021, meanwhile, was that Orange has performed well in a difficult market environment. In prepared remarks, he said Orange had "delivered on its commitments and is confirming all its objectives for 2023, including organic cashflow of between €3.5 billion and €4 billion."

Orange is forecasting a return to core operating growth in 2022 after reporting a decline in 2021.

Want to know more? Sign up to get our dedicated newsletters direct to

your inbox

It expects earnings before interest, tax, depreciation and amortization after leases (EBITDAaL) to increase by 2.5% to 3% in 2022, compared with a drop of 0.5% to €12.6 billion ($14.3 billion) in 2021.

It is also forecasting organic cash flow from telecoms activities of at least €2.9 billion ($3.3 billion) this year, and anticipates that capex will be no higher than €7.4 billion ($8.4 billion).

In 2021, group revenue increased 0.8% to €42.5 billion ($48.3 billion). Operating income was down 54.5% at €2.5 billion ($2.8 billion), primarily owing to the Spanish impairment charge.

Total net income fell to €778 million ($885 million) from €5.1 billion in 2020, which Orange blamed on the lower operating income as well as €2.2 billion in tax income recognised at the end of 2020.

"It's time to say goodbye," Richard said, in his concluding remarks.

"I want to end by saying again how confident I am in Orange. I do believe that today the Orange stock is the best available stock in Europe. I wish Orange the best for the future."

Related posts:

— Anne Morris, contributing editor, special to Light Reading

Read more about:

EuropeAbout the Author(s)

You May Also Like