System vendors are weighing up their ROADM plans as they work with operators to boost network flexibility

November 11, 2010

Operators need more efficient networks as they grapple with the cost of transporting ever-growing volumes of traffic, and are exploring all the different ways they can move traffic around their networks without breaking their capital and operating expenditure budgets.

The photonic layer is of particular interest to network planners. By using more advanced DWDM and Reconfigurable Optical Add/Drop Multiplexer (ROADM) technologies, operators expect the optical layer to make the greatest contribution toward the reduction of transport costs.

"ROADMs are widely deployed in metro and long-haul networks globally," says Sterling Perrin, senior analyst at Heavy Reading. "But what's been deployed so far has limited flexibility."

Add operational overload to limited flexibility. Since they only take fixed wavelengths, traditional ROADMs cannot exploit tunable transponders. If a transponder needs to be re-tuned, a service engineer must first unplug it and insert it into a new ROADM port. None of this helps carriers achieve their operational efficiency goals.

ROADMs are also limited in the number of "directions" to which an added wavelength can be routed -- that is, the number of connected nodes to which that added wavelength can be sent.

"Operators want ROADMs to do more of what they're good at," says Perrin. "They'd like an optical network that is fully flexible, with add/drop nodes operated in an automated fashion."

And it seems that demand for flexible ROADMs might be about to ramp: During the past decade, operators have focused on networking flexibility at the electrical layers, but these are now burdened. "It starts at the IP routers at Layer 3. Operators are now looking at how they can push traffic down the OSI stack to transport bits less expensively," says the Heavy Reading man.

There are several ways this can be done: Traffic can be moved to layer two, utilizing Sonet/SDH and Ethernet; to layer one, where Optical Transport Network (OTN) technology can be deployed; or to layer zero, the optical layer.

The problem with the optical layer is that it's the least flexible in terms of switching traffic rapidly, says the Heavy Reading man. "Innovation is needed to make the optical layer more useful in taking on some of these previous electrical layer functions -– that's all in flux right now."

New capabilities

So operators are looking to the system vendors -- and the component companies that make the Wavelength Selective Switch (WSS) modules at the heart of ROADMs -- to deliver new capabilities. The operators want Colorless and Directionless ROADMs -- designs that are fully automated in wavelength and direction -- as well as WSSs with higher port counts (or degrees).

They also want non-blocking Contentionless ROADMs that allow similar-wavelength lightpaths from different nodes to be dropped without wavelength contention. (See Verizon: Give Us More Flexible ROADMs for 100G.)

Another attribute on the carrier wish list is Gridless to accommodate future lightpaths above 100 Gbit/s. Operators want to ensure that the ROADMs they deploy will be more flexible in terms of bandwidth, allowing them to accommodate 400Gbit/s or 1 Tbit/s transmissions that are too "wide" to fit within today's 50 GHz channels.

"The hold-up has been the technology [progressing] to a point needed to create architectures that are colorless, directionless, contentionless, and gridless," says Perrin. And the delay isn't limited to the WSS elements, but also to Control Plane software and alternative technologies, such as 3D MEMS (microelectromechanical systems). "It even includes coherent technology, which is another way of making the optical layer more flexible," adds Perrin. (See Operators Hang Big Hopes on ROADMs.)

"3D MEMS is a new trend," says the analyst. A decade ago vendors were looking at the technology to create optical cross-connects. Now, lower port-count versions are appearing that could be used at the add/drop while working with WSSs.

"The advantage of 3D MEMs is that it reduces the number of WSSs needed," says Perrin, who cites 3D MEMS firms such as Calient Technologies Inc. and CrossFiber Inc. . (See Calient Gets Ambitious With Optical Switching.)

What's really needed? Cost reduction

The half-dozen leading ROADM vendors interviewed by Light Reading all acknowledged the need for colorless and directionless features. They are less clear about a timescale for contentionless ROADMs as they're unsure about carrier demand, and some question whether gridless ROADMs will ever be deployed.

For all involved -– the operators and the vendors -– cost is the biggest hurdle. Market demand is largely met by existing, lower-degree, modest ROADMs, and while operators generally want greater functionality, high initial costs mean advanced ROADM shipment volumes during the next five years will be limited. That, in turn, makes cost reduction from the supply side a significant challenge.

"I've talked to several operators, and they are gung-ho on making the optical layer more flexible," says Perrin, who reiterates that the carriers want a meshed switching layer that takes on more of the electrical layer's burden. "It will never do all the electrical layer's functions, but the more [bits it can transport] the less expensive it is to transport those bits," he notes. "That’s the fundamental driver."

The current technology hold-ups, and the operator/supplier discussions, mean it will be about two years before next-generation ROADMs are deployed, predicts Perrin.

So what are the vendors doing to meet the major operators' needs and shorten that time to market? Light Reading spoke with the following companies about their ROADM platform offerings and strategies:

Alcatel-Lucent (NYSE: ALU)

Ciena Corp. (NYSE: CIEN)

Cisco Systems Inc. (Nasdaq: CSCO)

Fujitsu Network Communications Inc.

Huawei Technologies Co. Ltd.

Tellabs Inc. (Nasdaq: TLAB; Frankfurt: BTLA)

On the following pages, each of these companies outlines its ROADM portfolio and provides feedback on market demand and the need for new capabilities.

Here’s a hyperlinked contents list:

Page 2: Alcatel-Lucent

Page 3: Ciena

Page 4: Cisco Systems

Page 5: Fujitsu Network Communications

Page 6: Huawei Technologies

Page 7: Tellabs

— Roy Rubenstein, editor of Gazettabyte, special to Light Reading

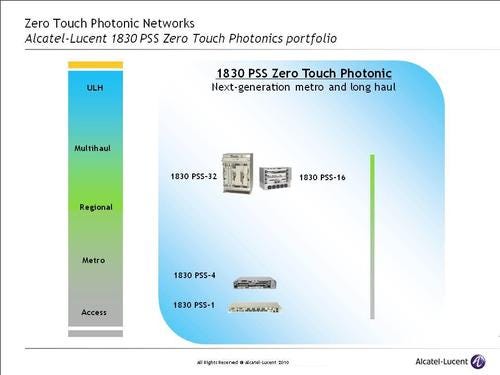

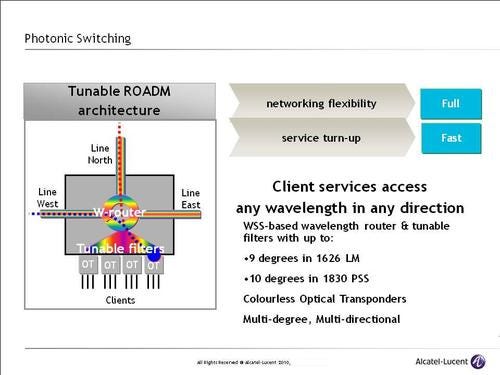

Alcatel-Lucent has three ROADM platforms: its flagship 1830 Photonic Service Switch (PSS); the 1626 Light Manager; and the 1625 LambdaXtreme. The 1830 and the 1626 are colorless, directionless, and contentionless.

Table 1: Alcatel-Lucent ROADM Portfolio

Platform | Band | Degree | Channels | Comment |

1830 Photonic Service Switch (PSS) family | C | Up to 1x10 | 88 | Metro, regional and long-haul. The platform is being extended to ultra long-haul. The ROADM is WSS-based. There are three 1830 platforms sizes, with the smaller versions designed for the metro edge (see diagram below). |

1626 Light Manager | C | Up to 1x9 | 96 | Core network: long-haul, ultra-long haul. WSS-based. |

1625 LambdaXtreme | C and L | 1x4 | 128 | Core network: long-haul, ultra-long haul. Blocker-based ROADM |

Alcatel-Lucent uses multiple WSSs to implement colorless multiplexing (see definitions box) and says it's working on using coherent detection for the demultiplexing. "Coherent technology is powerful but it isn't as simple as it sounds, just plopping a wavelength out at the receiver," says Sam Bucci, the vendor's vice president, terrestrial portfolio management.

Despite already having colorless, directionless, and contentionless ROADMs, Alcatel-Lucent stresses that such ROADMs are not widely deployed, and that most ROADMs use four degrees or less. The decision to support the advanced attributes, taken as long ago as 2006, was due to specific operator requests, says Bucci.

Currently, gridless ROADMs are the hot topic amongst Alcatel-Lucent's customers. Bucci says carriers are more interested in gridless than they are in contentionless ROADMs.

Alcatel-Lucent is a fan of liquid crystal on silicon (LCOS)-based WSS technology, which, it argues, offers good switching times. Bucci says his company is monitoring 1x23 WSSs, and that while such devices promise more compact designs, issues remain with reach and reliability.

But the company isn't hooked into a single track of development. It is also exploring the potential of 3D MEMS, as ROADM designs with the full complement of next-generation attributes require such a high WSS count that 3D MEMS become an elegant alternative. "I won't comment on timing, but we are pushing to see the 3D MEMS' performance, and how they are implemented," says Bucci.

He stresses, though, that the technology faces competition from LCOS-based WSSs in terms of space, power and efficiency.

Meanwhile, operators continue to ask for more compact, power-efficient ROADM designs. "A bi-directional, 4-degree ROADM in a shelf, one third of a bay, is perhaps even of greater importance than colorless, directionless, contentionless, and gridless," says Bucci. Operators also want modular designs to address specific requirements -- for example, having a partial colorless design and deploying smaller, 1x2-degree ROADMs.

Alcatel-Lucent plans to further develop the 1830 PSS, and offers the option of interconnecting the platform with existing 1625 and 1626 lines. "We don't see any other platform we would develop, or have plans to add a ROADM to, within our optical portfolio," he says.

For overall networking efficiency, Alcatel-Lucent’s goal is to combine the improved optical layer with the electrical and IP layers. "What we're doing is stitching together the abilities of the photonic layer, for restoration and for handling high capacity transitory traffic at 10, 40, and 100 Gbit/s, with OTN." (OTN provides 1Gbit/s increments of switching, allowing efficient packing of the wavelengths’ capacity.)

Once full-featured ROADMs are deployed, lightpath deployment and operations will be simplified, while the total cost of ownership will be reduced, says Bucci. Furthermore, coherent technology will enable adaptation to channel conditions, while the GMPLS control plane will make best use of the photonic layer.

Alcatel-Lucent doesn't rule out developing a photonic switch, an optical cross-connect last spoken of a decade ago. Such a platform is being considered due to the space and power efficiencies it promises.

Next Page: Ciena

Ciena's two ROADM platforms are its CN 4200 and the OME (Optical Multiservice Edge) 6500, which it inherited as part of the Nortel Metro Ethernet Networks acquisition in March 2010. (See Ciena/Nortel Product Plans Revealed and Ciena Beats NSN to Buy Nortel's MEN.)

Table 2: Ciena's ROADM Platforms

Platform | Band | Degree | Channels | Comment |

CN 4200 | C | 1x9 | 40 | Edge, metro, regional |

Optical Multiservice Edge - OME 6500 | C | 1x2, 1x5, 1x9 | 44, 88 | Metro, regional, long-haul |

Both platforms feature in Ciena's future plans -- the CN 4200 for metro/network edge deployments, and the OME 6500 for metro and long-haul networks.

The network interfaces, or degrees, the ROADMs support are 1x9 for the CN 4200, and 1x2, 1x5, and 1x9 for the OME 6500 family. Yet the vast majority of sites use two-degree ROADMs due to customers’ sensitivity to cost, according to Ciena. "Obviously, when you get closer to a mesh core network, the degree of connectivity [required] is higher, but in the metro you have many 1x2 sites," says Vincent Morin, Ciena's senior director, portfolio management.

Both ROADM platforms use WSSs. WSSs are relatively expensive, says Morin, and when attributes such as higher-degree, colorless, and directionless are added, costs rise rapidly as extra WSSs are used. It's the core network requirements that are driving the need for colorless, directionless, and contentionless ROADMs, states Morin, who estimates that only a quarter of all ROADMs will use such attributes during the next five years.

Ciena argues there will be three ROADM development stages. The first is colorless and directionless, for which there is a requirement now. "We will see first colorless, directionless deployments [in 2011], with contentionless following a year later," says Morin.

The vendor is currently testing its preliminary colorless and directionless designs, but has yet to make a public announcement about these advances. Morin contrasts the hype among system vendors for colorless and directionless ROADMs with the limited service provider deployments of such technology.

Contentionless is the next stage, while gridless is (potentially) the third, although Morin wonders whether gridless will ever be used.

Ciena has no plans to use higher-degree 1x23 WSSs. "Our view is that it is more elegant to solve colorless with coherent detection transceivers, as opposed to putting additional constraints on common equipment," he said.

The company is, however, open to 3D MEMS. Ciena claims it's still not clear if operators want colorless followed by contentionless, or if the two will be needed simultaneously. If the attributes are required in stages, a WSS coupled with coherent detection will be used. If the two are introduced together, 3D MEMS is a possibility.

"It is way too early to compare costs between WSS and 3D MEMs," says Morin. Ciena would need to be convinced about 3D MEMS’s reliability, even though it admits the technology looks promising. "But again, contentionless plus colorless -- just how many nodes are we really talking about in five years?" he asks.

For Ciena, it's vital to have flexible offerings -- simple 1x2 and 1x4 ROADMs that meet the requirements of the bulk of the market -- while for colorless, directionless, and contentionless ROADMs, cost will be key.

Next Page: Cisco Systems

The ONS 15454 multi-service provisioning platform (MSPP) is Cisco's main ROADM. The platform spans the metro edge, metro, and regional networks. More recently, two smaller platform variants have been announced. Cisco claims more than 10,000 of its ROADMs have been deployed.

Table 3: Cisco's ROADM Platforms

Platform | Band | Degree | Channels | Comment |

ONS 15454 multi-service provisioning platform | C | 1x2, 1x8, 1x9 | 80 | Long haul, metro regional, and metro access networks. Cisco claims all three platforms are used in metro access, metro, regional and long-haul networks. |

ONS 15454 M6 multi-service transport platform | C | 1x2, 1x4, 1x9 | 40 | Six-slot platform |

ONS 15454 M2 multi-service transport platform | C | 1x2, 1x4, 1x9 | 40 | Two-slot platform |

The ONS 15454 ROADM uses 2-degree and 8-degree nodes, based on planar lightwave circuit (PLC) and WSSs, respectively. The platform already supports colorless and directionless.

Cisco is more circumspect regarding the remaining ROADM attribute developments. Cisco says several operators are asking about contentionless, so that is being explored by the vendor.

But when might contentionless be needed? "We don’t really know," says Mike Capuano, director, service provider marketing, at Cisco. "There are lots of things we end up talking about with customers -- not all come to fruition."

Cisco is exploring using 1x23 degree WSSs, but it's too early to discuss their use. "It could be needed in the future, but we're focused on what customers need for the next two years," says Capuano. That said, Cisco claims it has been one of the main drivers behind 1x23 WSS developments, due to the device's ability to scale mesh networks to avoid provisioning bottlenecks, and better support directionless and contentionless add/drops.

Demand for 3D MEMS is further out. "I don’t have good visibility into the MEMS -- it's too far ahead for us to talk about," says the Cisco man.

Flexible spectrum filters, or gridless, is another ROADM requirement for which Cisco has no definite timetable, though it does back the concept, and began discussing the concept as long ago as 2007.

Cisco declined to discuss its ROADM platform roadmap, but points out that while its 15454 platform is close to a decade old, it has been significantly overhauled. An example is the platform's ROADM module, which now fits on one line card: Previously, five were needed. This simplifies the cabling, which is now confined to the card, whereas beforehand it required use of the backplane.

"The collapsing of all these functions on one card allows operators to save two thirds of the wiring closet 'mess,'" says Stephen Liu, Cisco's manager in service provider marketing. "It increases density as well as reducing power, and streamlines cabling and operational cost."

As a proponent of IP-over-DWDM, Cisco has a different view of electrical-layer needs compared with other vendors.

"If you look at traffic patterns with IP, it's getting more complex," says Capuano. "Our contention is that the number of layers between IP and optical should be minimized." Cisco argues for an architecture where the IP router feeds a colored wavelength into a DWDM system, and that if the router is to be bypassed, this is done at the optical layer. Cisco believes OTN switching also has a role, primarily for private line services.

Next Page: Fujitsu Network Communications

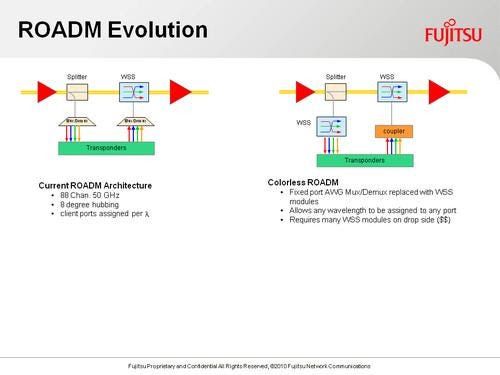

Fujitsu claims its Flashwave 7500 was the first ROADM to be deployed in North America, back in 2003. It also claims it was the first to have a WSS-based ROADM (2005). Fujitsu has three ROADM platforms, including the Flashwave 9500 that combines ROADM and packet optical networking, and the Flashwave 7420, which is aimed at smaller metro networks and access applications.

Table 4: Fujitsu Network Communications ROADM Platforms

Platform | Band | Degrees | Channels | Comment |

Flashwave 9500 | C | 1x9, 8-degree | 88 | Metro, regional |

Flashwave 7500 | C | 1x9 (12-degree hubbing) | 40 | Metro, regional. Also a 2-degree PLC-based ROADM. |

Flashwave 7420 | C | 1x9 (8-degree Dec 2010) | 40 | Access, metro |

Fujitsu's platforms address the metro networking market, but the vendor has said it plans to extend the Flashwave 9500 for ultra-long-haul networks.

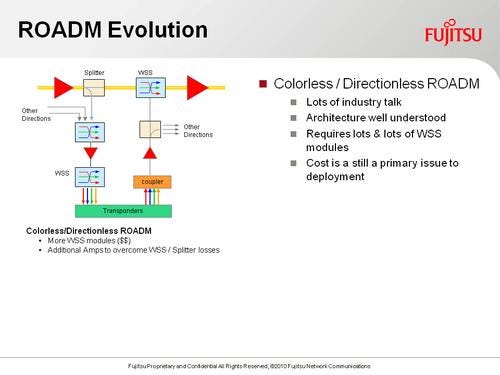

The vendor believes an integrated platform that combines the electrical switching offered by packet optical transport with ROADM switching can address operators' needs for the next three to five years. "Beyond that, things like gridless, colorless, and directionless make sense in the core part of the network, but are a little too pricey for metro networks today," says Randy Eisenach, WDM product marketing director at Fujitsu Network Communications.

Eisenach expects colorless and directionless ROADMs to be deployed in late 2011 in some core networks, where their expense can be justified. The need for such capabilities in metro networks is less clear, though, with Eisenach suggesting 2014 as a time frame for the earliest deployments.

Fujitsu says its systems incorporate an up-to-10-degree WSS, and that it's not seeing any demand for more. Implementing colorless and directionless is well understood, says Eisenach, citing the typical "brute force" method of cascading multiple WSSs, but he notes this has size and cost implications. Fujitsu has showcased its own optical filter alternative, but is still researching its options. "Near term, if you start to see colorless and directionless [deployments], they are going to be all WSS-based," he notes.

Through its research labs, Fujitsu demonstrated 3D MEMS technology back in 2004. But it's too early to say whether it will be used as an alternative to WSSs in Fujitsu's products.

In metro networks, operators want ROADM systems that can increase the DWDM channel count from 40 to 80, believes Fujitsu. Other operator requests include: lower speed aggregation for Sonet/SDH; Ethernet and OTN multiplexing; and support for 40Gbit/s and 100Gbit/s line-side interfaces. Discussions about GMPLS, colorless, and directionless are confined to longer-term operator requirements, says Eisenach.

"The idea of gridless is intriguing, but from an operational perspective I’m not sure carriers could implement and make use of it," says Eisenach. "There's some concern about offering something that may not be that easy to make operational, deploy, and control."

Fujitsu will support all three of its current platforms, but says it's putting newer technologies into the Flashwave 9500. Besides expanding reach, these include adding GMPLS capability and, further out, colorless, directionless, and gridless, says Eisenach.

Next Page: Huawei Technologies

Huawei’s OTN and traditional transport platforms address metro and long-haul networks and use several ROADM options in the form of plug-in cards. The platforms make use of three ROADM cards having degrees 1x2, 1x4, and 1x9. In terms of channel count, the 1x4- and 1x9-degree cards support 40 and 80 DWDM channels, while the 1x2 uses 40 channels only.

Table 5: Huawei's ROADM Platforms

Platform | Band | Degree | Channels | Comment |

OSN8800/6800 | C | 1x2 | 40 | The OTN series. The options for the two platforms cover metro, regional, and long-haul. |

OSN8800/6800 | C | 1x4 | 40, 80 | |

OSN8800/6800 | C | 1x9 | 40, 80 | |

BWS1600G/A, Metro6100 | C | 1x2 | 40 | The traditional series. |

BWS1600G/A, Metro6100 | C | 1x4 | 40 | |

BWS1600G/A, Metro6100 | C | 1x9 | 40 | |

BWS1600G | C | 1x9 | 80 | |

The ROADM designs are colorless and directionless. The vendor claims that both attributes are required for network restoration when using the Internet Engineering Task Force (IETF) 's wavelength switched optical network (WSON), the all-optical component of GMPLS. Using WSON, a wavelength can be automatically switched when a fiber cut occurs.

"Colorless and directionless are the basic hardware needed for WSON restoration," says Glen Fang, director of Huawei's WDM product line marketing, in an emailed response to questions. "There are more available optional routes for network restoration using a colorless and directionless ROADM." Huawei says it has built several 40Gbit/s WSON networks in Europe since 2008.

Fang believes the wider uptake of colorless and directionless ROADMs will coincide with the deployment of 100Gbit/s WDM systems. "The ROADM will only be a small part of the 100Gbit/s WDM system cost," he believes.

Huawei implements a colorless ROADM using cascaded WSSs. Using an alternative approach based on tunable filters is too expensive, says Fang. "Cascaded WSSs is the only solution for colorless ROADMs today."

Meanwhile, contentionless and gridless are still being researched by Huawei. "I cannot confirm an exact timing" for their potential introduction into Huawei's portfolio, states Fang. "I think the technologies we have supported satisfy most scenarios for now."

Contentionless and gridless ROADMs will also require new component architectures, such as an 8x20 WSS, claims Fang. "We are following such a ROADM component, and will add it into our OTN product series once it becomes available."

Huawei is generally keen on higher-degree ROADMs. "More degrees are needed," says Fang. "I know of some networks that really need more than 10 degrees." However, the Chinese vendor won't say when it expects a 1x23 WSS-based ROADM card to be available, saying only that it's currently researching the technology.

All three of Huawei’s designs are WSS-based, and it plans to continue using the technology within its ROADMs. However, it's still interested in 3D MEMs, but says that technology's use will depend on how the market develops and the technology's cost.

Huawei confirms that its OTN series is future-proofed, and that it will continue to invest in the platform. "Huawei's new products will be designed based on this platform, with 100 Gbit/s being one of the most important features," states Fang.

Next Page: Tellabs

Tellabs has two ROADM platforms -- the 7100 Optical Transport System (OTS), and the smaller 7100 Nano variant. The platforms are not designed for ultra long-haul, but Tellabs says they can support optical spans of up to 2,000 km.

Table 6: Tellabs's ROADM Platforms

Platform | Band | Degree | Channels | Comment |

7100 Optical Transport System (OTS) | C | 1x2, 1x5, 1x9 | 88 | Edge, metro, regional. The ROADM can be upgraded in one-degree installments once deployed in the field. |

7100 Nano OTS | C | 1x2, 1x5 | 88 | Edge, metro, regional. |

"Different to some other products on the market, both are interoperable and support similar distances and the same number of channels," says Bert Buescher, director, optical product management, at Tellabs. "Where there is a difference is in the amount of add/drop, and some of the switching matrix configurations."

According to Tellabs, operators are asking for a blend of optical switching, using ROADMs, and electrical switching, in the form of Ethernet, Sonet/SDH, and OTN. "It's always easy to look at the fun technologies that are coming out," but the ability to implement all the features in an operationally usable and cost-effective manner is what operators are really looking for, notes Bill Kautz, optical portfolio planning manager at Tellabs.

The vendor says the 7100 OTS already supports directionless, while the Nano ROADM is colorless. According to Kautz, it's the directionless attribute -– to support fiber cuts, for example -– that is requested more frequently by customers.

Tellabs says it doesn't cascade WSSs to implement colorless due to the optical loss and the signal impairments such an approach introduces. However, it won't say how it implements its colorless capabilities.

Despite the current split of attributes, both the 7100 OTS and Nano platforms are capable of supporting colorless and directionless, but there's a reason why they're not both deployed on a single Tellabs platform. Colorless was first introduced on the Nano to simplify provisioning of a small number of add/drop channels to deliver operational expense savings. Tellabs argues that colorless and directionless only makes sense on the same platform if contentionless is also added. The issue then is the resulting prohibitive system cost.

The vendor argues it's difficult to pin down a time frame for when contentionless will be needed, but it won't be for a few years yet. "Most of our customers place a much higher priority on directionless, and for contentionless it's more of an [operator] interest as to whether there is a future path [on our platforms]," says Kautz. He adds that operator customers talk even less about potential support for gridless capabilities on the Tellabs ROADM platforms.

Instead, operator discussions are focused on electrical switching and OTN, control plane support across layers, and 100Gbit/s transmission plans.

Back to: Introduction

Read more about:

OmdiaYou May Also Like