May 7, 2009

The next step in the ongoing development of the 3rd Generation Partnership Project (3GPP) standards for mobile networks is approaching commercial rollout. Yes, Long Term Evolution (LTE), as the recent 3GPP Release 8 is usually called, is scheduled to make its appearance soon in several countries, including Japan (NTT DoCoMo Inc. (NYSE: DCM) in 2010), Sweden (Telia Company in 2010), and the U.S. (Verizon Wireless in 2009).

LTE has generated a lot of excitement in large parts of the telecom industry because, unlike some of the earlier releases, it is far more than an incremental improvement because it aims to bring heavyweight broadband capabilities to mobile users. It is the next big thing in wireless, and many are predicting that it will usher in a revolution in the role and use of telecom services, and even in the nature of operator's businesses. (See Telco in Transition: The Move to 4G Mobility.)

Isn't 3G good enough?

Many operators are approaching LTE very cautiously and see no need to jump in before 2012 or later. This is partly because the global economic downturn has made rolling out new network infrastructure problematic, and partly because the existing and still relatively new lightweight broadband 3G networks are finally beginning to take off, and operators are desperate to milk them as much as possible to recoup the ridiculous amounts they paid for their 3G spectrum licenses during the dotcom boom. For the moment, and for many current purposes, 3G is good enough.

It's still early days for LTE equipment, although there has been a huge amount of vendor activity over the last year or two. In general, this activity reflects the reality that operators are going to migrate their networks piecemeal to LTE over a long timespan, and many vendors are emphasizing adding LTE capabilities to existing product ranges, or producing multistandard devices, rather than LTE-only equipment. So LTE isn’t going to be something like WiFi, which, when it arrived, was a new and self-contained product category.

This report provides a short roundup of who's currently who in the burgeoning LTE area and an overview of some recent drivers and product/technology developments. It uses a very simple breakdown into vendors of LTE access equipment, LTE core equipment, test and measurement, and a range of supporting devices and capabilities, such as silicon chipsets and software. We have tried to make the listing as complete as possible, but this is where you, Dear Reader, can help with any companies that have been missed.

If any companies need to be added, or any information corrected, please bring it to our attention either on the message board below or by sending an email to [email protected] or [email protected], placing "Who Makes What: LTE Equipment" in the subject line.

Here’s a hyperlinked contents list:

Page 2: LTE Reduced

Page 3: LTE Access

Page 4: LTE Core

Page 6: Test & Measurement

— Tim Hills is a freelance telecommunications writer and journalist. He's a regular author of Light Reading reports.

Next Page: LTE Reduced

LTE is horribly complicated when viewed as part of a complete architecture, as it forms Release 8 of the ongoing 3GPP series of architectural and standards developments for wireless networks. These standards by now embrace a huge array of network functional entities and interfaces (including the massive Internet Multimedia Subsystem – see, for example, What's Up With IMS?), and, even though the LTE development aims at simplification, it has to interwork with, and build on, the accumulated debris of earlier releases. So a fundamental issue for a Who Makes What is to decide what LTE actually means in terms of network equipment.

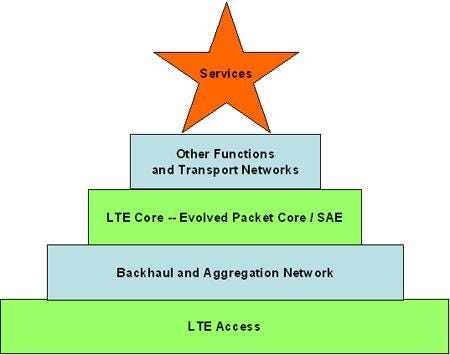

Figure 1 suggests that a possible way to do this is to concentrate on what is new in the architecture, as this will translate into new or upgraded equipment. On these grounds, LTE affects principally two broad areas of the network (tinted green in Figure 1):

The radio access network

The packet core network

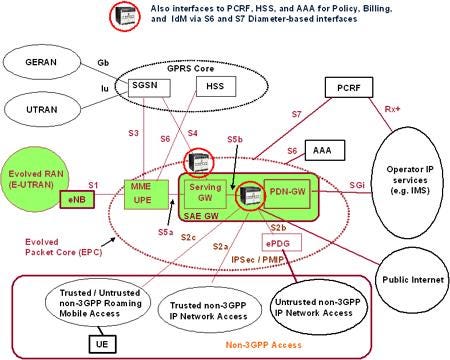

Figure 2 shows in a little more detail what this view of LTE equipment covers, and how it relates to some of the other network functions and access and transport networks involved in the earlier Releases of the 3GPP series. The main points are:

Figure 2 shows in a little more detail what this view of LTE equipment covers, and how it relates to some of the other network functions and access and transport networks involved in the earlier Releases of the 3GPP series. The main points are:

The earlier 2G and 3G Radio Access Networks (GERAN and UTRAN, respectively) are replaced by the new E-UTRAN (Evolved UTRAN/RAN). In particular, the 3G base-station NodeB is replaced by the new eNodeB.

The General Packet Radio Services (GPRS) core network, which supports both the 2G and 3G RANs, is replaced by a new Evolved Packet Core (EPC, but known also as System Architecture Evolution, SAE, when the new E-UTRAN and other access networks are included with it). This uses two new functional elements: the Mobility Management Entity (MME) node, which handles control signaling; and the SAE Gateway (which can be split into a separate Serving Gateway and a Packet Data Network Gateway), which handles traffic and the data-plane aspects.

There are lots of new interfaces, many of them with existing network functional elements, as LTE makes full use of these elements and interworks with non-3GPP access networks, for example. Thus the MME node uses the existing Home Subscriber Server (HSS), although this is now done through Diameter signaling rather than SS7. The use of Diameter here is significant because it means that all the interfaces in the LTE architecture are now IP ones.

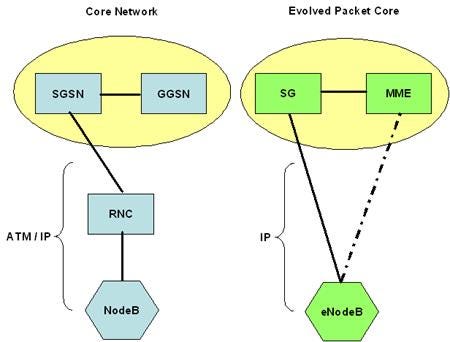

Although the 3GPP had many aims in developing LTE, a lot of them reduce to producing an architecture that can make mass-market ultrafast broadband services a commercial reality. So performance has to go up, costs have to come down, interfaces have to be open, and operations have to be simplified, to name only the most obvious. Figure 3, by making a comparison with 3G, illustrates some of the ways that the new architecture does this.

Although the 3GPP had many aims in developing LTE, a lot of them reduce to producing an architecture that can make mass-market ultrafast broadband services a commercial reality. So performance has to go up, costs have to come down, interfaces have to be open, and operations have to be simplified, to name only the most obvious. Figure 3, by making a comparison with 3G, illustrates some of the ways that the new architecture does this. First, legacy ATM is dispensed with in favor of all-IP. Then the architecture is flattened and simplified by dispensing with the Radio Network Controller (RNC) – instead, the eNodeB connects directly to the SAE Gateway and the MME. Reducing the number of nodes involved in a connection improves scalability, performance, and cost-efficiency.

First, legacy ATM is dispensed with in favor of all-IP. Then the architecture is flattened and simplified by dispensing with the Radio Network Controller (RNC) – instead, the eNodeB connects directly to the SAE Gateway and the MME. Reducing the number of nodes involved in a connection improves scalability, performance, and cost-efficiency.

On the RF side, LTE introduces the use of Orthogonal Frequency-Division Multiplexing (OFDM) radio access and Multiple-Input Multiple-Output (MIMO) antenna technologies. Pure OFDM is used on the downlink from the base station to the terminal, and was selected for its cost efficiency in supporting the requirement for spectrum flexibility – from under 5MHz bandwidth to up to 20MHz, and for both Frequency-Division Duplex (FDD) and Time-Division Duplex (TDD) modes of operation. On the uplink from terminal to base station, LTE uses a special version of OFDM called Single-Carrier Frequency-Division Multiple Access (SC-FDMA), chosen for its lower power consumption, an important consideration for terminals.

Product classification

On the basis of these considerations, this Who Makes What classifies LTE products under five broad headings:

Access – the radio base stations and eNodeB equipment

Core – the new Evolved Packet Core nodes

Silicon, platforms, and subsystems – the new chipsets and other subsystems or devices needed to implement the LTE Access and Core equipment

Software and protocols – similarly for software and protocol stacks

Test and measurement – the new equipment needed by vendors and operators to test and monitor LTE Access and Core equipment

Here's what we're leaving out:

Terminals/CPE. These are obviously crucial and will be made in vast quantities, so their omission might seem surprising. But there is a simple reason – they don’t really exist in the commercial-product sense yet. Yes, it’s almost GSM all over again: The standards are done, the infrastructure equipment exists, but there is not much on the CPE side – and the first services are launching in the next 12 months or so. Of course, this will be rectified in time, but it is a useful corrective to the industry’s tendency to overhype LTE’s commercial mass-market readiness.

In the meantime, there are demonstration devices and early platforms and chipsets (some of which are mentioned in the following pages). Given LTE’s high bandwidth capabilities and low latencies, and relatively limited early geographical coverage, most of the early CPE are likely to be data-type card dongles for laptops and netbooks, rather than flashy smartphones like the Apple iPhone.Antennas. Although LTE brings new antenna technologies to mobile networks, these are not new per se – WiFi networks have used MIMO techniques for some time, for example – and arguably belong more to the general art of RF communications than to any specific application such as LTE. In the interests of manageability, they are thus omitted, but, for the record, relevant vendors include Ace Antennas, Cellmax Technologies, Motorola Inc. (NYSE: MOT),Powerwave Technologies Inc. (Nasdaq: PWAV), Radio Frequency Systems (RFS) , and Socowave.

Backhaul/aggregation equipment. This is another crucial part of any real LTE network, and doubtlessly will encourage specialist and optimized Ethernet/IP solutions because of LTE’s wholesale move to IP and the need for new backhaul/aggregation to match the rollout of new LTE base stations (RAD Data Communications Ltd. , for example, is majoring on this application for its Carrier Ethernet pseudowire technology). But, again, this is arguably a new application of an existing art, rather than a new LTE equipment category.

Existing functional entities interfacing to EPC. The new interfaces between the EPC and entities such as the HSS, PCRF, AAA, and so on (see Figure 2) will obviously require vendors of products providing these entities to make changes. However, these are not specifically new LTE functional entities, and, as these products are very numerous, they are treated as beyond the scope of this Who Makes What.

Table 1 lists vendors against these five broad LTE product categories.

Table 1: Vendors of LTE Equipment

Vendor | Access | Core | Silicon / Platforms / Subsystems | Software / Protocols | T&M |

4M Wireless | Yes | ||||

ABIT | Yes | ||||

Aeroflex | Yes | ||||

Agilent Technologies | Yes | ||||

Alcatel-Lucent | Yes | Yes | |||

Allot Communications | Yes | ||||

Altair Semiconductor | (Yes) | ||||

Altera Corporation | Yes | ||||

Analog Devices | Yes | ||||

Anite | Yes | ||||

Anritsu | Yes | ||||

Aricent | Yes | ||||

AT4 Wireless | Yes | ||||

AXIS Network Technology | Yes | ||||

Azimuth Systems | Yes | ||||

BitWave Semiconductor | Yes | ||||

Blue Wonder Communications | Yes | ||||

Catapult Communications | Yes | ||||

Cavium Networks | Yes | ||||

Cisco Systems | (Yes) | ||||

CommAgility | Yes | ||||

CommScope/Andrew | (Yes) | ||||

ComSys | Yes | ||||

Continuous Computing | Yes | ||||

Dyaptive Systems | Yes | ||||

ERCOM | Yes | ||||

Ericsson | Yes | Yes | |||

Freescale Semiconductor | Yes | ||||

Fujitsu Network Communications | Yes | Yes | |||

Gambit Communications | Yes | ||||

Hitachi Communication Technologies | (Yes) | (Yes) | |||

Huawei Technologies | Yes | Yes | |||

IntelliNet Technologies | Yes | Yes | |||

IPWireless | Yes | (Yes) | (Yes) | ||

Keithley Instruments | Yes | ||||

Kineto Wireless | Yes | ||||

LG Electronics | Yes | ||||

Lime Microsystems | Yes | ||||

LNT Infotech | Yes | Yes | |||

LSI Corporation | Yes | ||||

MimoOn | Yes | Yes | |||

Motorola | Yes | ||||

MYMO Wireless Technology | (Yes) | ||||

NEC | Yes | Yes | |||

NetHawk | Yes | ||||

Nokia Siemens Networks | Yes | Yes | |||

Nomor Research | Yes | ||||

Nortel | Yes | Yes | |||

Panasonic Mobile Communications | Yes | ||||

Percello | Yes | ||||

picoChip | Yes | ||||

Polaris Networks | Yes | ||||

Powerwave Technologies | Yes | ||||

Prisma Engineering | Yes | ||||

Qasara | Yes | Yes | |||

Qualcom | Yes | ||||

Radiocomp | Yes | ||||

Rohde & Schwarz | Yes | ||||

RMI | Yes | ||||

Samsung Electronics | Yes | Yes | |||

Sandbridge Technologies | Yes | ||||

Sanjole | Yes | ||||

Setcom Wireless | Yes | ||||

Signalion | Yes | ||||

Sonus Networks | Yes | ||||

Spirent Communications | Yes | ||||

Starent Networks | Yes | ||||

ST-Ericsson | Yes | ||||

Stoke | Yes | ||||

Tata Consultancy Services | Yes | Yes | |||

Tecore Networks | Yes | ||||

Tektronix Communications | Yes | ||||

Texas Instruments | Yes | Yes | |||

Traffix Systems | Yes | Yes | |||

Ubidyne | Yes | ||||

Wavesat | Yes | ||||

WiChorus | Yes | ||||

Wintegra | Yes | Yes | |||

ZTE | Yes | Yes | |||

Parentheses indicate products planned or in development. |

Next Page: LTE Access

Functionally, base stations (whether LTE or not) include the RF section (principally the radio transceiver, but antennas and so on can be included here), the baseband unit, and the network-interface unit. In a complete product, some of these may come from a specialist second vendor, and flexibility may be offered by, for example, separating the RF sections from the baseband units to allow new subsystems to be swapped in as an upgrade to maximize the reuse of equipment.

Table 2 lists vendors and examples of LTE access products.

Table 2: Vendors & Examples of LTE Access Products

Vendor | Access products include |

Alcatel-Lucent | 9326 NodeB + 9426 LTE software |

AXIS Network Technology | LTE Remote Radio Heads |

Ericsson | BS 6000 base station series, EVO RAN |

Fujitsu Network Communications | BroadOne LS LTE eNodeB base station portfolio |

Hitachi Communication Technologies | (Developing products) |

Huawei Technologies | SingleRAN |

IPWireless | V5 Multi-Standard Base Station Platform |

Motorola | CTU4 and RCTU4 base station radios, eNodeB |

NEC | eNodeB |

Nokia Siemens Networks | Flexi Base Station |

Nortel | eNodeB |

Panasonic Mobile Communications | NTT's Super 3G (LTE) Base Station project |

Powerwave Technologies | Base station solutions supporting LTE |

Radiocomp | Remote Radio Heads for 3GPP LTE |

Samsung Electronics | eNodeB |

ZTE | ZXSDR R8860 Multi-Mode Outdoor RRU, ZXSDR B8200 Multi-Mode Indoor BBU |

Parentheses indicate products planned or in development. |

The radio/base-station side of LTE sees the introduction of new capabilities intended to simplify the rollout and management of mobile broadband networks -- and, of course, to lower costs. These include features such as plug-and-play, self configuration, and self optimization, and mean that the eNodeB represents a further level of sophistication in radio base stations and an increase in the intelligence residing at the network edge.

Unsurprisingly, software plays a crucial role in the eNodeB, and one approach to this product category is through a software upgrade/addition to an existing product. Alcatel-Lucent (NYSE: ALU) has done this with an LTE software module that can be loaded onto its 9326 Digital 2U eNodeB, already used by many of the company’s existing 3G customers. An obvious point of the approach is to give operators flexibility in deploying LTE into a 3G environment -- profitable hotspots can be targeted first, for example.

The use of software-defined radio (SDR) technologies means that LTE is thus often appearing as one option in multistandard radio/base-station products. As an example, Motorola has a common wireless broadband platform that will be used to support both WiMax 802.16e access points and the LTE eNodeB, and the company’s CTU4 and RCTU4 base-station radios support GSM, E-EDGE, and LTE.

Partly because LTE is being rolled out during a huge economic downturn, which is in turn taking place against an increasingly dismal background of energy and environmental issues, vendors are pushing hard the message that the new generation of base stations will be smaller and less power hungry, will be cheaper to operate, and will have lower adverse environmental effects than the than the old generation.

Ericsson AB (Nasdaq: ERIC) is thus a vendor trying to have it all ways with its EVO RAN (February 2009), which it bills as “a Radio Access Network (RAN) solution enabling operators to run GSM, WCDMA and LTE as a single network.” And the vendor claims lower costs and reduced power consumption into the bargain.

Spectrum issues

An issue with LTE rollout is spectrum availability and use, as the new radio technology needs new radio spectrum -- existing non-LTE networks are not being closed to release their spectrum. A fundamental point is that, as already stated, LTE may operate either in FDD or TDD modes, and spectrum allocations will mandate which. So vendors have an interest in producing equipment that can operate in either mode, and Huawei Technologies Co. Ltd. claimed to have demonstrated the world's first unified FDD/TDD LTE system at the February 2009 Mobile World Congress in Barcelona. The company says that this will enable operators to use spectrum more efficiently and help to lower costs.

A related point is that the LTE spectrum allocations potentially span a wide range of frequencies, some of which would be more commonly used globally than others. Radiocomp has thus argued that the current economic downturn makes it problematic that cost-competitive radio network solutions will be developed for all LTE frequency bands, so that mobile operators with non-mainstream frequency bands might find it difficult to procure suitable equipment. To mitigate this, the company has launched (February 2009) a range of software-configurable remote radio heads (RRHs), which span the LTE band from 700MHz to 2.5GHz and which it describes somewhat gushily as “basically super-compact, high-performance LTE base stations that connect to the rest of the network over optical fibers using OBSAI or CPRI.”

Another vendor that has recently jumped on the LTE RHH bandwagon is Axis Network Technology Ltd. , which announced (September 2008) a family of OEM RRH products for the 2.3-2.7GHz frequency bands. The company says that an RRH allows the radio to be located alongside the antennas and physically separated from the base station, thereby eliminating the losses associated with long RF cable runs (typically around 3dB per cable) as an optical-fiber data interface (such as OBSAI or CPRI) is used instead. This means, the company says, that a single MIMO RRH with 10W output power will provide greater coverage than a 40W SISO ground-based base station, with a consequent reduction in power and energy consumption.

Fujitsu Network Communications Inc. is an example of a vendor using such an architecture -- its BroadOne LS LTE eNodeB base station family (February 2009) has a distributed architecture, consisting of an RRH and a baseband unit (BBU). The BBU is available in indoor or outdoor models, while the RRH is designed to take advantage of the lower operational cost of an all-outdoor deployment, the company says.

Next Page: LTE Core

The LTE Core is essentially an evolution of the existing GSM/WCDMA core network – hence the Evolved Packet Core (EPC) moniker – but it is also being developed to ease interworking with the CDMA standards, so that operators using these, too, can evolve their networks into LTE ones. As already stated, the EPC aims at simplification and contains:

A control-plane node -- the Mobility Management Entity (MME)

A data-plane gateway -- the SAE Gateway (which can be split into a separate Serving Gateway and a Packet Data Network Gateway)

Cisco Systems Inc. (Nasdaq: CSCO) has pointed out that the new LTE EPC presents gateway vendors with some interesting challenges, such as:

Data traffic loads are going to be much higher than for current networks. One reason is obvious -- by design, LTE offers much higher bandwidths than existing networks and encourages applications that will use them. Less obvious is the fact that LTE does not support circuit-switched voice traffic directly, so voice has to be carried as VOIP. Thus gateways will be flooded with vast numbers of small VOIP packets as well.

The all-IP nature of LTE makes the network operate in an always-on fashion, which both drives up the gateway session counts (and hence loadings) and imposes severe requirements on gateway reliability and availability.

The central role that the EPC is going to play in the development of mobile broadband has encouraged vendors to fall over themselves in their efforts to introduce EPC solutions. Table 3 lists vendors and examples of LTE Core products ("solution" tends to be the polite term for something as big and complicated as an EPC), and its worth noting that Allot Ltd. (Nasdaq: ALLT), Ericsson, Nokia Networks , Samsung Electronics Co. Ltd. (Korea: SEC), Starent Networks Corp. (Nasdaq: STAR), and Tecore Networks Inc. all jumped in with new product launches at the February 2009 Mobile World Congress in Barcelona. Other vendors, such as Cisco Systems and Hitachi Communication Technologies, have announced that they are developing EPC products. In short, the telecom infrastructure heavyweights are all involved.

Table 3: Vendors & Examples of LTE Core Products

Vendor | Core products include |

Alcatel-Lucent | Evolved Packet Core |

Allot Communications | Service Gateway Sigma (SG-Sigma) |

Cisco Systems | (Developing EPC Serving Gateway (SGW) and the Packet Data Node (PDN) gateway) |

Ericsson | Evolved Packet Core portfolio -- SGSN/MME, Mobile Packet Gateway, Converged Packet Gateway |

Hitachi Communication Technologies | (Developing products) |

Huawei Technologoes | Evolved Packet Core |

IntelliNet Technologies | LTE gateways |

NEC | Evolved Packet Core |

Nokia Siemens Networks | EPC -- Flexi Network Server, Flexi Network Gateway |

Nortel | LTE Access Gateway, Evolved Packet Core |

Samsung Electronics | EPC -- MME, S-GW/P-GW |

Starent Networks | Evolved Packet Core |

Sonus Networks | MobilEdge Access Node (within Sonus mobilEvolution architecture) |

Stoke | LTE SAE Gateway (via SSX 3000) |

Tecore Networks | ICore LTE |

Traffix Systems | Rosetta Diameter Gateway |

WiChorus | SmartCore EPC platforms |

ZTE | Evolved Packet Core |

Parentheses indicate products planned or in development. |

The EPC is a rich field for product/solution development partly because of the many possibilities for collocating LTE and non-LTE functions within nodes. Starent Networks, for example, cites the possibility of an EPC Mobility Management Entity (MME) combined with a 2G/3G SGSN, a Packet Data Network Gateway (PGW) and GGSN, and an HRPD Serving Gateway (HSGW) and PDSN. Such flexibility will help upgrading and migration to LTE.

The issue of the relation of LTE to existing circuit-switched voice services has led to the recent formation of the Voice over LTE via Generic Access (VoLGA) Forum , whose founders include Alcatel-Lucent, Ericsson, Huawei Technologies, LG Electronics Inc. (London: LGLD; Korea: 6657.KS) , Motorola, Nortel Networks Ltd. , Samsung Electronics, Starent Networks, T-Mobile International AG , and ZTE Corp. (Shenzhen: 000063; Hong Kong: 0763). (See Forum Tackles Voice Over LTE.) The basic argument here is that many operators may be unwilling to build a new IMS-based VOIP network to run in parallel with their existing huge investments in core-network R4 voice circuit switches just so that they can offer voice services immediately on their new LTE networks. However, an initial data-only play on LTE could be risky, as voice/SMS are primary revenue-generating services.

The approach of the VoLGA Forum is to define a new node (the VAN-C) which sits in or behind the EPC (and behind the MME) and which connects to the existing R4 switches. This presents circuit-switched voice as a packet application (resembling any other IMS-based packet application) to the handset or user device (see Figure 4). The new work is felt to be necessary because of dissatisfaction with the only existing defined way to use the circuit-switched core network for voice over LTE -- CS-Fallback. The VAN-C uses the 3GPP Generic Access Network (GAN) standard, and requires no change to existing MSCs and operational systems. It supports:

The VAN-C uses the 3GPP Generic Access Network (GAN) standard, and requires no change to existing MSCs and operational systems. It supports:

All circuit services over LTE

IMS RCS and combinational services (CS+IMS) over LTE

Handover of active calls between LTE and GSM/UMTS

Expected LTE femtocell deployments

The goal is to have a 3GPP specification for VoLGA eventually.Vendors are, of course, pushing their own solutions to the LTE/voice issue. Nokia Siemens Networks, for example, has announced (no surprises, February 2009) its Fast Track VoLTE (voice over LTE), comprising software and hardware upgrades to existing 3GPP circuit-switch core networks. These allow the company’s customers to use their existing mobile softswitching and NVS VoIP server infrastructure to manage voice traffic over the LTE network before an eventual migration to IMS.

Next Page: Silicon, Platforms, Subsystems & Software

LTE equipment of all types makes extensive use of chipsets, software, and specialized subsystems, and the industry has responded through a growing ecosystem of vendors and products to support the technology. Within the space limitations of a Who Makes What it is impossible to list every type of RF or digital device, for example, that might make its way into a finished LTE product, especially as there is a lot of commonality at the component level with other technologies. So this section tries merely to round up some of the more recent developments that have a specific bearing on LTE.

Typically, an LTE base station or user device needs semiconductor and other components to perform the following major functions:

RF frontend

Baseband processing (the LTE Layer 2 MAC and Layer 1 OFDM PHY)

Network interfacing

Control

Chipsets are available that integrate some of these functions within a single chip. For example, Wintegra Inc. ’s WinPath3 W series processors combine the real-time IP packet processing of both the radio baseband and network-interface protocols, the point being to reduce cost and power consumption.

Table 4 lists vendors and examples of LTE silicon and platform products, and Table 5 does the same for LTE software and protocol products. Technically, the silicon and the software sides are closely related because, as Aricent Inc. points out, LTE presents new challenges as the new radio components require the re-engineering of the Layer 1 (Physical) and Layer 2 (Media Access Control) software used in an eNodeB. The company has thus launched (September 2008) its LTE eNodeB development suite to offer a combination of software and development services to accelerate the prototyping and development of new chipsets and testing systems for LTE.

Table 4: Vendors & Examples of LTE Silicon / Platform / Subsystem Products

Vendor | Silicon / Platform / Subsystem products include |

Altair Semiconductor | (In development) FourGee-3100 LTE CAT-3 baseband processor (supporting also WiMAX and XGP), FourGee-6150 MIMO RF transceiver supporting LTE-TDD, FourGee-6200 multiband LTE-FDD MIMO transceiver |

Altera Corporation | SOCs for LTE RF Remote Radio Heads, Channel Cards (Modem/Baseband) and Switch Cards |

Analog Devices | Various LTE applicable RF+ DSP devices |

BitWave Semiconductor | BW1102 Softransceiver RFIC |

Cavium Networks | OCTEON Multi-core MIPS64 processors |

CommAgility | AMC-3C87F3 DSP and FPGA embedded signal-processing AMC board for wireless baseband solutions, including WiMax and LTE |

ComSys | ComMAX LT8000mobile baseband processor |

Ericsson | M700 mobile platform |

Freescale Semiconductor | MSC8156 DSP |

IPWireless | (LTE chipsets in development) |

LG Electronics | Handset modem chip (in development) |

Lime Microsystems | LMS6002 multiband multistandard RF transceiver IC |

LSI Corporation | APP3300 Network Processor |

MYMO Wireless Technology | Developing IP Cores & Reference Products: Physical Layer and MAC for 3GPP LTE. Prototypes and Reference designs: LTE UE & BS. Platforms: DSP, FPGA, ASIC and customized reference platforms |

Percello | Aquilo femtocell SOC family |

picoChip | PC8618 picocell and PC8608 femtocell platforms |

Qualcom | MDM9xxx-series LTE device chipsets |

RMI | XLR processor family |

Sandbridge Technologies | SB3500 flexible baseband processor |

ST-Ericsson | M700 mobile platform |

Texas Instruments | LTE developmental ecosystem |

Ubidyne | uB900 Antenna Embedded Digital Radio |

Wavesat | Odyssey 9000 under development (release due in third quarter 2009) |

Wintegra | WinPath3 W series processors |

Source: Light Reading, 2009 |

Table 5: Vendors & Examples of LTE Software/Protocol Products

Vendor | Software / Protocol products include |

4M Wireless | PS100 LTE protocol stack |

Aricent | LTE Evolved Node B (eNodeB) development suite |

Continuous Computing | Trillium Long Term Evolution (LTE) |

IntelliNet Technologies | LTE protocol stacks |

IPWireless | (LTE software in development) |

Kineto Wireless | Gateway software |

LNT Infotech | LTE User Equipment Stack Implementation consisting of L2, L3 and NAS layers optimized for the ARM Target Platform, LTE Diameter solutions (such as HSS, OCS/OFCS) |

MimoOn | mi!Femto, mi!Infra, mi!Mobile |

Nomor Research | LTE Protocol Stack Library, LTE eNB Emulator |

Qasara | LTE Protocol Stack, LTE Protocol Engine, LTE Virtual UE |

Tata Consultancy Services | LTE eNodeB Physical layer (PHY), eNodeB higher layer protocol stacks ( RLC, MAC, PDCP, RRC) |

Texas Instruments | LTE developmental ecosystem |

Traffix Systems | OpenBloX LTE Diameter stack |

Wintegra | LTE protocols |

Source: Light Reading, 2009 |

LTE involves a wide range of protocols, and there has naturally been something of a rush to make these stacks available -- 4M Wireless, Continuous Computing Corp. , and Wintegra, for example, have all released stacks since mid-2008. As an example of what is available, Continuous’s Trillium LTE protocol software includes Diameter, S1-AP, eGTP, GTP, MAC, PDCP, RLC, RRC, and X2-AP, and supports LTE femtocells, macro/pico LTE base stations, and the network elements within the EPC. They are multithreaded for multicore/multithreaded processors, and include reference applications for relevant LTE interfaces, such as LTE-Uu, S1, S5, S6, S7, S10, and X2.

Of course, some vendors, such as Wintegra, are also producers of network-processor chips and other silicon devices, and the result is the offering of specific silicon/software platforms for LTE devices. As an aside, the arrival of LTE adds yet another wireless protocol set to an already extensive list that includes 1xRTT, AM/FM, AMPS, Bluetooth, CDMA, CDMA2000, CDPD, DAB, DECT, DMB, DVB-H, EV-DO Rev 0 / Rev A, GPS, GSM, HSDPA, HSUPA, MediaFLO, NAMPS, UWB, WCDMA, WiBro, Wi-Fi, and WiMax. It is not surprising that some vendors, such as BitWave Semiconductor Inc. , are promoting software-defined radio or programmable RF platforms as a means of producing the cost-effective multistandards handsets that will be needed for the rollout of LTE within an existing non-LTE environment. (See Figure 5.) More generally, BitWave also argues that the numerous available bandwidths, spectrum bands, modulation methods, duplex modes, and MIMO configurations create many different combinations for the handset manufacturer, making it expensive and risky to place a bet on just one single combination, given the cost of RF silicon. In contrast, programmable RF devices mean that OEMs will take on less risk in picking product use cases because they can later change characteristics such as frequencies, bandwidths and so on.

More generally, BitWave also argues that the numerous available bandwidths, spectrum bands, modulation methods, duplex modes, and MIMO configurations create many different combinations for the handset manufacturer, making it expensive and risky to place a bet on just one single combination, given the cost of RF silicon. In contrast, programmable RF devices mean that OEMs will take on less risk in picking product use cases because they can later change characteristics such as frequencies, bandwidths and so on.

Table 4 shows that there is a considerable number of small (and generally fabless) semiconductor houses involved in LTE, and the number is potentially larger as there is a close connection between WiMax and LTE silicon -- the RF aspects of the technologies are very similar, for example. Several companies (for example DesignArt Networks and the not-so-small Fujitsu Ltd. (Tokyo: 6702; London: FUJ; OTC: FJTSY)) have WiMax system-on-chips (SOCs), and also state their expertise and interest in LTE -- but do not have commercial products yet. Indeed, analysts are already beginning to forecast a coming shakeout in LTE and WiMax silicon. (See, for example, the November 2008 Light Reading Insider 4G Chips: WiMax/LTE Technology & Components.)

With so many vendors involved, there has been a flurry of new LTE silicon devices announced or released over the last year, with much of the effort directed toward handset/user-device, picocell, and femotcell application. Some vendors (such as Picochip ) are pushing the argument that the bulk of LTE’s rollout will be via very small cells, with the consequence that a premium will be put on devices with self-configuration and self-optimization features so as to reduce operators’ capital and operational costs. However, one major operator, Verizon, appears to have pooh-poohed that approach for its initial rollouts (see No Femtos in Verizon's First LTE Rollout).

But self-configuration/optimization or not, there is no doubt that LTE makes big demands on processors because of the high data rates and low latencies involved. Freescale Semiconductor Inc. , for example, has introduced (November 2008) its MSC8156 base-station processor with twice the performance of its previous fastest digital signal processor. And LG Electronics claimed a world first in December 2008 with a 13 x 13mm handset modem chip, potentially able to support 100Mbit/s downstream and 50Mbit/s upstream.

Next Page: Test & Measurement

T&M vendors are always very busy when new network technologies come along, and LTE is no exception. Table 6 gives a taste of this by listing some of the LTE T&M products that vendors have launched recently, mainly over the last year.

Table 6: Some Recent LTE T&M Products

Vendor | Test and measurement products include |

ABIT | Air Protocol Analyzer series |

Aeroflex | TM500 LTE Test Mobile platform, 7100 Digital Radio Test Set |

Agilent Technologies | E6620A Wireless Communications Test Set |

Anite | Nemo Network Testing Solutions with LTE support, LTE Development Toolset |

Anritsu | MD8430A Base Station Simulator, MD8435A LTE UE Simulator |

AT4 Wireless | LTE Protocol Tester T4110 |

Azimuth Systems | ACE MX MIMO Channel Emulator |

Catapult Communications | DCT2000/LTE Network Element Simulator |

CommScope/Andrew | Invex.NxG i.Scan Test Receiver |

Dyaptive Systems | DMTS-9200 LTE Network Load and Performance Test System |

ERCOM | LTE eNodeB Mobipass test range |

Gambit Communications | MIMIC Wireless Simulator for 3G/4G Wireless (WiMAX, Wi-Fi, LTE) |

Keithley Instruments | MIMO RF Test Systems |

LNT Infotech | LTE simulators (such as EPC Call simulator, SGSN simulator), TTCN3-based LTE conformance test suites |

MimoOn | mi!TestMOBILE |

NetHawk | NetHawk M5 protocol analysis platform, NetHawk EAST LTE simulator |

Polaris Networks | Protocol conformance testers, load testers and network device emulators (eNodeB, MME, S-GW) |

Prisma Engineering | LSUv3 Radio for multiterminal testing over the radio interface |

Qasara | LTE eNodeB System Simulator |

Rohde & Schwarz | R&S TS8980 RF test system for development of LTE-compatible mobile stations |

Sanjole | WaveJudge 4900 LTE |

Setcom Wireless | S-CORE conformance and research test environment for LTE |

Signalion | SORBAS 3GPP LTE Test-UE |

Spirent Communications | Landslide LTE Test Applications (EPC Gateways and MME), SR5500 Wireless Channel Emulator |

Tata Consultancy Services | Proprietary verification tools for wireless baseband systems |

Tektronix Communications | G35-LTE: Simulation and Load Generation, K2AirLTE Uu Interface monitoring platform, NSA-LTE: Troubleshooting and Performance Analysis |

Source: Light Reading, 2009 |

Most of this effort has gone into the RF/air-interface aspects and eNodeB functionality, as this is where much of the newness and complexity of LTE reside. Further, as Tektronix Communications points out, the new LTE architecture reduces the amount of information on access-network performance -- such as congestion, interference, and coverage issues -- that can be deduced from measurements on wireline network interfaces through traditional network and service analyzers. This is because the eNodeB has become more intelligent and handles access control functions itself, rather than referring back to the core.

This means, Tektronix says, that vendors and operators are being pushed into looking directly into the air interface for information on network access performance and service quality, and so need to be able to correlate this analysis with data related to other network interfaces. Hence the launch at the Barcelona February 2009 Mobile World Congress of the company’s K2Air probe. This monitors up to 300 UEs in parallel on the air interface in real time and correlates this information with data on fixed LTE as well as legacy 2G and 3G interfaces, allowing end-to-end monitoring of network and network-element performance.

Naturally, another important area of T&M emphasis is product development systems for chipset designers, software developers, and handset vendors. At one end of the scale are single benchtop instruments, such as Aeroflex Inc. (Nasdaq: ARXX)’s 7100 Digital Radio Test Set (November 2008), which has an integrated RF interface, baseband, and protocol stack. The vendor says the device simulates the network from the physical layer to the core network IP infrastructure, and provides both parametric analysis and protocol logging and diagnostics. End-to-end IP connectivity allows the data throughput performance and latency to be assessed. A base frequency range of up to 6GHz is intended to cope with both current and potential future spectrum allocations.

At the other end of the scale are large multiproduct systems intended to cover the complete lifecycle of LTE UE development, production, and use, including both automation tools and instrumentation. As an example of a big, busy player in this area, Agilent Technologies Inc. (NYSE: A) has:

Launched LTE protocol development solutions based on the E6620A Wireless Communications Test Set, along with the Anite SAT LTE Protocol Development Toolset

Added LTE and SAE to the J7910A signaling analyzer real-time platform

Offered the MXA signal analyzer with Vector Signal Analysis LTE software, and the MXG vector signal generator with LTE Signal Studio software

Launched the LTE TDD Wireless Library (W1910/E8895) for Agilent SystemVue and Advanced Design System (ADS)

Launched the N7625B Signal Studio for LTE TDD -- a PC-based software application for creating standards-based TD-LTE signals

Launched 89600 VSA software to provide LTE TDD signal analysis tools, physical layer testing and troubleshooting of LTE transceivers and components

Launched the PXB MIMO Receiver Tester for LTE real-time signal generation and channel emulation for base-station testing.

As the last item in the list shows, the use of MIMO antenna technology brings its own T&M requirements. Still in the A's, another vendor, Azimuth Systems Inc. , is majoring on this with the launch (February 2009) of its ACE MX MIMO Channel Emulator, which the company describes as a purpose-built, enhanced testing solution designed to meet the needs of MIMO and OFDM systems, arguing that the proper laboratory testing of MIMO systems requires the use of rich channel modeling and emulation techniques such as dynamic channel conditioning, shadow fading, and complex antenna correlation.

Emulation is also the name of the game for vendors such as mimoOn GmbH and Prisma Engineering S.r.l. , whose product lines include software-defined radios (SDRs) for emulating a range of LTE radio devices for test and development purposes. And emulation in a further sense is the domain of ERCOM’s new LTE eNodeB Mobipass (February 2009), which provides both subsystem and full-system eNodeB functional and load test scenario based on the emulation of all LTE interfaces, including CPRI-based and RF-based UE-emulation.

— Tim Hills is a freelance telecommunications writer and journalist. He's a regular author of Light Reading reports.

Back to Page One: Introduction

You May Also Like