Indian-based multinational carrier says it will survive as traditional telecom players become less relevant

August 25, 2011

Tata Communications Ltd. is beefing up its global network to offer telepresence and Ethernet services and developing more industry-specific service packages, all preparing for the day when traditional telecom transport providers are extinct, says Tata's top guy in the U.S.

Dave Ryan, Tata's SVP for the Americas, sees that happening within the next 10 years, as content distributors and owners, including Internet giants such as Google, own the real value. Surviving will depend on "how we align with these evolving service providers to enable them to offer their services globally."

Telecom companies are "really going to become like a piece part, as opposed to companies today that provide all the solutions," Ryan says. "We are planning to be part of that shift."

Tata's plan for surviving this transition doesn't look that different, on the surface, from that of many other multinational providers: Build a global fiber optic network, partner with other companies to reach markets you don't reach, add IP and Ethernet capabilities, layer on services such as telepresence and cloud, and develop vertical market specialties.

Ryan insists there are differences in Tata's approach on most of these fronts:

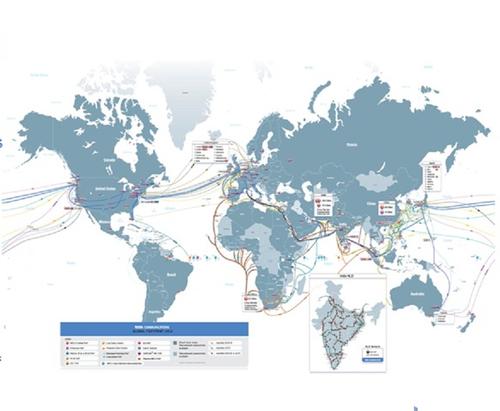

Tata's global network, largely using submarine cable, is newer and goes whether others don't. Ryan says Tata's network has about 25 percent of the world's lit capacity, reaching 240 countries. Its 210,000 route kilometers of fiber optic cable go from the East Coast of the U.S. across the Atlantic into Europe, through the Middle East into the west side of India then down around Africa and west through the U.S. into the Pacific, where it hits most Asian markets.

Tata's fiber optic network is relatively new, it has been designed around known network disruptions, such as natural disasters, and also avoids simply duplicating existing fiber routes, according to Ryan. In addition to making Tata a prime choice for route diversity and disaster recovery, the network lets multinationals reach emerging Asian markets, such as Malaysia and Vietnam, on its network -– although it is also selling wholesale services to folks such as AT&T Inc. (NYSE: T) and Verizon Enterprise Solutions as well.

Tata's fiber optic network is relatively new, it has been designed around known network disruptions, such as natural disasters, and also avoids simply duplicating existing fiber routes, according to Ryan. In addition to making Tata a prime choice for route diversity and disaster recovery, the network lets multinationals reach emerging Asian markets, such as Malaysia and Vietnam, on its network -– although it is also selling wholesale services to folks such as AT&T Inc. (NYSE: T) and Verizon Enterprise Solutions as well.

"As mature markets are saturated, multinational corporations see markets like the Middle East, Africa and Asia as areas where they want to focus their future revenue-generating activities and where their supply chain and partnerships exist, and we are trying to be positioned as the company that helps them expand into those markets," Ryan says.Tata's telepresence service offers broader connections. Tata believes it can do a better job of helping multinational executives avoid 14-hour flights because it has 33 public telepresence rooms in 17 countries, offering direct connections to Verizon, BT, Orange, Telefonica and Cisco-powered telepresence locations. The carrier's Global Meeting Exchange (GMX) service also connects to service providers including Telus, UAE-based Etisalat and Saudi Arabia-based Mobily in the Middle East, PLDT in the Phillipines and more, (See Philippines Gets TelePresence, Tata Extends Telepresence With Cisco, Singapore Gets Telepresence Facility and Verizon, Tata Push Telepresence Ties.)

"Others are one-region centric or their exchange is only existing in the U.S. market, and you get redundancy issues and some delay issues, some challenges with that," Ryan says.

Global telepresence hasn't taken off as fast as or to as great an extent as many first thought, which Ryan is willing to concede. But Tata's U.S. operation is firmly focused on the largest multinational corporations, and within that crowd, telepresence offers a substantial savings over the cost and hassle of travel.

Ryan says Tata is ready for the next phase of global telepresence: Linking personal connections, via PCs and tablets, instead of requiring people to go to a corporate telepresence room or a public one.Tata's Ethernet service is also unique. Tata was the first global carrier to deploy Provider Backbone Bridging – Traffic Engineering (PBB-TE) on a global scale. That makes its Ethernet service more scalable and easier to secure from D-DOS attacks because of the way it handles addressing. PBB also lets Tata offer its multinational customers an easier way to scale up their global services as needed. (See Tata Comms Unveils Next-Gen Ethernet Network.)

"You can get a 10Gig port, but you don't have to pay for 10 Gigabit capacity between two ends of the earth," Ryan says. "Bridging capability allows us to offer our customers a chance to be much more flexible in how they can scale if they need it or burst as they need it. The fact that this is deployed globally now gives us a competitive advantage in that marketplace as enterprises look to Ethernet for the next wave of global connectivity."Concentrating on vertical segments enables unique offerings. This is probably the most difficult claim for Ryan to make because Tata is not the only service provider focusing on specific market segments, and two of its four prime segments –- banking and finance, media and entertainment -– are being targeted by multiple telecom providers and every CDN provider, respectively. The other two are manufacturing and the IT/ITES industry, the companies handling corporate outsourcing.

Tata has more than 1 million square feet of data center and collocation space in 42 sites globally, from which it can offer vertical solutions.

"With a high volume of network capacity, data centers, a global reach, now we are putting ourselves in the position of thinking like a manufacturer or video content providers and offering solutions to get us out of a point-to-point commodity service provider," he says. "We are adding value to those four verticals."

It's a touch ironic that one area to which Tata isn't yet adding value, at least in the U.S., is in cloud offerings, considered the hottest play by most service providers. That's because its target customers, the largest multi-nationals, aren't rushing to the cloud, or necessarily buying its hype, Ryan insists.

"I'm not completely convinced that those companies we have a particular strength in have decided that they are going to close their data centers around the world and hand it off to the cloud," he says.

Tata is offering cloud services in its home market of India and will add that capability as it becomes more apparent what its customers expect, he says. (See Tata Gets Cloudy With Google.)

— Carol Wilson, Chief Editor, Events, Light Reading

You May Also Like