The IPTV revolution has started stateside, but what's next? * Next-gen TV * Better technology * Finding value

December 8, 2008

Telco IPTV is quivering between being the next big thing in U.S. mass-market media and a me-too justification for a very expensive long-term fiber-access rollout. Will IPTV really work for the telcos? Where does it go from here?

After one of the longest gestations in the history of North American telecom services -- the first implementations having occurred in a small way in the late 1990s -- telco IPTV has finally reached a sizable early-adopter phase, with U.S. carriers such as AT&T Inc. (NYSE: T) and Verizon Communications Inc. (NYSE: VZ) moving aggressively ahead with their deployments. By fall 2008 these two had about 1.5 million IPTV subscribers between them, although the figures are slightly misleading because Verizon is running a hybrid IPTV system. (See What’s IPTV?)

Elsewhere, IPTV indeed seems to be beginning to boom. By the end of 2007, Asia-Pacific (mainly China, Hong Kong, South Korea, Taiwan, Singapore, and Japan) accounted for about one third of the world’s then 10 million or so IPTV subscribers. Hong Kong has seen particularly rapid take-up: Over 40 percent of DSL subscribers now use IPTV, following its 2003 launch by incumbent telco PCCW Ltd. (NYSE: PCW; Hong Kong: 0008) and the Hong Kong Broadband Network Ltd. (HKBN) , according to the International Telecommunication Union (ITU) ’s "Asia-Pacific Telecommunication/ICT Indicators 2008." And significant IPTV deployments are underway in such European countries as Belgium, France (over 3 million subscribers), Italy, the Netherlands, Spain, and Sweden.

And rapid growth is forecast. Analyst firm Infonetics Research Inc. estimated earlier in 2008 that there will be 93 million IPTV subscribers worldwide by 2011. Similarly, Pyramid Research, in January, predicted that the IPTV market worldwide would have 99.4 million subscribers by 2012. Strategy Analytics estimates that U.S. IPTV service revenues will approach $14 billion in 2012, growing from $694 million in 2007.

In the U.S., total IPTV subscribers went from a mere 17,000 in 2004 to more than 1.6 million at the end of 2007, according to Pyramid Research . Pyramid's October 2008 subscriber data contains a forecast that puts the U.S. as having more than 10.4 million IPTV subscribers by the end of 2011, with nearly 60 percent of those connecting to the service via fiber-to-the-home.

Now comes the but. Although the U.S. has clearly passed the initial technology hurdle and is probably getting close to the end of the early-adopter phase, the country is still at a point where the number of subscribers is very small compared to those for traditional forms of video delivery -- over the air, cable, or satellite.

“The general consumer today has a couple of choices for pretty good video content delivery,” says David Foote, chief technology officer for GPON vendor Hitachi Telecom (USA) Inc. “IP video itself does not yet provide a compelling reason to switch away from traditional satellite or cable TV, for example. But you can see on the horizon some compelling potential reasons to do so eventually.”

This gets to the root of the problem. The U.S. pay-TV market is served by a very mature cable industry, as well as a robust satellite industry -- and, of course, there are over-the-air TV broadcasting and upcoming alternatives such as Over The Top (OTT) Web/Internet video services, too, as the following video discusses:

The established cable and satellite players have highly honed strategies for customer retention, and the cable operators have been very aggressive in building triple-play TV/video, broadband, and VoIP bundles that have gone down well. So there is currently a strong element of me-too in the telcos’ IPTV as they try to get a foot in the consumer’s door. That reality has led to unprecedented price competition, as discussed in the following video, which recaps a recent Heavy Reading consumer survey:

What will really count for the telcos is whether (and, if so, how quickly) they can reach the tantalizing things on the IPTV horizon, and whether they turn out to be a mirage or not. As Light Reading’s sister site Cable Digital News recently pointed out, there’s quite a list of issues that could take some of the shine off telco IPTV, and this report looks at a few more. (See Top Five Telco TV Threats .)

So it’s still too early to judge whether IPTV is going to be a success or not, although, clearly, the early technical hurdles have been overcome and it most definitely works. The question now is: Where does IPTV go from here?

Here’s a hyperlinked contents list:

{column}

Page 2: What’s IPTV?

Page 3: US IPTV Now

Page 4: Next-Generation TV

Page 5: What’s the Point?

Page 9: Evolving IPTV: Add Value...

Page 10: ... And More Value

— Tim Hills is a freelance telecommunications writer and journalist. He's a regular author of Light Reading reports.

Next Page: What’s IPTV?

IPTV is TV (and other forms of video, such as VOD) over IP packets, and, as the telecom future is seen as eventually everything over packet networks, there are no surprises there. But not all IPTV is the same, and some distinctions need to be made. In particular:whether the distribution network is a closed, managed service-provider network or the open, public Internet; and

whether the system is pure IP only or a hybrid between IP and another video-transport technology.

In the strict sense of the term, telco (or service provider) IPTV refers to the combination of closed, managed network and pure-IP system. So the telco completely controls everything -- network, service, quality, content, and user experience -- and it’s all done via IP, whether linear broadcast TV, VoD, or all the numerous backchannel matters such as service control. This is AT&T’s U-verse approach, for example.

In contrast, the new generation of OTT (over-the-top) Web/Internet TV/video providers, such as Hulu LLC and Joost , and generic broadcasters’ catch-up services may be all-IP, but they rely entirely on the public Internet as the distribution network. With the current largely best-effort nature of the public Internet, this means accepting certain limitations on what can be done -- for example, a movie download service is more natural for the OTT treatment than streaming real-time HDTV.

But there is also strong interest in a third IPTV type that combines the closed, managed network with a hybrid approach to the video transport. This relies on what is effectively a technological fluke: The GPON (see, for example, Who Makes What: GPON Equipment) and EPON FTTH technology adopted by a lot of telcos works by broadcasting downstream the optical signals to all subscribers served by a particular PON. So, by adding an extra wavelength that is separate from those used for the IP packets, it’s possible to use another technology to transport broadcast TV signals. Flashier things, such as VoD and system control, are handled by the independent IP channel. Very conveniently, the long-established cable RF system for linear video broadcasting can be carried over pretty well wholesale by using technologies such as RF Overlay and RF Over Glass. (See The Future of Fiber Access.)

So an attraction of the hybrid approach, notably adopted in the U.S. by Verizon, is that it gives a telco a quick entry into a big slice of the me-too aspects of cable TV -- conventional linear broadcasting -- by removing the complications of broadcasting hundreds of real-time channels across their IP network. Further, it can also work for the cable competition, as it gives cable operators a way of beginning their own migration toward IPTV.

“Installing RF Over Glass (RFOG) creates a FTTH network using the same topology that PON systems require, and the network operator can continue using RF technology over that network with no subscriber impact,” says Shane Eleniak, VP of Business Development, Alloptic Inc. “Then that RFOG network can be overlaid with a PON (EPON or GPON) system while leaving the RFOG system in place and without service disruption. That lets the network operator deploy IPTV on a per subscriber basis, which eliminates the risks of a slash cutover of services on a large area.”

In principle, IPTV is independent of the broadband access network used to connect to the customer, but the high bandwidths required by video signals (especially if multiple channels have to be sent simultaneously to the same home) have a huge practical impact. Generally, telcos see fiber as the long-term core solution (either FTTH as done by Verizon or FTTC with VDSL as by AT&T), but all-DSL solutions (such as ADSL2+) are also used (also by AT&T, for example) for more limited services.

But it must be stressed, as covered in the recent report, "Guide to Open IPTV Standards," that there is much more to IPTV than just IP packet transport of video signals. A huge amount of standards effort is going into developing such things as the management to provide the required level of QoS/QoE, security, interactivity, and reliability over managed IPTV networks. As an indication of the sort of work now in hand, the Open IPTV Forum -- an industry body -- finalized in September 2008 parts of its Release 1, covering:audio/video media formats content metadata

protocols for home network, user-network and network-network interfaces

declarative application environment

procedural application environment

content and service protection.

Given all these developments, what’s being done with the technology?

Next Page: US IPTV Now

Currently, U.S. IPTV provision is heavily biased toward the two largest Tier 1 telcos, AT&T and Verizon, but with a growing scattering of smaller players among the Tier 2 regional and Tier 3 rural telcos, CLECs, municipal and utility networks, and others. But even at the top, support is not yet solid, as the smallest Tier 1,Qwest Communications International Inc. (NYSE: Q), has yet to declare its IPTV intentions publicly.

"There are some 1,500 Tier-2/Tier-3 players in the U.S.," says Richard George, North American manager of advanced video advertising provider Packet Vision Ltd. , which has developed an addressable advertising solution for IPTV. "They are in various stages of considering IPTV or TV products. At a macro level, I would say that roughly one-half have aspirations to play in the TV space; probably half of that number (about 25%) may have the sophistication to be able to contemplate launching service, and half again (about 12%) are probably at some stage of deployment."

Generally, everyone recognizes that broadband access is the foundation of future fixed-line telecom services, and that video in various forms is going to be a big part, but this isn’t the same as saying that a telco must offer an IPTV service. As always, the issue is the business case, and most operators have struggled with it, as paybacks can typically be up to eight or nine years. But it seems to have been particularly awkward for some of the Tier 2 telcos, which remain as yet uncommitted. Their markets typically embrace a mix of small and mid-sized towns in rural regions, and the lowish populations and densities, combined with longer distances, don’t help the economics.

Interestingly, the situation at the smallest, Tier 3 end of the business appears to somewhat easier. Hitachi’s Foote points out that his company was providing ATM switches in the mid '90s to small telcos in the Midwest for switched digital video, which can be viewed as a precursor to IP video. It ran over ATM instead of IP, but the basic concept was the same -- stored digital content in a server, some of it is broadcast or unicast, and some available in as rather limited VoD.

"Some of those telcos have started to upgrade to IP video," he says. "They have been doing it for over 10 years and are very comfortable with it, and, for them, it was primarily just a transition from ATM transport protocols to IP transport protocols. That does have impact on the equipment you use, but the fundamentals of the service, what they are trying to do, how to market it, and so on, and support their customers -- they are very familiar with all that."

A true boom

Both AT&T and Verizon are pushing their TV services hard, and are essentially scrabbling to get the subscriber numbers up as fast as they can and to put early deployment problems behind them. (Such problems include AT&T’s exploding cabinets and Verizon’s dodgy electrical grounding, both extensively covered by Light Reading -- start at Exclusive Photos: Fire to the Node, Part II and Verizon Opines on Grounding Gripes.) In this vein, AT&T in October 2008 took the unprecedented step of saying it would sell U-verse services at Circuit City and Wal-Mart retail stores -- but it has set itself the target of having more than 1 million U-verse TV customers in service by the end of 2008, and time is running out.

But, for both these operators, there are high strategic stakes that mean normal business rules are being relaxed -- Tier 1 telco TV is a survival play, so it’s going to be big and will not be allowed to fail.

"Their financial expectations are lower than they would typically be for a new service introduction,” says Curtis Howe, president and CEO of Mariner xVu , an IPTV systems integration specialist. "Once of the key drivers in this market has been the retention of telephony customers as opposed to the inherent profitability of IPTV itself. So retention typically plays a significant part in the U.S. or Canadian business cases. And that is really retention against cable-TV triple play which has been very, very effective in North America in taking market share."

Sneakily, the archrival cable operators themselves have begun to take an interest in IPTV, although this is as yet very low key. They have been evolving their infrastructure to be more IP friendly over time, and some of the bigger operators have made steps in the direction of IP. But there is not yet the same level of commitment to IP video among the cable operators here as there is among the telcos.

An overriding problem for the cable operators, especially because of Verizon’s FiOS FTTH deployments, is to upgrade their HFC plant to be able to compete purely on a bandwidth basis. This means node splitting, upgrading to DOCSIS 3.0, and upgrading to 1GHz on their spectrum allocations across the coax.

"They are starting to do some switched digital video, but that is to reclaim bandwidth on the coax for high-speed data, so it is not really what I would call IP video," says Foote. "But I think they realize that they are going to have to offer at least some subset of IP video services. However, they have invested so much money in RF transport, RF headends, and a whole RF-oriented delivery mechanism, that to tell Wall Street they are now going to spend much more to do something similar with IP would probably get them punished pretty severely. So I think they have to introduce IP video slowly and incrementally."

Next Page: Next-Generation TV

With so much push for IPTV from the big players, it’s not surprising that the industry is thinking in terms of a tenfold or so increase in subscriber numbers to around 17 million or 18 million by 2012 as hockey-stick growth kicks in. But raw numbers don’t tell very much about future of IPTV in U.S. because the whole nature of U.S. TV as a medium is also changing profoundly.

One change, of course, is in the demographics of the youth market, one of the key TV viewing segments commercially. This century has seen the rise of the Echo Boomers, who are the sons and daughters of the Baby Boomers and form the generation that has grown up with PCs, cellphones, video recorders, and multichannel cable TV -- and has also become pretty familiar with broadband Internet, file sharing, home cinemas, iPods, HD-DVDs, and all the rest of it. For these -- and for many others, too -- the concept of watching traditional linear broadcasting as the main form of TV is dead. Instead, viewing is personalized by a pick-and-choose process of video recording and downloading of favorite shows.

While this essentially interactive style of viewing plays well to IPTV’s capabilities, it creates a huge problem of achieving a critical mass of viewers to keep the advertisers happy, and hence for the telcos’ business model.

"The challenge is how you go from a broadcast untargeted message at a cheap cost per unit, to a targeted effective message at a high cost per message," says Andrew Burke, CEO of IPTV set-top-box vendor Amino Communications Ltd. "Gone are the days of the mass market where everyone sits down to watch at the same time at 6:00 p.m. in the evening. So we have to get cuter. This means looking at the likes of IPTV, experimenting with it, learning from it and driving greater effectiveness now because the market is not going to wait."

At the same time, HDTV has rapidly become the new default standard, so no telco can now introduce a TV service without supporting it, considerably increasing the ante in terms of network bandwidth, as made clear in this LRTV special:

And there is a lot more in the technology pipeline in terms of video format developments that will chew up even more bandwidth. Spare a thought, for example, for NHK (Nippon Hoso Kyokai)’s ultra-high-definition Super High Vision TV signal, which, even when compressed, requires 160 Mbit/s to 600 Mbit/s for video and 7 Mbit/s to 28 Mbit/s for audio. (See The Future of Fiber Access.)

{column}There are also now many ways of distributing TV services, as the Echo Boomers well know. These include traditional terrestrial broadcasting, traditional RF cable TV and satellite TV, and the newer methods, including fiber-based IPTV, RF Over Glass, OTT Web TV/video (of various types), video players (of various types -- DVD, Blu-Ray, iPOD-type, PVRs/DVRs, network based, and so on), fixed wireless (such as WiMax) and mobile wireless (3G and 4G/WiMax in the future). A difficult question is how these different methods will interact and affect the market for TV and video.

One indication of the complexity of the answer may be provided by Sezmi, a recent U.S. startup that aims to launch commercial services by the end of 2008. Sezmi Corp. is aimed squarely at what, borrowing a leaf from the Web, has become known as TV 2.0 -- a marriage of TV and the interactive, user-oriented Web 2.0. The company has developed its FlexCast video distribution technology to combine terrestrial digital broadcast TV with existing broadband infrastructures. By using available capacity in existing digital TV broadcast networks, it is able to create a private, secure broadcast transmission for content.

The point is to put all video, including broadcast and cable network programming, movies, and Internet video, into a single package that is accessed through a user interface oriented to highly personalized on-demand use; content can be organized on a named-viewer basis within a household, for example, and playlists can be shared between users within and without the home. Naturally, this gives the possibility of highly targeted advertising.

Another twist to the TV 2.0 idea has been added by industry giants Intel Corp. (Nasdaq: INTC) and Yahoo Inc. (Nasdaq: YHOO), which previewed plans for a TV Widgets Channel in August 2008. According to the companies' joint statement, this is “a television application framework optimized for TV and related consumer electronics devices that use the Intel Architecture. The Widget Channel will allow consumers to enjoy rich Internet applications designed for the TV while watching their favorite TV programs.”

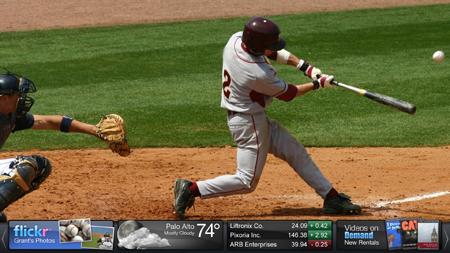

In other words, there will be plenty of other things to look at and click on when your team isn’t doing so well, as Figure 1 shows. And it may be a mistake to think in either/or terms. Just because a telco has launched an IPTV service does not bar it from consorting with the enemy and offering a Web TV service as well. In Europe, Telecom Italia (TIM) has done just this by launching an OTT Web TV service to complement its existing IPTV service. It hopes the new Web-based video offering will allow it to expand its brand and give it an edge against competitors such as Fastweb SpA (Milan: FWB).

And it may be a mistake to think in either/or terms. Just because a telco has launched an IPTV service does not bar it from consorting with the enemy and offering a Web TV service as well. In Europe, Telecom Italia (TIM) has done just this by launching an OTT Web TV service to complement its existing IPTV service. It hopes the new Web-based video offering will allow it to expand its brand and give it an edge against competitors such as Fastweb SpA (Milan: FWB).

In the U.S., Toledo Telephone has said its partnership with video-on-demand specialist VUDU Inc. is allowing it to more easily sell premium broadband subscriptions. (See The Next Black Swan Is a 10-Foot GUI.) Certainly, telcos can use both IPTV and Web TV as an aid to market segmentation.

"OTT content is a major opportunity for the IPTV operators to create a competitive differentiation because the infrastructure they have deployed, including their IP-based set top boxes, is more suited for the OTT content -- the long-tail content, if you like -- than the existing cable infrastructure," says Mariner’s Howe. "So we see that as a key opportunity for IPTV operators bringing OTT content onto the TV over a managed IP network."

Opportunity, competitive differentiation... these are words the telcos like to hear. So what do telcos hope to get out of the big and expensive push into IPTV?

Next Page: What’s the Point?

There are several positive perceptions now clustering around telco IPTV. These include:It offers higher-quality video services than conventional cable TV.

It has the ability to offer very tailored and personalized VoD and other services through the sophisticated control and management mechanisms supported by the IP backchannel, which will also support two-way services.

In contrast to Web TV, telco IPTV is a closed environment (walled garden) for the operators and service providers, and so it allows differentiation and premium services. Having control over the user interface and the electronic programming guide (EPG) is clearly a very big plus.

TV is a very big dollop of glue with which to consolidate diverse customer services (and those from different suppliers) into a single package.

Potential to converge all services through a single home network, with the TV forming a key part of the customer interface.

Customers seem to like the idea.

Strategically, U.S. telcos have both shorter- and longer-term aims for IPTV. As pointed out already, me-too linear broadcast TV levels the playing field with the cable operators in triple play, which is the immediate competitive threat. But, since telcos have been able to obtain bandwidth advantages over cable from their new fiber access networks, they have tended to use better high-speed Internet access, combined with VoIP, as the main hook to capture customers, rather than video services per se.

But now that is starting to shift as telcos look to the longer term. They are starting to emphasize their video services more, to introduce new interactive possibilities based on user-experience (types of widgets, GUIs, and applications), and to develop some of the IP-based convergence ideas that would distinguish them from the cable companies longer term. Essentially, the aim is to make their video services distinct from what the cable companies and the satellite companies offer, and this means finding some major market differentiators, which could be as simple as a killer feature or function.

And the ultrafast-broadband/IPTV combination is a good one for just plain empire building. As Taran Singh, triple play product manager of test vendor Ixia (Nasdaq: XXIA) points out, expanding into new geographical areas through a straight push for more subscribers can be a strong move because the telco can deploy access technologies that are very good and offer very high bandwidths to attract new customers.

“I think that is the first step they will take, because once they can get a customer they want their eyeballs first and then they can work on enriching their experience and keeping them there,” he says.

The IPTV industry is naturally full of ideas of how the interactive side could develop. Some are wonderfully batty, such as follow-me-anywhere video that switches automatically from cellphone to the in-house fixed-screen TV when the owner enters (if I’m watching the movie on my cellphone, how do I manage to put the key in the door? Does that open automatically, too?).

But video nirvana is not reached overnight, and there is still work to be done by the telcos before they can reap such exotic benefits.

Next Page: Evolving IPTV: Systems Technology

IPTV certainly works, and the well-reported early-stage problems, particularly with middleware, are effectively over. But this still leaves a lot of technology challenges in moving smoothly from the early-adopter to mass-deployment stage.

"The technical feasibility requirements have been met, at least for early adopters," says Alloptic's Eleniak. “However, scaling to ubiquitous deployment requires that the technology move from ‘possible’ to ‘easy,' and those technology challenges have yet to be addressed on a large scale.”

All areas of IPTV technology have seen significant improvements in the last few years: components, routing, compression, middleware, and the access network infrastructure itself. What challenges the industry now is the nexus of issues that includesComplexity, scalability, and interoperability

Ensuring quality of experience

Effective and easy in-home video distribution.

Complexity, interoperability, and scalability

IPTV is software driven -- and is thus inherently complex -- and inevitably also raises issues of interoperability in a multivendor environment. The increasing complexity of services and features and the need to incorporate flexibility are sources of problems, as is the quality of some vendors’ support, according to some telcos. And, despite much improvement from the early days, middleware still seems to be creating problems. Market-research firm Infonetics Research expects a spending spree on IPTV middleware during 2008 and 2009 because many of the early IPTV service providers are running into scaling issues with their off-the-shelf middleware.

Complex software-driven systems with elements sourced from multiple vendors can be a nightmare because as soon as any vendor in the value chain changes a piece of software it might cause a problem elsewhere. This means that the system integrator has to retest to ensure that some new bug has not been introduced, which implies a cost for both the vendors and the service providers.

And what can be termed frontend testing of middleware innovations in particular is often difficult, Ixia’s Singh points out, because by definition it requires the test to do something new and possibly complex.

“A lot of frontend testing is not generally done in a way that is actually repeatable,” he says. “It is a little more ad hoc, a little more creating something new, and you test it as a one-off as part of a development test. It is generally not part of an overall test plan. However, it should be. It plays a central role in the delivery of the IPTV service.”

Complexity does, however, create an opportunity for some vendors as the numerous smaller telcos and service providers in particular will usually need help with the system integration, and the trend in the U.S. is to appoint the access vendor as the prime system integrator. Hitachi Telecom, for example, does this under the slogan: “From source to subscriber."

“The idea is that we bring together a whole family of solutions, and bring in known partners that we work with,” says Hitachi’s Foote. “We verify the interoperability, and we know it all works together. So it’s a fixed set of end-to-end pieces that we know works.”

Huge scalability is essential -- and a big challenge if telcos are going to scale to support, say, a tenfold increase in user numbers in certain geographies in a full mass-market deployment. This is still very much an open issue because there is so little real experience, and a lot of the difficulty comes from the integration of technologies, services and software from different vendors.

There aren't any IPTV networks with more than 10 million linear video subscribers. "So, how do IP-based video networks, including IPTV and IP VOD go to, say, 20 million subscribers? That will be the next big challenge in the U.S.," says Robert Winters, CMO of test vendor Shenick Network Systems Ltd.

And it’s not just a question of integration. Mass-market scalability, coupled with the fact that bandwidth-hungry HDTV is now de rigueur for U.S. IPTV deployments, also means that bandwidth scalability is going to be a big issue for telcos. The problem does not reside so much deep in their network cores, where there tends to be much more bandwidth available than is commonly supposed, but more out toward the edge and the access networks.

Despite the use of switched video and distributed video caching, for example, telcos may still have to have to settle for some degree of customer oversubscription and access control if they are to strike a financially acceptable balance between cost and service availability. How some unlucky customers may react to a service unavailable message when settling down to enjoy their favorite program remains to be seen. Throwing a beer can at a 60-inch plasma TV is expensive.

Vendors, such as Shenick, are producing test and monitoring equipment to help telcos assess their bandwidth capabilities and real-time associated audio availability in an effort to maintain one of the key attributes of IPTV: user quality of experience.

Next Page: Evolving IPTV: Quality of Experience

Like shopping, dining out, and vacations, IPTV can’t be offered these days without a lot of attention to quality of experience (QoE). It’s important here to distinguish QoE from the more familiar quality of service (QoS), which in telecom tends to be used in the very restricted sense of a service satisfying a number of prespecified and measurable network performance parameters -- for example, maximum and minimum bandwidths, maximum latency, and so on. Although IPTV services must be offered to certain levels of QoS (otherwise they wouldn’t work properly), QoS alone is insufficient since it doesn’t say much about how the video application itself is working.

This is the task of QoE, which effectively takes the end-user view of how the subscriber service is working -- how it is experienced by the user. That much is made clear in this soundbite montage from LRTV on the subject of IPTV QoE:

That QoS is not a reliable guide to QoE is easily shown: A dropped packet in the network may set off an alarm for a QoS failure, for example, but may pass entirely undetected on the viewed video and so have no impact on QoE.

Unfortunately, it also works very much the other way, too. A large Tier 1 service provider suffered an embarrassing large-scale failure in 2007 when an OSS problem led to some subscriber content viewing rights to be lost, so these customers couldn’t access what they wanted to watch. In this case there was absolutely no network-level problem, and so there were no QoS alarms or information for troubleshooting.

In another example, Mariner reports that its QoE service monitoring system has been able to identify core network problems that raise no alarms, but severely impact the user’s QoE. In one case, the QoE monitors detected a number of set tops that had dropped off the network. However, there were no alarms in the network operations center (NOC) to say that anything was wrong with the network.

"It turned out that there was no hardware failure or corrupted software, but a router had been installed in another community, several hundred miles away, with an IP address that duplicated a router serving those set-top boxes," says Mariner's Howe. So customers were seriously affected, and the QoE monitors reported it, even though the problem was not visible to the standard network management systems used in the NOC.

{column}Operational frontier

Such examples highlight the fact that IP networks in the U.S. have more of a challenge in delivering QoE compared to conventional satellite or cable networks. Howe argues that, once they have overcome the initial integration challenges of IPTV, the next frontier for North American IPTV is to make it work better in an operational sense.

“The big challenge becomes operating the service and making it a reliable service of consistent quality for the end consumer. As leading operators have started to scale their services up in the market, QoE is now emerging as a key issue," he says.

The industry is rising to the challenges posed by QoE, and new methods of testing and monitoring are emerging. Mariner’s system, now installed with a couple of operators, monitors the service right at the set-top box, studying the various transactions, the quality of the content coming in, accesses to VoD, the EPG and so on, and reporting on those in real time. This data is synchronously correlated to provide a real-time picture of what is happening across the entire customer base.

And Ixia’s Singh points out that the extensive lab testing that is usually done pre-deployment can be brought back into play to resolve issues thrown up by live networks and services, where it may not be practical to troubleshoot at the level of individual customers.“Because they have built these labs in the past to test services, telcos can bring the scenario back into the lab and try to recreate the real conditions so they can see the effects of the problem,” he says.

Ultimately, in a highly competitive consumer market like video, QoE will go much further than the experienced video and service quality. It will have to embrace the whole consumer package: pricing, convenience, range of content, and so on. All this is a key to telco differentiation from cable and other forms of TV distribution, such as OTT Web TV.

Next Page: Evolving IPTV: In-Home Distribution

Literally last in the IPTV delivery chain is the home network. This is quite a challenging environment in North America, partly because the number of TVs (and PCs) per home tends to be high, so home networks tend to be fairly complex.

Operational challenges with installation, troubleshooting, repair, and testing can emerge from the combination of home network environment, the last-mile infrastructure, and, to a lesser extent, the application-level software. Mariner’s Howe says remote QoE monitors detect a significant frequency of silent failures in the home: The QoE data are now being used to proactively solve these problems and improve customer satisfaction, often without the need for a technician to visit the customer’s home.

Lior Weiss, VP of marketing for wireless home-networking vendor Celeno, points out that IPTV virtually mandates home networking simply because the broadband access point and the TV(s) are seldom in the same room.

“Although today, some home-network solutions are capable of a single standard-definition video stream distribution, carriers are facing many challenges when seeking technology that would support multi-high-definition streams for in-home video distribution,” he says. “The carriers are looking to alleviate the pain points, which are high video quality, no truck rolls, and resiliency to interferences.”

There is now a range of technology options for video home networks, including those that aim to reuse existing wiring, such as HomePNA 3.1 (aka ITU-T G.9954) for twisted-pair phonelines or coax, and MoCA 1.1 for coax only. Wired Ethernet cabling (CAT5) would be ideal for home networking, but to the mass market it is pretty much irrelevant, as very few houses have it.

There are also the various electricity powerline options, although there are lingering issues over robustness and susceptibility to electrical interference, and there is the disadvantage of no dominant standard. A primary issue, of course, is whether any particular wiring installation is actually either extensive enough or free from defects to require no further attention from the telco, or whether upgrading or extensions will be needed. This is particularly relevant when the telco is trying to wean away an existing cable-operator subscriber with a multi-TV coax network.

Wireless bliss

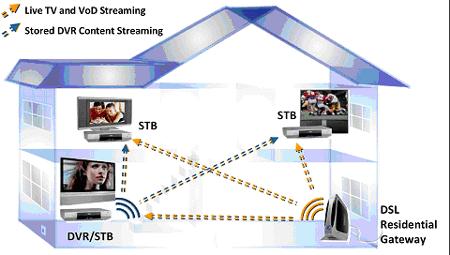

According to Weiss, the carrier’s nirvana would be no (new) wiring, self installation by the user, on-target performance, and low cost. Wireless video home networking (see Figure 2) has very obvious attractions for the first two, and recent technology improvements are bringing the other two into reach. The sticking point is that video home-networking performance requires a definite combination of range, throughput and consistent robustness. Achieving just one parameter by itself will not meet the necessary QoE, and a combination is needed: enough throughput for multiple HD streams (starting at around 30 - 40 Mbit/s and may reach even 80 Mbit/s in demanding scenarios such as a whole-home DVR) across distances, ceilings, and walls, while not dropping a single packet (which may translate immediately to a video pixelization or flicker). Arguing that there is an industry consensus that current off-the-shelf 802.11n chipsets implementations do not comply today with carrier’s requirements for reach, robustness, and throughput, Weiss believes that something fundamental has to change at the silicon level, and that beam-forming MIMO and other channel-aware smart technologies address better the requirements for video distribution over WiFi, while still maintaining compatibility with 802.11n. (See Raising a Ruckus With U-verse.)

Arguing that there is an industry consensus that current off-the-shelf 802.11n chipsets implementations do not comply today with carrier’s requirements for reach, robustness, and throughput, Weiss believes that something fundamental has to change at the silicon level, and that beam-forming MIMO and other channel-aware smart technologies address better the requirements for video distribution over WiFi, while still maintaining compatibility with 802.11n. (See Raising a Ruckus With U-verse.)

Having multiple types of applications apart from IPTV running on the home network will create complications for both vendors and operators. Separation of the time-sensitive traffic such as video and voice onto 5GHz spectrum and the best-effort data traffic onto 2.4GHz spectrum will simplify things.

“But even that by itself won’t be enough in the long run, and vendors will have to build sophisticated QoS mechanisms to guarantee service and capacity in the home network to enable the desired quality of experience expected,” he says. “Turning today’s WiFi hub to a true WiFi switch architecture will be key for the home-network evolution.”

But technology alone is not going to be enough to make telco IPTV into more than a me-too service. Telcos have to use it to add value so that they can extract premium revenues or at least beat the competition for customers.

Next Page: Evolving IPTV: Add Value...

The question of what telcos should do to exploit the potential of IPTV fully has been getting a lot of attention now that the first large-scale commercial deployments are beginning to take off and IPTV begins to enter the mainstream.

This was a big theme at the July 2008 IPTV World Forum, held in Chicago, and again at November 2008 TelcoTV show, in Anaheim, Calif., with vendors at both shows stressing that telcos needed to do more to exploit IPTV -- it cannot remain just standard broadcast TV distributed via IP. Indeed, an editorial discussion at TelcoTV kept coming back to the themes of more content choices and more valuable services as levers to keep IPTV from being a commodity service that doesn't earn its keep:

Not long ago, telcos saw their principal video enemy as the cable operators, so the game was mainly to take away their customers -- whatever the telcos do had to translate into making their newly acquired customers more satisfied than they were with cable. Now the situation has become more complex with the increasing commercialization of OTT Web TV, mobile video, and so on. This means differentiating telco IPTV from other forms of TV distribution becomes even more crucial.

In this interview with VUDU's Edward Lichty, it's obvious that these new video on-demand services are at least as much of a competitive threat to telcos as they are a complementary piece of an overall video strategy:

Realizing the hope and threat presented by VUDU and others, U.S. telcos are pinning their hopes on a combination of three main points of differentiation:Just offering a better quality of overall customer service, with more attractive packages and price points.

Extending IPTV features and capabilities, and integrating and converging existing services and functions, to make a more appealing and convenient customer experience.

Targeting the customer personally in a very big way.

The first two can quickly be disposed of. Just as the cable operators have done a good job using a new technology (VoIP) to break into what the telcos tended to treat as a ho-hum boring voice monopoly, the telcos hope to use cable-operator complacency to do the same with TV and video. And the right combination of content, choice, and quality may be able to keep the Web TV challenge under control.

And telcos, with their networking background, think they are well placed to do all sorts of whizzy things based on running home networks through telco-controlled gateways -- for example, to converge different telecom services onto the TV, or to provide sophisticated network-based digital video recording and content management services.

But without doubt it is personalization that is seen as the differentiator that could have the largest -- and widest -- commercial impact. At the simplest level, personalization means making it easy for the customer to tailor their TV and video viewing through such things as sophisticated EPGs, VoD, and so on. At a more complex level, it means bringing IP-based personal interactivity into the mix, and there are lots of wacky ideas in the telcos’ labs on just how this fusion might lead to salable services. AT&T’s suggestion, made at TelcoTV 2007 in Atlanta, that an IPTV-based application able to track one’s family and friends in real time when they were flying across the country may not be one of them.

Targeted ad insertion

Where personalization does promise to prove a key commercial differentiator is in targeted advertising. Targeted ad insertion is now a big area of interest, as it ranges from straightforward localization (insertion of ads according to the locality in which the video is viewed) to highly personalized and targeted ads inserted according to monitoring and analysis of the viewer’s behavior and preferences. In the world of IPTV, Big Brother is keeping an eye on you, and big vendors, like Alcatel-Lucent, are placing big bets in the space, as noted in this interview of Basil Alwan, president of AlcaLu's IP division:

“There is a great deal of discussion to try to explore what an IPTV platform can offer in terms of applications versus what cable can do,” says Packet Vision’s George. “No one really has it nailed yet, but clearly advertising, by virtue of its place in creating incremental revenue for the operator, is a critical motivation -- and is feasible.”

And it should be a sizable market. Under FCC mandate (and unlike in many other national markets globally), U.S. TV distributors (whether cable or telco) are allowed to replace two minutes per hour of national ad slots with local ones. So U.S. cable networks have for years been doing local ad insertion, which Kagan Research estimated was worth $4.3 billion in 2006. But this localization is very crude, as the best case may be down to a zip code or a zone that includes a couple of zip codes, and is purely geographical. IPTV, in contrast, can go down to you or your living room.

Very little real IPTV ad targeting has been done yet in the U.S. (Verizon is still at the test stage, for example, although in some other countries -- such as the Channel4/Inuk IPTV service in the U.K. -- early targeting is in operation), and the initial efforts may be very limited and simple, such as showing different ads at different times of the day (time-based targeting), or by grouping viewers into a small number of broad categories. In practice, there is already a certain amount of implicit targeting in that IPTV requires fiber (whether FTTH or FTTC), and initial fiber rollouts tend to be in the more affluent demographic areas.

An obvious problem is customer privacy -- as ongoing controversies surrounding online behavioral tracking companies, such as Phorm and NetBuAd, illustrate -- but this hasn’t stopped a raft of vendors, such as Alcatel-Lucent, BigBand Networks, Microsoft, Packet Vision, RGB Networks, and Sotal Enterprises, from launching systems to allow IPTV operators to offer advertisers highly targeted ad insertion capabilities. However, there are differences between the various approaches and how they will be used that will have to be considered in such debates.

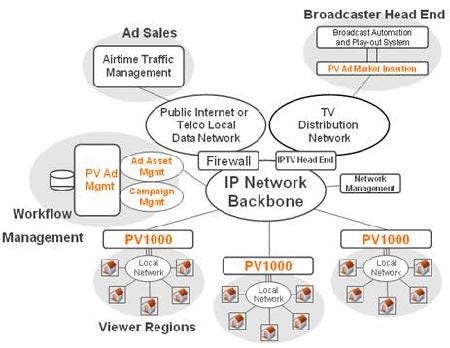

{column}A simple illustration of the possibilities is where Home A owns a cat and Home B owns a dog. Provided that the telco has been able to collect this demographic data (through a discount offer in exchange for a completed lifestyle questionnaire, perhaps, or by analyzing Web searches), since it knows which home is which from the active IP addresses, Home A can see an ad for cat food and Home B one for dog food at exactly the same time. And, of course, there is the usual business that viewers can use the IP interactivity to respond to special offers and so on. Figure 3 shows one way in which this kind of capability might be implemented. Multiplexing ads in this way not only gives the advertiser a more relevant audience, but also increases the number of ads that can be carried. The essence of addressability in the TV industry is that telcos can attract advertisers that are interested only in reaching one particular target market, and not having to pay for any overspill. If such capabilities become widespread nationally, as AT&T and Verizon clearly intend (aided by smaller telcos, too), there could be a revolution in TV advertising.

Multiplexing ads in this way not only gives the advertiser a more relevant audience, but also increases the number of ads that can be carried. The essence of addressability in the TV industry is that telcos can attract advertisers that are interested only in reaching one particular target market, and not having to pay for any overspill. If such capabilities become widespread nationally, as AT&T and Verizon clearly intend (aided by smaller telcos, too), there could be a revolution in TV advertising.

Testament to the concern that this prospect is causing the cable operators is Project Canoe, which has been funded by the top six MSOs to the tune of about $150 million. This is essentially creating a national one-stop platform for national advertisers to offset the fact that U.S. cable is deployed on a regional or metro basis, not a national one.

Next Page: ... And More Value

Another potential differentiator for the telcos compared to the cable operators may lie in the IP-enabled set-top box itself, for two main reasons. One is that an IP box makes it inherently easier to navigate IP content. Personalization and interactivity are very much at the heart of Web 2.0 services such as YouTube, Hulu, and other IP OTT video-oriented service providers, and are having a big impact on the evolution of the U.S. media and entertainment businesses generally. There is thus a natural fit between a telco IP infrastructure running into the IP home network and the hugely influential Web 2.0 services -- essentially, it is where the leading edge is.

In this LRTV interview, Entone president Steve McKay says that even though set-tops are generally fading in favor of home gateways, both types of IP devices can help operators integrate Web-based video into their overall IPTV offering:

IP set-tops also make a difference when it comes to targeted content, such as targeted ads. As Amino’s Burke points out, the foundation for sophisticated targeting is to take the consumption statistics at the TV, feed them back, and categorize the viewers, so that both content and advertising offers can be made, based on that categorization. Such categorization can be fairly basic to start with -- for example, movies can be classified by genre.

“It all follows on from there,” he says. “T-commerce, focused advertising, ad insertion, better upselling, and cross-selling of VoD catalogues, the deliver of long-tail content -- all these things will come from that basic understanding of the entertainment consumption habits of your customers.”

And the IP set-top box can play the role of the necessary in-home measuring device, as it understands a lot about what is going on -- for example, how well the service is responding, what the video quality is, what equipment is connected (say, a flat-screen TV or a basic tube display), how much of the EPG is used, what content is used, and what broadcast content is viewed.

All this is not going to happen immediately because it will require a new generation of sophisticated IP set-top boxes, which are only now beginning to appear, and the adoption of universal standards by the industry so that advertisers can be served uniformly nationwide. Fortunately, there is a lot of activity going on in industry bodies, such as the Open IPTV Forum, to address these issues. (See Guide to Open IPTV Standards.) Ultimately, the impact on the TV industry could be huge.

“It will become very apparent over time with the IP backchannel whether people are watching programmes, whether they are fast forwarding over advertising, or actually responding to those ad messages -- and whether product placement really works,” says Burke.

IPTV and videoconferencing

In all the inevitable excitement over consumer TV and video, it’s easy to overlook the potential of what might be called crossover services and applications. These are mainly aimed at businesses but can crossover into homes because a lot of people work there, if only sporadically. And one of the longer-term drivers for putting fiber into the residential mass market is to make home teleworking a mainstream activity for environmental, economic, and social reasons -- and a new source of revenue for telcos.

When IPTV reaches a home, it would be a small step for a telco to offer an IP videoconferencing service as well. IP videoconferencing is already an emerging trend for larger enterprises, often offered by telcos as part of an outsourced package of integrated computer and telephony (ICT) services, but there are also a number of operators that specialize in videoconferencing. Since operators these days make more money from data traffic than from voice, there is an obvious attraction in moving videoconferencing, which is data-traffic intense, down into new markets.

Joe Frost, VP marketing of Psytechnics Ltd. , a vendor of IP service-quality measurement solutions, points out that telcos do not really care what that data is; it's currently largely a mix of email, client server, and voice, but improvements in IP videoconferencing create an opportunity for a new service.

“It is certainly not perfect for mobile use, say, but what a telecoms operator or service provider is looking to do is to add to their enterprise-service portfolio home-based videoconferencing or personal video conferencing -- not just a branch-to-branch service,” he says. “The other big opportunity is to provide it for consumer use. I think that is going to be a massive new revenue stream for operators because video is much heavier on network bandwidth use, and it would be sold as a premium service. Real-time family videoconferencing, no matter where the family members are, is the next trend in terms of telephony. But the operators have to get the experience right or no one is going to pay for it.”

{column}So, as with consumer IPTV, QoE is crucial issue for operators, as focusing on network QoS alone is not enough. Essentially, this means monitoring in real time the actual user experience for the videoconferencing sessions. But this is going to be only part of the story, as there is then the question of troubleshooting a misbehaving session. Since the session may involve several different media, several different operator networks, and several home networks (which might use one of several technologies, including wireless), this will be quite a challenge. But, if telcos can crack the problem before it becomes a reality for consumers, it would be a strong value-add in itself as customers value service and reliability rather than pricing alone.

The new Bell system is born

If IPTV realizes its wider value-added potential, the TV could well become the future Bell phone -- the basic home wireline device through which the telco interfaces with its customers. Such a device would have to handle and deliver in a simple and usable experience a wide variety of content and sources: IPTV, VoD, broadcast content (terrestrial, cable or satellite), OTT content -- either taken off the open Internet (unmanaged OTT) or managed OTT through the IPTV conditioned pipe, and user-generated content on the home network or Internet (such as photo albums and videos).

And all this will be put into a full-circle TV model, where information and interactivity flow back into the telco network at the same time that the network is delivering content to the user, resulting in a highly personalized experience.

Says Amino’s Burke: “We are getting to the point where, if a fewtelcos start to deliver a more interactive, more full-circle solution, then the trend will be set, and I believe North America will be the market that will do it first.”

— Tim Hills is a freelance telecommunications writer and journalist. He's a regular author of Light Reading reports.Return to Page One: IPTV: Boom or Doom?

You May Also Like