Crown Castle, a bellwether for the 5G marketplace, recently posted a 2023 outlook that's below many analyst expectations. That could signal a general pullback in 5G network spending among operators.

Crown Castle, one of the nation's biggest cell tower operators and a bellwether for the sector, offered the market's first real look at what 2023 holds. And, according to most financial analysts, the company's overall perspective on next year is pretty "meh."

"At first blush, Crown Castle's initial 2023 outlook looks great (spoiler: we'll explain why it isn't)," wrote the financial analysts at MoffettNathanson in a recent note to investors.

"While our first look at Crown Castle's 2023 guide proved slightly ahead of what most were looking for from a headline perspective, we would caution investors that the devil is in the details," warned the financial analysts at Wells Fargo in their note to investors.

At the heart of the issue are one-time events that are helping to boost Crown Castle's overall expectations for 2023. For example, the company expects to receive a bump from T-Mobile due to the fees it will pay Crown Castle for canceling some of the small cells that Sprint ordered before T-Mobile acquired the company.

When those one-time events are stripped out of Crown Castle's overall 2023 financial guidance, it doesn't look that much different from Crown Castle's 2022 results. And that lack of growth – amid US operators' big 5G network buildouts – is sparking caution among some analysts.

According to the MoffettNathanson analysts, Crown Castle's overall 2023 numbers "are noticeably below forecasts."

One to watch

Crown Castle is one of the nation's three big cell tower operators, alongside SBA Communications and American Tower. Crown Castle owns 40,000 cell towers, 115,000 small cells and 85,000 route miles of fiber across most of the biggest cities in the US.

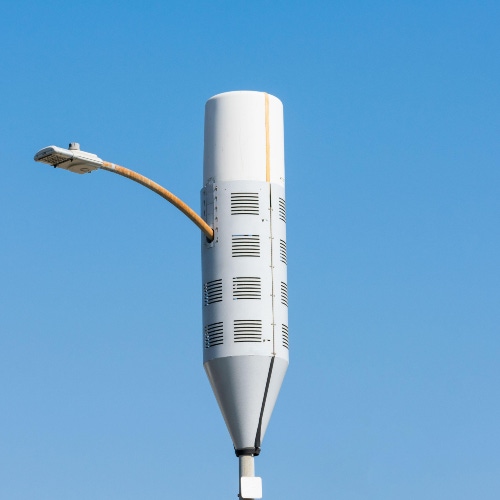

Figure 1:  Small cells often sit atop light poles.

Small cells often sit atop light poles.

(Source: Michael Vi/Alamy Stock Photo)

Moreover, Crown Castle routinely provides its next-year financial outlook during its third quarter, whereas much of the rest of the US telecom industry does so in the fourth quarter. Thus, Crown Castle is often an early indicator of which way the wind is blowing in the US wireless industry.

And, according to the 2023 outlook that Crown Castle supplied this week alongside its third quarter 2022 results, there's a bit of an ill wind blowing. Meaning, the company doesn't expect its big customers – AT&T, Verizon and T-Mobile – to spend very heavily on small cells and cell towers next year.

Crown Castle's overall 2023 forecasts "are likely to be viewed as disappointing," according to the financial analysts at Cowen. Indeed, the company's shares fell slightly to around $126 per share after the company released its third quarter 2022 results.

However, Crown Castle executives sought to offer a relatively positive outlook.

"We've seen the carrier investment cycle continue, and at this point, I don't have any concern that we're going to see a pullback from that front on the carrier side. They all have multi-year plans that they've shared with us. And they've obviously made sizable commitments to us around that, around those deployment cycles," Crown Castle CFO Dan Schlanger said during the company's recent quarterly earnings call, according to a Seeking Alpha transcript.

Broadly, Crown Castle executives said they continue to see demand for cell towers. As for small cells, they said the company expects to switch on roughly 10,000 small cells next year for the likes of Verizon and T-Mobile, up from 5,000 last year.

And the financial analysts at Raymond James also offered some positivity: "And in the case of any economic downturn, we believe carriers would be much quicker to cut back on various internal opex expenses and handset promotions rather than anything related to tower spending and leasing," they wrote in a note to investors.

A spending slowdown in the US

5G has been a hot topic for the US wireless industry for years now. But it certainly caught fire in 2021 and throughout 2022 as T-Mobile, Verizon and AT&T all spent heavily to expand their networks using valuable midband spectrum.

However, there are some indications that such network spending may start to slow beginning next year as US operators finish the initial part of their midband 5G network buildouts. Indeed, executives from both Verizon and T-Mobile have signaled that they expect to reduce their overall capital expenses (capex) starting next year.

That message is also beginning to trickle out from big 5G equipment suppliers. For example, Ericsson recently warned of a coming slowdown in North America, its biggest market. "Operators are guiding for lower capex in 2023," said CEO Börje Ekholm. His hope is that other regions will pick up the slack for Ericsson.

Some financial analysts noted that Crown Castle may be the first big US tower company to witness this spending slowdown because its network holdings are located in big US cities where operators have spent much of their initial 5G focus. SBA and American Tower, on the other hand, own towers throughout the US and therefore may not see a slowdown next year because operators will be working to extend their midband 5G buildouts into more rural areas throughout 2023.

Related posts:

— Mike Dano, Editorial Director, 5G & Mobile Strategies, Light Reading | @mikeddano

About the Author(s)

You May Also Like