Verizon CTO Ed Chan said the operator plans to speed up its small cell buildout starting in 2023. His comments, made to financial analysts at Wells Fargo, come after the small cell market in the US took a breather during 2021 as big network operators focused on building out their new midband spectrum holdings via bigger, macro cell sites.

"Verizon anticipates small cells activity will ramp in 2023 as activity shifts toward 16t16r deployments from early 8t8r deployments built in 2022," wrote the Wells Fargo analysts of their recent meeting with Chan. Newer 5G radios can generally support more antennas, including 16T16R configurations.

"Chan also referenced that a third party had taken longer to grow scale and expertise to handle the installs Verizon had planned, but that it is reaching a point where a higher mix will trend toward third-party deployments from self deployments today," the analysts added.

Verizon officials did not respond to questions from Light Reading about Chan's meeting with Wells Fargo executives. The meeting is not listed among the operator's recent public investor events.

The small cell news could be important to equipment vendors, ranging from Airspan to Ericsson to CommScope. Jennifer Fritzsche, managing director at investment bank Greenhill & Company, wrote recently that Chan's comments could presage a resurgence in the US small cell market. She speculated that Verizon could turn to third-party small cell providers like Crown Castle and ExteNet Systems.

10% but quickly growing

"Typically, Verizon has been the most front footed in its network approach (recall they were doing fiber to the home [aka FiOS] in 2007!)," Fritzsche said. "Time will tell, but we do not see AT&T or T-Mobile sitting back when Verizon is leaning in and getting that spectrum it paid so much for 'live.' Remember AT&T's two main talking points: 5G and fiber. Small cells touch both of these talking points in a big big way."

She added: "In my mind it continues to be a matter of 'when' not 'if' small cells grow and it feels like we are now (finally) a lot closer than we were."

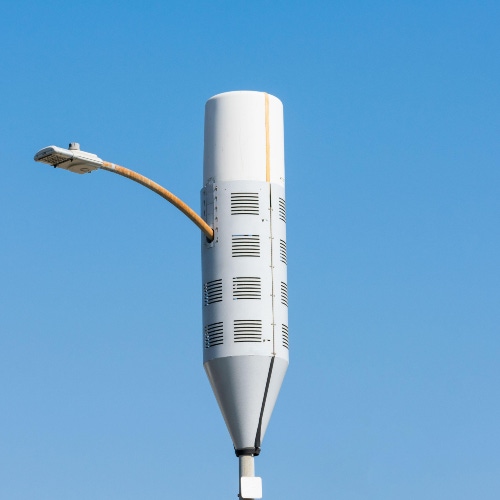

Figure 1:  (Source: Michael Vi/Alamy Stock Photo)

(Source: Michael Vi/Alamy Stock Photo)

Others agree. Executives at small cell companies including ExteNet and Airwaive have speculated about an upswing in small cells starting in 2023.

"In general, operators continue to rely heavily on the macro network to expand the coverage and improve the capacity, reflecting the superior RAN [radio access network] economics with macro cell sites," wrote analyst Stefan Pongratz, with research and consulting firm Dell'Oro Group, in response to questions from Light Reading. "At the same time, small cell investments are growing and will continue to grow at a faster clip than macros. Of course the diverging growth paths will not be enough to compensate for the vastly different starting points (small cells are roughly 10% of the total RAN market today) and macros are still expected to dominate."

The Big Red lead

Verizon is widely regarded as the leader in small cells in the US. The company has so far deployed 30,000 small cells sites for its millimeter wave (mmWave) 5G network.

"We continue to deploy millimeter wave, which is a key part of our network, providing massive bandwidth in dense urban areas," said Verizon's Rima Qureshi, the operator's chief strategy officer, during a recent Verizon investor event. But company officials haven't provided any specific goals for small cell buildout in 2023 and beyond.

T-Mobile has said that it eventually expects to operate around 40,000 to 50,000 small cells as it completes its big 5G network buildout, while AT&T at one point had planned to operate 40,000 small cells by 2015. But AT&T did not meet its goal, and company officials have remained quiet about small cells since.

Verizon, AT&T and T-Mobile have all been working to deploy their midband 5G spectrum holdings, and that work has shifted their focus away from small cells. Macro cell towers can cover wide geographic areas, while small cells – which typically sit atop street lights and rooftops rather than large cell towers – are primarily viewed as a method to improve capacity rather than coverage.

Preparing for the future

US operators are making significant progress in their midband 5G deployments. T-Mobile covers more than 200 million people with its midband 5G network, and Verizon is hoping to get close to that figure early next year. As operators finish expanding their coverage areas with macro cell towers, they're expected to turn their attention to filling in coverage with small cells.

"Even as the focus on building out the 5G macro coverage is intensifying, carriers need to continue advancing their small cell grids, not only to prepare for future capacity requirements, but also to improve the performance consistency across the network," wrote Dell'Oro's Pongratz. He suggested that small cells will be necessary to improve midband 5G coverage areas, including in-building coverage, because midband signals can't travel as far as signals in lowband spectrum. Most 4G networks work primarily in lowband spectrum.

Pongratz said Dell'Oro expects global small cells to advance at a 6% compound annual growth rate (CAGR) by 2026. In North America, the firm acknowledged that small cell growth slowed somewhat in 2021, but it continues to expect that small cells in North America will increase at a 10% to 15% CAGR through 2026.

Related posts:

— Mike Dano, Editorial Director, 5G & Mobile Strategies, Light Reading | @mikeddano

About the Author(s)

You May Also Like