As the world's largest market for mobile phones, competition is hotting up in China -- driven by 3G, Android and more low-cost smartphones

There are more than 840 million cellular subscribers in China and the competition is everywhere. There is an abundance of "mobile phoneys," and carriers such as Guangdong Mobile Communication Corp. Ltd. are paying big bucks for celebrity endorsements of particular handsets. (Leonardo DiCaprio got US$5 million for his.)

As the mobile phone market grows there, UBM TechInsights has completed a series of 30 teardown reports to determine which vendors are establishing a foothold in the most popular 2G and 3G devices. TechInsights says it will continue the analysis with 35 more teardowns in 2011. (Disclosure: Both Light Reading and UBM TechInsights are owned by the same parent, UBM LLC.)

China is seeing handset competition from traditional market leader Nokia Corp. (NYSE: NOK), North American giants like Apple Inc. (Nasdaq: AAPL) and BlackBerry and local companies Huawei Technologies Co. Ltd. , Lenovo Group Ltd. (Hong Kong: 992) and Tianyu, whose devices are improving in quality.

Some of these handset makers, such as Huawei and ZTE Corp. (Shenzhen: 000063; Hong Kong: 0763), bridge the gap and focus on both 2G and 3G in China, but the global brands like Samsung Electronics Co. Ltd. (Korea: SEC) and RIM are squarely focused on 3G, according to TechInsights Product Manager and report author Steve Bitton.

The 3G smartphones opportunity in China is growing so fast that some brands, such as Samsung and Motorola Mobility LLC , are offering Chinese-only designs. More and more Chinese brands are also branching into 3G as consumer demand for the technology shows no signs of slowing.

"The manufacturing know-how is there, it just getting the design and smartphone down," Bitton says.

All About Android

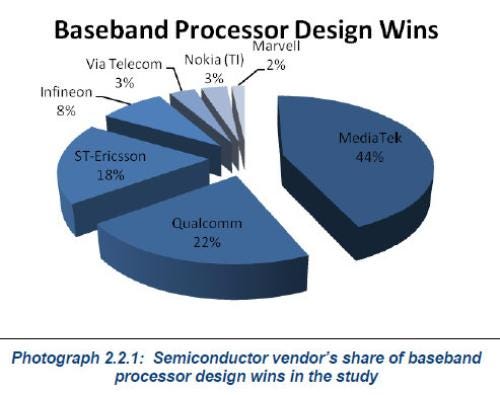

Within the devices TechInsights profiled MediaTek Inc. (Taiwan: 2454) basebands and transceiver dominated the low-end GSM phones, but Qualcomm Inc. (Nasdaq: QCOM)’s early association with Android is helping it gain design wins in the nascent 3G market. (See Zoom Builds 3G Phones with Qualcomm.)

The only exception to Qualcomm's 3G dominance was in the TD-SCDMA devices, in which MediaTek and ST-Ericsson featured most prominently.

"Qualcomm phones were usually the upper high-end phones," Bitton says. "The popularity of Android in China is amazing. A lot of the manufacturers and Chinese brands were keen on Android, because of the cost of the operating system itself."

Bitton notes that many of the 2G MediaTek phones did not use Android; instead, they ended up using their own operating system. "We believe MediaTek did so well because they offered a full chipset/ operating system solution that was attractive for the lower-end phone manufacturers," he says.

Surprisingly, TechInsights did not find any basebands from Spreadtrum Communications Inc. in any of the phones it tore down, despite the fact that it's encroaching on MediaTek's dominance with lower-cost chipsets.

That could be because Spreadtrum hasn't yet embraced Android. MediaTek is shifting its focus to low-cost Android smartphones, while Speadtrum focuses on dominating feature phones. These lower-end devices are the norm in China today, but smartphones are expected to grow from 16.7 percent of the phone market to 54 percent by 2013, according to the Data Center of China Internet. For the phone and parts makers, the expected growth in 3G, coupled with an enormous demand for 2G, means that China may remain a fractured market.

"It's such a large market with a three different 3G protocols in play, which naturally takes different designs and different markets to capture, on top of 2G," Bitton says. "It will be hard for the consolidation of parts, just because it's such a wide and varied market, even going into 3G."

— Sarah Reedy, Senior Reporter, Light Reading Mobile

About the Author(s)

You May Also Like